Child Governance Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Child Governance Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

child governance Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

CHILD GOVERNANCE STARTUP BUDGET INFO

Highlights

The five-year financial model template in Excel is designed to enhance child governance models by incorporating important elements of youth financial education, such as child budgeting techniques and children's savings programs. With prebuilt statements—including a consolidated forecast income statement, balance sheet, and cash flow pro forma—it facilitates financial decision-making for kids and empowers youth in finance. This comprehensive tool also features key financial charts, summaries, and metrics that illustrate the impact of financial education on fostering financial independence among children. Moreover, it provides parental financial guidance by estimating required startup costs, ensuring parents have effective financial tools for supporting their children’s asset management and investment strategies.

The child governance Excel template addresses key pain points for parents and educators by providing a structured framework for youth financial education and decision-making. It incorporates child budgeting techniques and children's savings programs, empowering youth in finance while fostering financial independence through child-centric financial planning. With built-in financial tools for parents, it enhances parental financial guidance, enabling them to teach children about financial responsibility and asset management. The model's comprehensive projection of financial statements assists in illustrating the impact of financial education and the importance of developing healthy financial habits in children, thus effectively supporting their long-term understanding of investment strategies and entrepreneurship education.

Description

Our child governance financial model is structured to support informed decision-making while encouraging youth financial responsibility and fostering financial independence among children. This comprehensive template includes a detailed 5-year projection with monthly and yearly financial statements, relevant KPIs, financial ratios, and diagnostic tools to enhance understanding of financial habits in children. It focuses on empowering youth in finance through effective budgeting techniques, children's savings programs, and investment strategies while incorporating parental financial guidance and school-based financial education. Additionally, the model includes analysis of funding options such as business bank loans and equity funding, ensuring a holistic approach to children's asset management and the impactful development of youth entrepreneurship education. With user-friendly input sheets, this model enables stakeholders to adapt financial data easily, ultimately promoting financial inclusion and literacy for children within the community.

CHILD GOVERNANCE FINANCIAL PLAN REPORTS

All in One Place

Introducing our Child Governance Financial Model Template—an adaptive tool designed for dynamic financial decision-making. This customizable Excel spreadsheet integrates child governance models, empowering youth in finance through robust projections. Tailored to accommodate various scenarios, it enhances parental financial guidance while fostering financial independence among children. As your business evolves, our scalable model adapts seamlessly, ensuring you remain at the forefront of youth financial education. Invest in children’s savings programs and budgeting techniques today to instill lasting financial habits and promote financial inclusion for the next generation. Empower your business with impactful financial tools for parents.

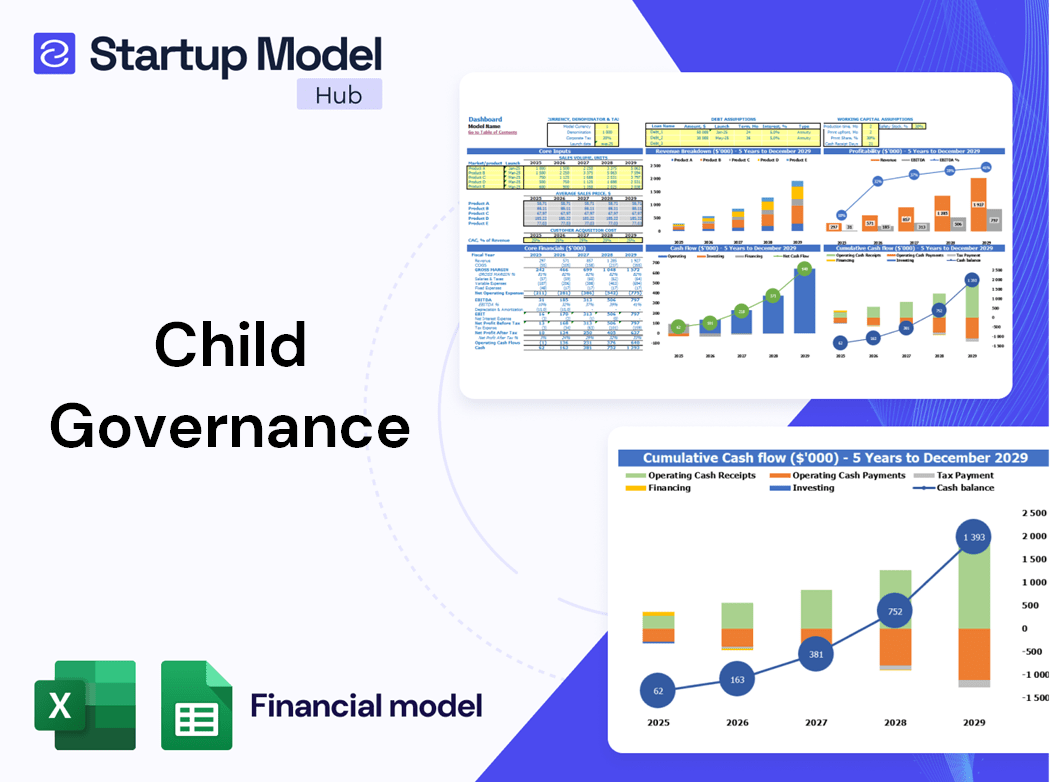

Dashboard

Our child governance models emphasize financial literacy for children, equipping them with essential skills for financial decision-making. Through tailored children's savings programs and youth financial education, we foster financial independence and responsibility. Our user-friendly dashboard integrates budgeting techniques and investment strategies, enabling parents to monitor their children's financial habits effectively. With customizable key performance indicators (KPIs), it gathers data from various proforma statements, ensuring you stay informed about your child's financial journey. Embrace child-centric financial planning to empower youth in finance and cultivate future entrepreneurs.

