Construction Equipment Rental Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Construction Equipment Rental Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

construction equipment rental Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

CONSTRUCTION EQUIPMENT RENTAL FINANCIAL MODEL FOR STARTUP INFO

Highlights

The five-year financial model template in Excel for construction equipment rental provides a comprehensive analysis specifically designed for the construction rental business model, featuring prebuilt three statements: a consolidated projected income statement, balance sheet, and cash flow forecast. With an emphasis on operational costs for equipment rental and rental income streams, this tool facilitates heavy machinery rental forecasting and effective cash flow management for rentals. Key financial metrics for equipment leasing, such as depreciation in rental assets and profitability analysis, are integrated, allowing users to perform cost-benefit analysis for leasing and assess investment returns in rental equipment. Additionally, the model includes financial performance benchmarks for rentals, empowering users to evaluate vendor relationships in equipment rental and make informed decisions regarding equipment rental pricing strategies. This template is particularly valuable for those considering entering the equipment rental market, providing essential insights before purchasing rental assets.

The construction equipment rental Excel financial model template addresses key pain points by providing a comprehensive analysis of operational costs for equipment rental and a streamlined approach to cash flow management for rentals. It simplifies rental income streams forecasting and assists in crafting effective equipment rental pricing strategies while allowing for detailed profitability analysis of equipment rental. Users can perform break-even analysis for rentals, ensuring that they clearly understand the market demand for construction rentals and the risk assessment in rental operations. Additionally, the template supports capital expenditure in rental equipment decisions, facilitates accounting for rental income, and enhances vendor relationships in equipment rental by offering insights into financial performance benchmarks for rentals, ultimately leading to improved investment returns in rental equipment.

Description

The construction equipment rental financial model provides a comprehensive framework for analyzing key aspects such as capital expenditure in rental equipment and operational costs for equipment rental, allowing entrepreneurs to assess the rental income streams and effectively manage cash flow. By utilizing this dynamic Excel financial projection, businesses can perform profitability analysis of equipment rental, develop pricing strategies, and forecast future performance with a focus on financial metrics for equipment leasing. The model emphasizes the importance of break-even analysis for rentals and risk assessment in rental operations, supporting informed decision-making regarding vendor relationships and investment returns in rental equipment. With detailed financial projections, including a forecasted profit and loss statement and cash flow forecast, businesses can evaluate market demand for construction rentals and execute a cost-benefit analysis for leasing while adhering to performance benchmarks and organizational goals.

CONSTRUCTION EQUIPMENT RENTAL FINANCIAL MODEL REPORTS

All in One Place

Our comprehensive construction equipment rental analysis spreadsheet serves as an essential resource for both startups and established businesses. It includes detailed pro forma templates for crucial financial statements—such as income statements and cash flow forecasts—while also offering performance review reports and summarized monthly and annual metrics. With a focus on capital expenditure, operational costs, and profitability analysis, this model equips you with the tools needed for effective cash flow management and strategic decision-making, ensuring robust financial performance benchmarks for your rental operations. Elevate your equipment rental business model with our tailored approach.

