CredIT Card Processing Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

CredIT Card Processing Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

credit card processing Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

CREDIT CARD PROCESSING FINANCIAL MODEL FOR STARTUP INFO

Highlights

This five-year credit card transaction fees financial model template is designed for fundraising and business planning for startups and entrepreneurs in the payment processing industry. It includes essential features such as sales revenue projections, operational expense analysis, and financial performance metrics, all tailored to the nuances of credit card processing. The model facilitates transaction volume analysis and cash flow modeling while providing a comprehensive fee structure comparison among merchant service providers. With a focus on optimizing the business model, this template aids users in evaluating startup ideas, planning pre-launch expenses, and integrating risk management strategies to enhance overall performance. It is fully editable, allowing for customization to suit individual financial forecast models and accounting for payment transactions, thus ensuring a robust foundation for securing funding from banks, angels, grants, and VC funds.

This financial model effectively addresses critical pain points for buyers by offering a comprehensive analysis of credit card transaction fees and payment processing solutions, ensuring that users can assess their merchant account services and select optimal payment gateway options. By integrating transaction volume analysis and operational expense analysis, it facilitates a clear understanding of the cost structure, allowing for accurate risk management strategies and profit margin calculations. The template also enhances financial performance metrics through effective cash flow modeling and thorough accounting for payment transactions, helping businesses project sales revenue and customer acquisition costs while enabling a detailed fee structure comparison with various merchant service providers. Furthermore, it supports business model optimization by providing essential insights into financial forecast models and improves overall decision-making with its robust suite of tools for financial planning.

Description

The credit card processing financial model template offered by our team provides a comprehensive financial framework, assisting businesses in analyzing credit card transaction fees, evaluating payment processing solutions, and managing merchant account services effectively. This robust template includes a 5-year financial forecast model, which encompasses crucial elements such as transaction volume analysis, cost structure assessment, and operational expense analysis, enabling users to optimize their business model. With features that allow for easy adjustments to inputs, users can track financial performance metrics like sales revenue projections and cash flow modeling, while incorporating risk management strategies into their accounting for payment transactions. By comparing fee structures and integrating various payment gateway options, this template empowers merchants to enhance their profit margin calculation and improve customer acquisition costs.

CREDIT CARD PROCESSING FINANCIAL MODEL REPORTS

All in One Place

Concerned about creating a financial forecast model for your startup? Fear not! Our expertly crafted financial projection template simplifies the process, integrating essential tools for transaction volume analysis and cost structure assessment. With a comprehensive approach to credit card transaction fees and payment processing solutions, you'll quickly master key metrics like profit margin calculation and cash flow modeling. Designed for ease of use, this template empowers you to optimize your business model and enhance financial performance. Elevate your understanding of accounting for payment transactions and gain confidence in your financial planning today!