Business Financial Statements

Our comprehensive business plan template equips entrepreneurs with essential tools for crafting precise financial statements, forecasts, and calculations. It not only streamlines the process of financial decision-making for kids but also fosters financial literacy for children through engaging presentations enriched with dynamic graphs and charts. By visualizing financial data, users can effectively communicate results to stakeholders and potential investors, ultimately empowering youth in finance. This approach promotes financial responsibility and independence, setting the stage for children's asset management and youth entrepreneurship education. Unlock the potential for impactful financial education with our tailored resources.

Sources And Uses Statement

Understanding sources and uses of funds is crucial for fostering financial independence in children. By implementing child governance models and youth financial education programs, we can enhance children's financial literacy. Techniques such as child budgeting and savings programs empower youth in finance, cultivating sound financial habits. Parents play a pivotal role by providing financial guidance and tools, while schools can integrate financial decision-making into curricula. Through effective child-centric financial planning and investment strategies, we can significantly impact youth entrepreneurship and financial responsibility, paving the way for a financially inclusive future.

Break Even Point In Sales Dollars

This startup cost template features a comprehensive break-even chart spanning five years, effectively illustrating the break-even point both numerically and visually. By incorporating child governance models and financial literacy for children, it supports youth financial education initiatives. The tool emphasizes child budgeting techniques and parental financial guidance, fostering financial independence and responsibility among young learners. Additionally, it advocates for children's savings programs and effective asset management, empowering youth in finance. By promoting school-based financial education, this template contributes to enhancing the impact of financial education on future generations.

Top Revenue

The Top Revenue tab in our financial model template provides a comprehensive overview of your offerings' financial performance. Utilizing this robust tool, you can analyze annual revenue streams, highlighting key metrics like revenue depth and revenue bridge. This model not only facilitates effective financial decision-making but also supports child governance models by empowering youth in finance. By integrating financial literacy for children and youth financial education, it encourages the development of strong financial habits, fostering financial independence and responsibility from an early age. Leverage this template to promote children's asset management and parental financial guidance effectively.

Business Top Expenses Spreadsheet

To foster financial independence in children, it's crucial to implement effective child governance models that emphasize youth financial education. Utilizing child budgeting techniques and children's savings programs can empower youth in finance, enhancing their financial decision-making skills. Parental financial guidance and school-based financial education play pivotal roles in cultivating responsible spending habits. By equipping children with financial tools and investment strategies, we can nurture a generation adept in children's asset management. Ultimately, promoting financial literacy for children ensures a strong foundation for their future, encouraging youth entrepreneurship and fostering financial inclusion.

CHILD GOVERNANCE FINANCIAL PROJECTION EXPENSES

Costs

The Child Governance 3 Statement Model Excel serves as an innovative tool, offering insights into a company's expenses while projecting essential financial assets for achieving strategic goals. This template enables users to identify weaknesses, particularly in areas prone to underfunding. Expenses play a critical role in effective business planning, crucial for communicating with investors and securing loans. By integrating financial literacy for children, this model fosters financial responsibility and empowers youth in finance, paving the way for better financial habits and decision-making in the future.

CAPEX Spending

The automated CAPEX model integrates capital expenditures into a comprehensive cash flow statement in Excel, while also highlighting alternative income sources for the company. By utilizing child governance models and fostering financial independence, this approach equips youth with essential financial literacy skills. Empowering youth in finance through school-based financial education and parental guidance promotes responsible financial habits and effective decision-making. The focus on child-centric financial planning and investment strategies encourages children's savings programs, ultimately paving the way for informed financial behaviors and youth entrepreneurship education. This holistic strategy significantly impacts financial inclusion for children and their future success.

Loan Financing Calculator

Our startup financial model template includes a detailed loan amortization schedule, designed with user-friendly pre-built formulas. This essential financial tool helps businesses track monthly, quarterly, or annual repayments by breaking down each installment into principal and interest components. By integrating such financial decision-making resources, we equip entrepreneurs with the knowledge they need to foster financial responsibility and independence. Additionally, this model serves as a foundation for youth financial education, empowering the next generation with the financial literacy necessary for effective asset management and informed budgeting techniques.

CHILD GOVERNANCE INCOME STATEMENT METRICS

Financial KPIs

Return on Investment (ROI) is a critical metric in child-centric financial planning and youth financial education. It provides a clear ratio of cash inflows to cash outflows from investments, highlighting the effectiveness of financial decision-making for kids. By understanding ROI, children can develop essential financial habits and strategies, fostering financial independence and responsibility. Parents can enhance this learning through parental financial guidance and by introducing children to budgeting techniques and savings programs. Ultimately, fostering a solid foundation in developmental finance empowers youth in finance, paving the way for a financially secure future.