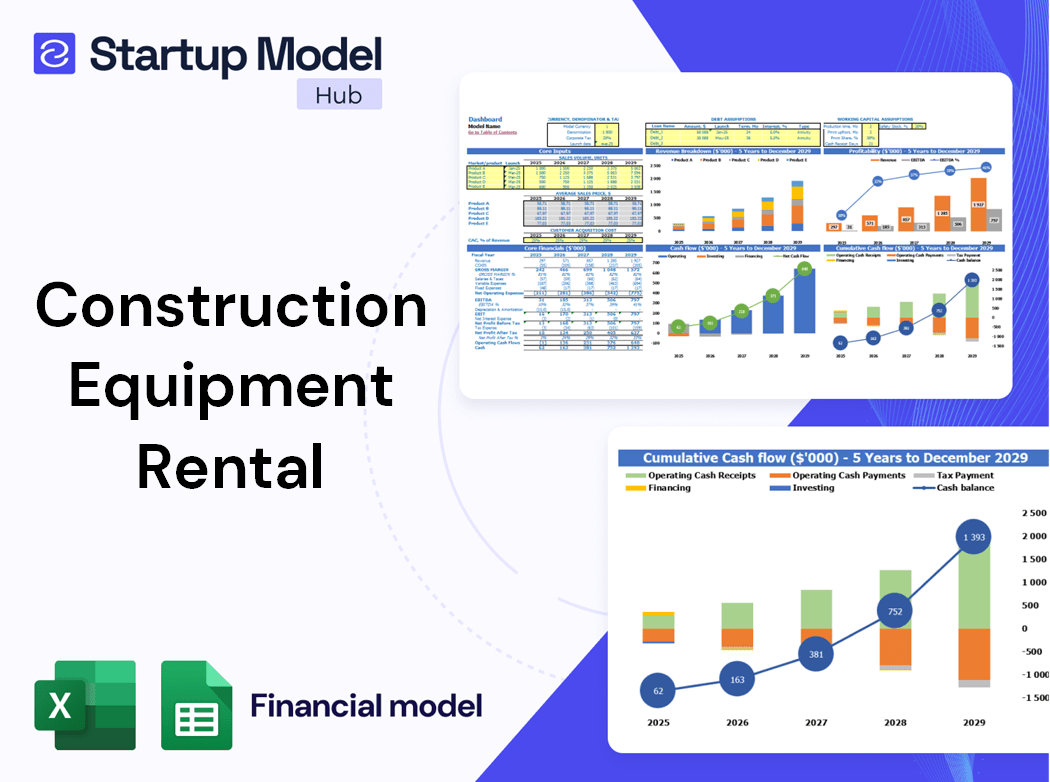

Dashboard

Our comprehensive financial projection template features an integrated all-in-one dashboard designed for the construction equipment rental industry. It includes a robust cash flow forecasting model, projected balance sheet, and a five-year cash flow projection, allowing users to perform detailed monthly or annual breakdowns. This interactive dashboard provides critical insights through clear figures and visual charts, empowering users to make informed decisions. Enhance your understanding of operational costs, profitability analysis, and rental income streams to optimize your construction rental business model and maximize investment returns in rental equipment.

Business Financial Statements

Our financial projection includes a comprehensive summary that consolidates key data from various spreadsheets. This summary integrates vital financial reporting elements such as projected balance sheets, pro forma profit and loss statements, and cash flow projections. Designed specifically for the construction equipment rental analysis, this ready-to-use format enhances your pitch deck, showcasing financial metrics crucial for your equipment rental business model. By clearly presenting your capital expenditure, operational costs, and potential income streams, you can effectively communicate your strategy for profitability and risk management in the dynamic equipment leasing market.

Sources And Uses Statement

The sources and uses statement of funds is crucial for understanding a company's financing strategies. It outlines the various funding sources—such as business loans, investor capital, and equity financing—and illustrates how these funds are allocated. In the 'uses' section, stakeholders can see where the company directs its financial resources, including capital expenditures on land, buildings, and rental equipment, as well as start-up costs. This analysis not only aids in cash flow management for rentals but also supports effective construction equipment rental pricing strategies, providing a clear picture of the business's financial health and operational efficiency.

Break Even Point In Sales Dollars

This financial model template includes a break-even sales analysis, essential for determining when your construction equipment rental business will begin generating profits. By assessing projected revenues and operational costs, it offers valuable insights into cash flow management for rentals. This analysis aids in crafting accurate equipment rental pricing strategies, while also serving as a foundation for profitability analysis of equipment leasing. Understanding this pivotal timeframe helps inform vendor relationships and capital expenditure decisions, ensuring sustainable investment returns in rental equipment. Ultimately, it serves as a strategic tool for evaluating financial performance benchmarks and market demand for construction rentals.