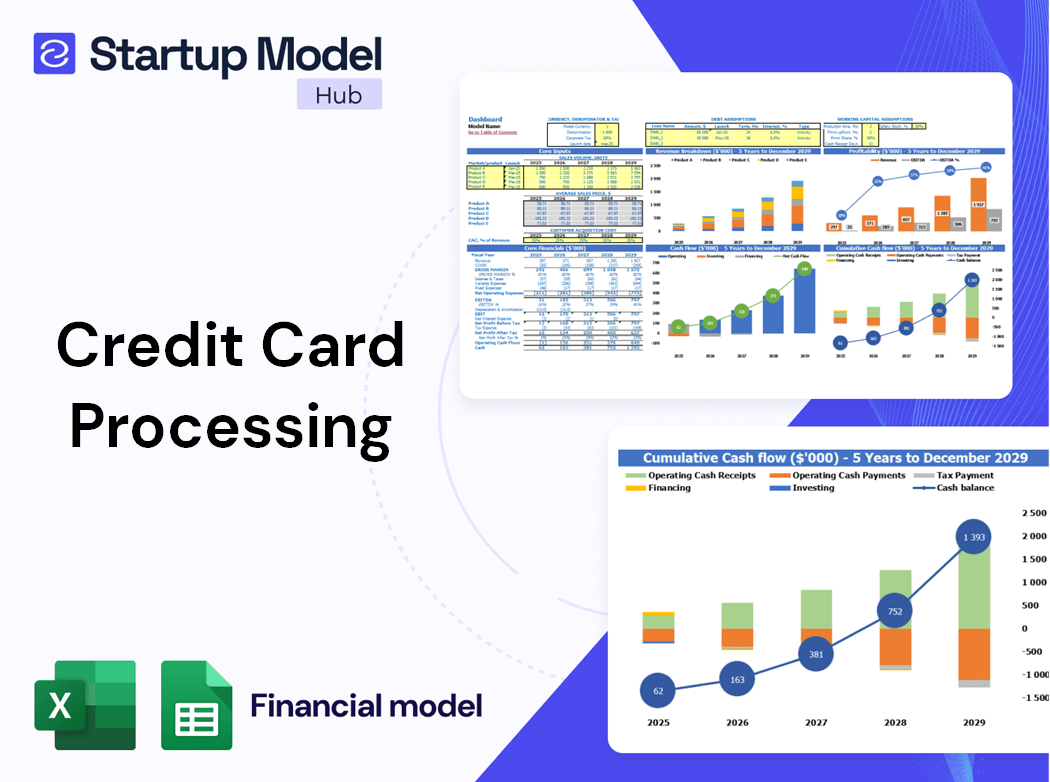

Dashboard

Our business plan template in Excel features a comprehensive dashboard that consolidates data from your 5-year financial forecast. This dynamic dashboard allows you to establish key performance indicators (KPIs) and integrates them with your financial statements for accurate insights. You can effortlessly create and modify a monthly overview of essential financial metrics, enhancing your ability to assess credit card transaction fees, evaluate payment processing solutions, and optimize your cost structures. Stay agile in your financial performance analysis and make informed strategic decisions to maximize your business model’s profitability.

Business Financial Statements

The financial health of a business is encapsulated in three essential statements: - **Income Statement**: This reveals the company's revenue and expenses, accounting for elements like depreciation, taxes, and interest income. - **Balance Sheet**: A snapshot of assets, liabilities, and shareholders' equity, ensuring the equation (assets = liabilities + equity) holds true. - **Cash Flow Statement**: This outlines cash inflows and outflows, offering insight into the company's profitability and liquidity. Together, they provide a comprehensive view, guiding decisions on credit card transaction fees, operational expense analysis, and business model optimization.

Sources And Uses Statement

The sources and uses of funds statement within a financial forecast model offers a clear summary of funding sources and allocation strategies. This essential tool ensures that total sums align, reflecting a balanced financial picture. For businesses considering recapitalization, restructuring, or mergers and acquisitions (M&A), this statement becomes invaluable. It aids in assessing cash flow modeling, optimizing the business model, and evaluating transaction volume analysis. By analyzing credit card transaction fees and payment processing solutions, companies can enhance their financial performance metrics and effectively manage operational expenses while strategizing for growth.

Break Even Point In Sales Dollars

Our financial modeling Excel template includes a pro forma for a five-year breakeven analysis, enabling companies to optimize their business models effectively. By leveraging this break-even sales calculator, you can strategically assess pricing for your products or services, ensuring that sales revenue projections align with operational costs. This tool is essential for conducting a comprehensive transaction volume analysis, taking into account credit card transaction fees and payment processing solutions. Enhance your financial performance metrics and streamline risk management strategies with our user-friendly template. Empower your decision-making and drive profitability through informed insights.

