Cruise Ship Hotel Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Cruise Ship Hotel Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

cruise ship hotel Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

CRUISE SHIP HOTEL FINANCIAL MODEL FOR STARTUP INFO

Highlights

The cruise ship industry dynamics are heavily influenced by several interconnected factors, including cruise itinerary pricing and maritime tourism revenue, which are essential for effective hotel financial forecasting. Understanding cruise line operating expenses and controlling costs, such as food and beverage expenditures, is crucial for maintaining profitability, particularly in shipboard amenities and onboard entertainment revenue streams. Moreover, evaluating guest experiences and demographics analysis helps in planning for hotel occupancy rates and investment analysis for cruise ships. With the ongoing emphasis on sustainability initiatives and the impact of maritime regulations, it's vital for operators to incorporate comprehensive financial performance metrics and annual operating budget planning into their strategies to enhance cruise package value assessments and manage port fees and logistics effectively.

The cruise ship industry dynamics necessitate a robust financial model that addresses the key pain points for potential buyers. This ready-made Excel template streamlines hotel financial forecasting, ensuring accuracy in projecting maritime tourism revenue and cruise line operating expenses. It incorporates guest demographics analysis and shipboard amenities profitability to enhance the guest experience evaluation, while also integrating food and beverage cost control to maintain healthy hotel occupancy rates. Additionally, the template factors in cruise itinerary pricing and port fees and logistics for comprehensive financial performance metrics, ultimately supporting annual operating budget planning and investment analysis for cruise ships, all while considering the impact of maritime regulations and promoting sustainability initiatives.

Description

The cruise ship hotel financial plan for startup encompasses a comprehensive financial model designed to navigate the intricate dynamics of the cruise ship industry, focusing on critical metrics such as maritime tourism revenue and cruise line operating expenses. This adaptable 5-year projection template includes essential financial statements like the profit and loss statement, projected balance sheet, and cash flow analysis, facilitating a thorough investment analysis for cruise ships. Additionally, it evaluates hotel occupancy rates and shipboard amenities profitability while accounting for port fees and logistics, ensuring a holistic approach to guest experience evaluation and guest demographics analysis. The model incorporates financial performance metrics and hospitality market research to assist in food and beverage cost control, cruise itinerary pricing, and ongoing sustainability initiatives, ultimately empowering stakeholders to assess the cruise package value and enhance onboard entertainment revenue streams effectively.

CRUISE SHIP HOTEL FINANCIAL MODEL REPORTS

All in One Place

Our innovative financial model simplifies the cruise ship industry dynamics and hotel financial forecasting, delivering streamlined insights across all 15 sheets with minimal input. By integrating factors like cruise line operating expenses, maritime tourism revenue, and guest demographics analysis, it ensures clarity in financial performance metrics. This tool facilitates comprehensive assessments of cruise itinerary pricing, onboard entertainment revenue streams, and sustainability initiatives, all while maintaining organized assumptions in a single sheet. Boost your investment analysis for cruise ships and enhance profitability in shipboard amenities and hotel occupancy rates effortlessly.