Top Revenue

A primary concern for management is generating sustainable revenue streams in the construction equipment rental sector. Accurate forecasting is crucial in preparing a pro forma Excel template as revenues significantly impact the company’s overall value. Misestimating revenue affects all components of the bottom-up financial model. Therefore, management and financial analysts must pay close attention to detail when developing strategies for rental income. Utilizing a startup financial projection template helps create accurate forecasts by incorporating growth rate assumptions grounded in historical financial data, ensuring effective cash flow management and enhancing profitability analysis for equipment rentals.

Business Top Expenses Spreadsheet

The Top Expenses section of our three-statement model offers a comprehensive breakdown of operational costs for equipment rental, categorizing expenditures into four essential groups. This pro forma projection features a detailed chart, showcasing annual expenses related to customer acquisition, payroll, and additional costs. Such insightful profit and loss forecasts are crucial for startups and business strategists, aiding in risk assessment and enhancing cash flow management for rentals. By understanding these financial metrics, businesses can optimize their construction equipment rental analysis and improve profitability through informed decision-making and effective investment returns.

CONSTRUCTION EQUIPMENT RENTAL FINANCIAL PROJECTION EXPENSES

Costs

Unlock the potential of your construction rental business with our intuitive financial projections spreadsheet. Designed for efficiency, this tool automates updates across all cells, eliminating manual intervention. Accurately forecast operational costs, analyze rental income streams, and assess your capital expenditure in rental equipment. Utilize our model to enhance cash flow management for rentals and improve your profitability analysis. With built-in metrics for equipment leasing, you can benchmark financial performance and make informed decisions. Streamline your construction equipment rental analysis and enhance vendor relationships with this essential financial tool.

CAPEX Spending

Capital expenditures (CAPEX) are pivotal for growth in the construction equipment rental sector, enabling firms to acquire long-term assets that enhance operational efficiency. By strategically forecasting capital expenditures, companies can anticipate market demand and mitigate risks associated with equipment leasing. These investments, recorded under the 'Depreciation' section in monthly financial projections, contribute to cash flow management and profitability analysis. Furthermore, a robust CAPEX plan supports effective rental pricing strategies and vendor relationships, ultimately leading to sustainable rental income streams and improved financial performance benchmarks for the business.

Loan Financing Calculator

Monitoring loan repayment schedules is crucial for startups and growing companies, as they directly influence cash flow management for rentals. These schedules detail the principal amount, terms, maturity period, and interest rates, impacting cash flow forecasting and financial projections. Accurate tracking ensures that loan repayments are reflected in the balance sheet and integrated into monthly cash flow statements. By understanding the implications of loan repayments on operational costs and capital expenditure in rental equipment, companies can enhance profitability analysis and make informed decisions about equipment leasing agreements and investment returns in rental assets.

CONSTRUCTION EQUIPMENT RENTAL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Key performance indicators (KPIs) within the five-year financial projection template are vital for entrepreneurs and investors to evaluate the health of the construction equipment rental business model. These financial metrics provide quick insights into operational costs, rental income streams, and overall profitability. When a KPI signals underperformance, it prompts business owners to investigate potential issues and devise strategic plans to address risks. Regular monitoring of these indicators enhances cash flow management and informs equipment rental pricing strategies, ensuring sustainable growth and investment returns in the competitive rental market.

Cash Flow Forecast Excel

The Operating Cash Flow Chart Template provides a clear illustration of the cash generated from core business operations without factoring in secondary revenue sources like interest or investments. This essential financial metric is crucial for construction equipment rental analysis, aiding in capital expenditure planning and operational cost management. By leveraging this tool, businesses can optimize cash flow management for rentals, refine equipment rental pricing strategies, and enhance profitability analysis. Understanding these dynamics enables informed decision-making and strengthens vendor relationships while aligning with market demand for construction rentals.

KPI Benchmarks

Benchmarking is essential for assessing the performance of construction equipment rental businesses against industry leaders. Utilizing an Excel pro forma template enables users to effectively compute key financial metrics, such as profit margins and operational costs for equipment rental. This tool simplifies the comparison of vital data, including rental income streams and depreciation in rental assets, side-by-side with competitors. By analyzing these financial projections and establishing best-in-class pricing strategies, businesses can enhance cash flow management and investment returns while conducting thorough profitability analyses and risk assessments to drive informed decision-making.