Top Revenue

Revenue is crucial for any business's success, prominently featured in pro forma projections. A well-developed company diversifies its revenue streams, which should be evident in its financial model. Financial analysts must meticulously assess the revenue structure and future projections to ensure accuracy. Our three-statement model integrates essential assumptions for sophisticated revenue forecasting, leveraging historical growth rates and existing data. Discover the key elements for creating robust revenue projections, including insights into credit card transaction fees and payment processing solutions, in our comprehensive startup financial model template. Optimize your business model for enhanced financial performance metrics today.

Business Top Expenses Spreadsheet

Understanding your spending origins empowers effective financial management. The "Top Expenses" section of our business plan forecast template allows companies to analyze annual expenses through a structured lens. By categorizing costs into four key areas, such as customer acquisition costs and fixed expenditures, businesses can conduct a thorough cost structure assessment. This detailed approach enables insights into transaction volume analysis, profit margin calculations, and operational expense analysis, ultimately guiding businesses toward optimized financial performance and improved risk management strategies. Leverage these insights to refine your business model and enhance your overall financial health.

CREDIT CARD PROCESSING FINANCIAL PROJECTION EXPENSES

Costs

Our comprehensive three-statement financial model empowers you to strategically plan for the future. It facilitates financial forecast modeling and expense budget preparation for up to five years. By analyzing transaction volume and categorizing costs—such as variable expenses, COGS, and payroll—you can gain valuable insights into your cost structure. This detailed approach enables businesses to optimize their business model, assess credit card transaction fees, and evaluate payment processing solutions. Ultimately, it enhances your financial performance metrics and supports informed decision-making for sustainable growth.

CAPEX Spending

Capital expenditures (CAPEX) represent investments in assets that drive future growth. Accurate forecasting of these expenditures enables a company to assess its capacity and project growth potential. By acquiring long-term assets, businesses enhance their competitive edge and position for accelerated development. This strategic capital budgeting analysis is crucial, as it yields long-term benefits. Additionally, CAPEX is reflected in the forecast income statement under 'Depreciation,' providing a comprehensive view of the company’s financial health. Optimizing your business model and understanding the cost structure, including credit card transaction fees, are essential for sustained success.

Loan Financing Calculator

Start-ups and growing companies must actively manage their loan repayment schedules, which are crucial for effective cash flow modeling. These schedules provide a detailed breakdown of amounts, maturity terms, and more. Interest expenses from the debt schedule directly influence cash flow forecasts and are reflected in financial performance metrics. Additionally, principal repayments impact the cash flow pro forma template, aligning with financing activities. Monitoring these elements, along with credit card transaction fees and cost structure assessments, enhances profitability and supports business model optimization for sustained growth.

CREDIT CARD PROCESSING EXCEL FINANCIAL MODEL METRICS

Financial KPIs

EBIT (Earnings Before Interest and Taxes) is a vital indicator of a company's operational efficiency, reflecting its earnings potential from core activities. By excluding financial costs and taxes, EBIT provides a clearer picture of sustainable performance. It serves as a key metric for evaluating financial performance, aiding in transaction volume analysis and cash flow modeling. Utilizing effective payment processing solutions and optimizing your cost structure can enhance profit margin calculations, ultimately driving better sales revenue projections and overall business model optimization. Emphasizing EBIT enables businesses to strategically assess risk management strategies and improve financial forecast models.

Cash Flow Forecast Excel

The cash flow model in Excel is a vital financial report for businesses, emphasizing the importance of generating positive cash flows. This statement not only details current funds but also highlights potential cash shortfalls, which could hinder eligibility for new financing. By integrating transaction volume analysis and operational expense assessments, companies can optimize their business model, ensuring effective risk management strategies and enhancing financial performance metrics. Ultimately, a robust cash flow model aids in strategic decision-making, paving the way for better customer acquisition costs and improved profit margin calculations.

KPI Benchmarks

Our financial benchmarking study within the forecasting model empowers users to conduct comparative analysis with industry standards. By identifying key financial indicators, businesses can assess their performance against peers. Once data is entered, the template reveals comparative results, pinpointing areas for enhancement. Regular benchmarking deepens understanding of financial performance metrics, enabling companies to optimize their business models, manage costs effectively—including credit card transaction fees—and enhance sales revenue projections. Utilize this tool to refine your risk management strategies and boost overall profitability. Embrace the path to financial success through informed decision-making.