Cash Flow Forecast Excel

In smaller businesses with straightforward accounting, net income from profit and loss statements often aligns with cash flow changes. However, incorporating a cash flow projection template is essential. It includes financing activities, such as loans or capital raises, which don’t appear in income statements. This projection is vital for understanding potential future cash needs, burn rate, and runway. For young entrepreneurs and financially literate youth, mastering these elements fosters financial independence and responsibility, empowering them to make informed financial decisions and develop effective budgeting and investment strategies.

KPI Benchmarks

This startup financial model template includes a dedicated tab for comparative analysis, assessing average performance indicators among industry peers. By benchmarking against similar companies, it provides a comprehensive evaluation of your organization’s potential and areas for growth. This analytical approach not only fosters financial responsibility but also promotes informed financial decision-making. As youth financial education emphasizes, understanding these dynamics equips stakeholders with the tools needed for effective budgeting and investment strategies, ultimately empowering future leaders to achieve financial independence. Engage with this model to enhance your child-centric financial planning and guide informed financial habits.

P&L Statement Excel

The Profit and Loss Statement serves as a vital tool for child governance models, clearly outlining revenue sources and enhancing financial literacy for children. By examining key components—income, expenses, and net income—stakeholders gain insights into profitability. Utilizing a profit and loss forecast template can help assess the financial health of children's savings programs or youth entrepreneurship education initiatives. This empowers youth in finance and fosters financial independence, enabling them to make informed financial decisions with parental guidance. Ultimately, effective financial tools for parents and child-centric financial planning enhance the impact of financial education and cultivate responsible financial habits in children.

Pro Forma Balance Sheet Template Excel

A pro forma balance sheet serves as a vital financial tool for young entrepreneurs, showcasing a startup's key assets—such as buildings and equipment—alongside its liabilities and capital. Understanding this financial document fosters financial literacy for children, encouraging effective financial decision-making. For banks, the assets section signifies the security backing any loans, emphasizing the importance of child-centric financial planning. By integrating concepts like child budgeting techniques and children's savings programs, we can empower youth in finance and enhance their financial habits, ultimately fostering financial independence and responsibility from an early age.

CHILD GOVERNANCE INCOME STATEMENT VALUATION

Startup Valuation Model

Navigating the complexities of financial decision-making is vital for today's youth. Our tools, including a startup valuation calculator, empower young entrepreneurs to grasp essential metrics such as NPV, IRR, and ROIC, fostering financial independence. By integrating these metrics, children can enhance their financial literacy and develop budgeting techniques crucial for their future. This model not only aids in predicting cash flow but also promotes sound financial habits, ensuring robust asset management skills. Ultimately, it lays the groundwork for effective youth financial education and encourages parental guidance, leading to informed financial choices.

Cap Table

A Cap Table within financial projection templates highlights the flow of financial resources, providing insights into the various instruments integral to financing. It reflects how strategic decisions influence profitability, fostering financial literacy for children by illustrating complex concepts in a simplified manner. Understanding the Cap Table can empower youth in finance, promoting responsible financial decision-making and encouraging their engagement in children's savings programs. By integrating child-centric financial planning and parental financial guidance, we can cultivate essential financial habits, ensuring children develop the skills necessary for fostering financial independence and inclusion as they grow.

KEY FEATURES

Empowering youth in finance through school-based financial education fosters financial independence and responsible money management habits for lifelong success.

Empowering youth in finance through financial literacy programs fosters independence and responsible decision-making in their financial futures.

Implementing child-centric financial planning fosters financial independence and responsibility, equipping youth with essential skills for future success.

A robust child governance financial model empowers youth in finance, fostering financial independence and responsible decision-making for future success.

Implementing child governance models fosters financial literacy for children, empowering them to make informed decisions and ensuring future financial independence.

Implementing a child governance financial planning model fosters financial independence and responsibility, equipping youth with essential financial literacy skills.

Implementing child governance models empowers youth in finance, fostering financial independence and responsible decision-making for a secure future.

Implementing effective child governance models enhances financial literacy for children, fostering independence and responsibility in their future financial decision-making.

Empowering youth in finance through tailored educational programs fosters financial independence, promoting responsible decision-making for future success.

Exploring diverse financial scenarios empowers children to make informed decisions, fostering financial independence and responsibility for their future.

ADVANTAGES

Empowering youth in finance through children's savings programs fosters financial independence and responsibility, ensuring a brighter future for all.

Implementing child governance models enhances youth financial responsibility, fostering financial independence through effective budgeting and investment strategies.

Utilizing a child governance financial model fosters essential financial literacy and responsibility, empowering youth to confidently manage their future assets.

Implementing youth financial education enhances children's financial habits, empowering them with skills for budgeting, saving, and investing early in life.

Empowering youth in finance through child governance models fosters financial literacy and independence, ensuring lifelong positive financial habits.