P&L Statement Excel

The proforma income statement serves as a vital tool for financial reporting in the construction equipment rental sector. It streamlines analysis of key financial metrics, facilitating accurate calculations and insights. This projected statement evaluates profitability while showcasing cash flow management for rentals. By examining operational costs and revenue streams, it provides a comprehensive view of the construction rental business model. Ultimately, this analysis aids in risk assessment, investment returns, and pricing strategies, enhancing overall financial performance benchmarks within the equipment leasing landscape.

Pro Forma Balance Sheet Template Excel

In this financial projection model for your construction equipment rental business, monthly and annual balance sheets seamlessly integrate with cash flow forecasts, projected profit and loss statements, and other key financial metrics. This comprehensive setup enables a robust overview of assets, liabilities, and equity, aligning with essential financial statements. By optimizing operational costs and assessing market demand for construction rentals, you can enhance rental income streams while implementing effective pricing strategies. This cohesive framework supports informed decision-making, ensuring a strong foundation for profitability analysis and risk assessment in your equipment leasing operations.

CONSTRUCTION EQUIPMENT RENTAL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This projected cash flow statement template offers a comprehensive analysis tool for the construction equipment rental sector. Users can conduct a Discounted Cash Flow (DCF) valuation, enhancing their understanding of financial metrics such as residual value and replacement costs. Additionally, it facilitates an in-depth profitability analysis of equipment rental, assessing various rental income streams and capital expenditure in rental equipment. With capabilities for break-even analysis and cash flow management for rentals, this template is essential for optimizing vendor relationships and forecasting market demand in construction rentals. Elevate your investment returns with insightful financial performance benchmarks today.

Cap Table

A cap table is a crucial financial instrument for start-ups, essential for navigating the complexities of equity allocation. Our financial forecast template includes a cap table with four funding rounds, enabling users to project ownership stakes and understand potential shareholder dilution. This tool effectively encompasses various equity components, including preferred shares, share options, and convertible bonds, ensuring comprehensive financial oversight. By leveraging a well-structured cap table, start-ups can enhance their investment returns and make informed decisions about capital expenditure in rental equipment, optimizing operational costs and cash flow management for their construction rental business models.

KEY FEATURES

Implementing a robust financial model enhances cash flow management and profitability analysis for startups in the equipment rental industry.

A robust financial model enhances investment returns in rental equipment by providing clear insights into profitability and cash flow management.

A robust financial model enhances cash flow management and minimizes risks associated with customer payment issues in equipment rentals.

A robust financial model enhances cash flow management, ensuring timely payments and improving overall profitability in equipment rental operations.

A robust financial model enables proactive identification of cash gaps and surpluses in the construction equipment rental business.

Effective cash flow forecasting empowers construction rental businesses to navigate financial challenges and seize growth opportunities proactively.

Implementing a robust financial model enhances cash flow management and boosts confidence in loan repayment for equipment rental businesses.

A robust cash flow model enhances your loan application by demonstrating clear repayment strategies and financial viability for your rental business.

A robust financial model enhances decision-making by visualizing key metrics like cash flow and profitability in one convenient dashboard.

Our 5-year projection plan dashboard provides instant visibility, streamlining financial analysis for construction equipment rental profitability.

ADVANTAGES

Utilizing a robust financial model enhances cash flow management and drives investment returns in the construction equipment rental business.

A robust five-year financial projection enhances stakeholder confidence by showcasing profitability and sustainability in equipment rental operations.

Unlock profitability with a robust financial model that enhances cash flow management and investment returns in construction equipment rentals.

Optimize your investment strategy and enhance cash flow management with a robust construction equipment rental financial model.

Using a robust financial model enhances cash flow management and profitability analysis in the construction equipment rental industry.