P&L Statement Excel

The annual projected profit and loss Excel template provides a comprehensive overview of your transactions throughout the year. It encompasses a detailed analysis of expenses and revenues, along with critical financial performance metrics. By incorporating elements like credit card transaction fees, sales revenue projections, and operational expense analysis, this template aids in assessing your cost structure. Additionally, it facilitates transaction volume analysis and aids in strategic decisions for business model optimization, ensuring you stay ahead in managing financial forecasts and maximizing profit margins effectively.

Pro Forma Balance Sheet Template Excel

This projected balance sheet for your startup provides a comprehensive view of your current and fixed assets, liabilities, and equity. By analyzing accounts receivable, accounts payable, and accrued expenses, you can effectively assess your financial performance metrics. This financial forecast model serves as a vital tool for evaluating your cash flow, optimizing your cost structure, and enhancing your business model. Utilize this opportunity to conduct a transaction volume analysis and gain insights for strategic decision-making, ultimately reinforcing your risk management strategies and boosting your profit margins.

CREDIT CARD PROCESSING FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our comprehensive startup valuation model excels in assessing credit card transaction fees and payment processing solutions, providing essential data for investors and lenders. With a focus on financial performance metrics, the weighted average cost of capital (WACC) illustrates the minimum return on invested funds. Our free cash flow valuation highlights available cash flow for stakeholders, while discounted cash flow analysis determines the present value of future cash flows. Optimize your business model and enhance your financial forecast with our expert insights into merchant account services and payment system integration.

Cap Table

This cap table offers remarkable capabilities, enabling precise calculations of investor share percentages and investment amounts. Its versatility not only aids in effective accounting for payment transactions but also enhances financial performance metrics. By providing insights into credit card transaction fees and profit margin calculations, it supports businesses in optimizing their models. Moreover, with features like transaction volume analysis and operational expense assessments, it serves as an invaluable tool for businesses aiming to refine their financial forecast models and improve cash flow management. Experience the power of comprehensive data integration for superior decision-making.

KEY FEATURES

A robust financial forecast model enhances decision-making by analyzing transaction volumes and optimizing credit card processing fees for increased profitability.

A cash flow forecasting model enables you to analyze financial performance metrics and optimize business strategy through informed decision-making.

A robust financial forecast model enhances decision-making by analyzing credit card transaction fees and optimizing payment processing solutions.

Leverage cash flow modeling to confidently navigate operational decisions and enhance profitability through informed financial insights.

Our financial forecast model optimizes business model performance by analyzing credit card transaction fees and enhancing profit margins.

The financial forecast model streamlines planning, eliminating complexity and allowing focus on optimizing business performance and transactions.

Implementing a financial forecast model enables proactive identification of potential cash balance shortfalls, enhancing your business's financial stability.

The financial forecast model acts as a proactive tool, enabling businesses to optimize cash flow and anticipate transaction costs effectively.

Implementing a financial forecast model enhances cash flow management and optimizes operational efficiency for improved business profitability.

A robust financial forecast model empowers businesses to strategically allocate surplus cash for growth and debt management opportunities.

ADVANTAGES

A robust financial forecast model enhances decision-making by optimizing operational expenses and improving profit margin calculations for startups.

Utilizing a financial forecast model optimizes cash flow, enhances profit margins, and streamlines payment processing solutions for businesses.

A robust financial forecast model enhances decision-making by optimizing cash flow and identifying potential shortfalls in credit card processing balances.

Optimize your business model by utilizing a financial forecast model that minimizes credit card transaction fees and enhances profit margins.

Optimize your business model with a financial forecast model that enhances cash flow modeling and boosts sales revenue projections.