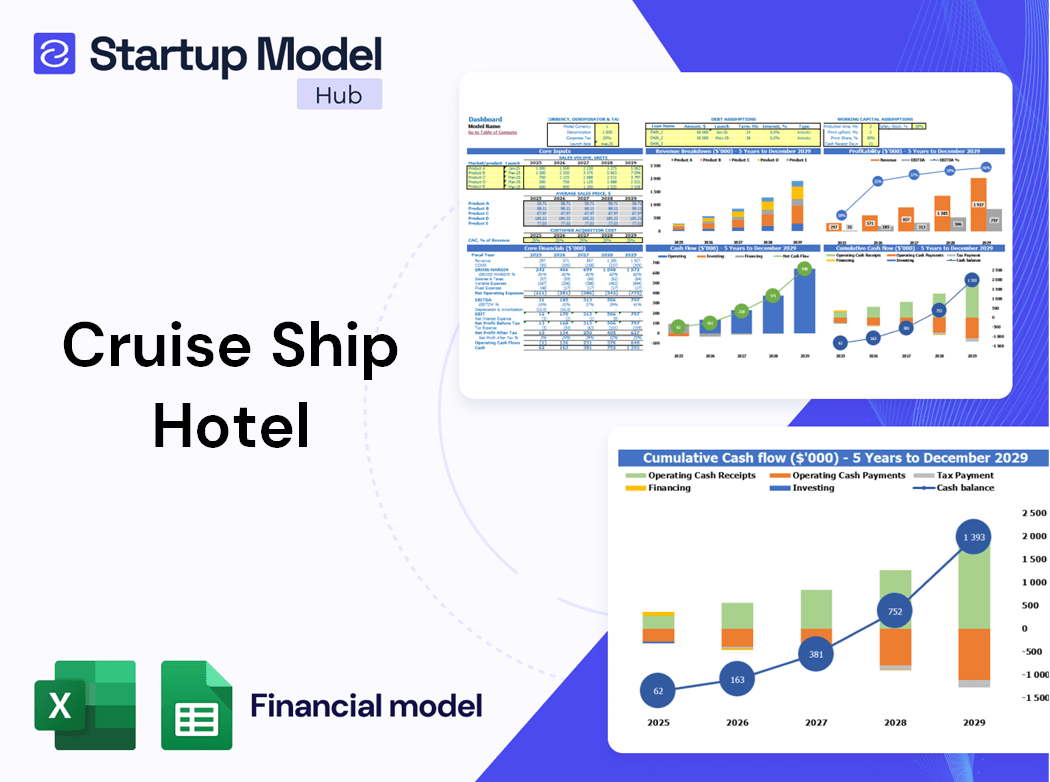

Dashboard

This financial modeling Excel template provides a comprehensive overview of vital financial indicators tailored to the cruise ship industry dynamics. It allows you to analyze maritime tourism revenue trends, track cruise line operating expenses, and evaluate hotel occupancy rates over desired time periods. The dashboard presents a detailed breakdown of revenues, cash flow statements, and financial projections, essential for effective annual operating budget planning. Utilize this tool to enhance guest experience evaluation, assess investment analysis for cruise ships, and ensure profitability in shipboard amenities and onboard entertainment revenue streams.

Business Financial Statements

Our comprehensive financial plan template is designed specifically for the cruise ship industry dynamics, offering a seamless integrated financial summary. It consolidates key data from various spreadsheets, including pro forma balance sheets, projected profit and loss statements, and cash flow analyses tailored for maritime tourism revenue. Our experts have meticulously formatted this summary to enhance your pitch deck, ensuring clarity and professionalism. With this tool, you’ll be well-equipped to evaluate operating expenses, investment analysis for cruise ships, and financial performance metrics, all vital for navigating today’s hospitality market.

Sources And Uses Statement

A projected income statement template in Excel offers valuable insights into a cruise line's financial landscape, highlighting sources of income and expenditures. By analyzing hotel occupancy rates, cruise line operating expenses, and onboard entertainment revenue streams, stakeholders can assess profitability and make informed decisions. This financial performance metric serves as a cornerstone for investment analysis and annual operating budget planning, ensuring alignment with maritime tourism revenue goals. Additionally, integrating guest demographics analysis and cruise package value assessments can enhance strategy development for optimizing shipboard amenities profitability and overall guest experience evaluation.

Break Even Point In Sales Dollars

Understanding the break-even point in unit sales is crucial for evaluating profit potential at varying sales levels. Additionally, the safety margin indicates how much of a decline in revenue the business can withstand before facing financial losses. In the context of the cruise ship industry dynamics, these metrics aid in assessing operational risks and guiding financial performance metrics, essential for strategic planning in areas like cruise itinerary pricing and investment analysis for cruise ships. This knowledge supports effective annual operating budget planning and enhances overall guest experience evaluation, critical for sustaining profitability in maritime tourism.

Top Revenue

Utilizing the Top Revenue tab, you can generate a comprehensive demand report for your cruise ship hotel’s services. This tool evaluates the profitability and financial appeal of various scenarios, enhancing your understanding of maritime tourism revenue. With the five-year financial projection template, you can analyze revenue depth and create a revenue bridge, forecasting demand across weekdays and weekends. These insights will enable you to optimize resource allocation, streamline cruise line operating expenses, and enhance guest experience evaluation, ultimately driving financial performance metrics and maximizing onboard entertainment revenue streams.

Business Top Expenses Spreadsheet

Evaluate your spending with our financial projection model template, designed specifically for the cruise ship industry dynamics. Here, expenses are categorized into four main groups, with an additional 'other' category for your unique data needs. This customizable feature allows you to incorporate specific financial insights, such as maritime tourism revenue, cruise line operating expenses, and onboard entertainment revenue streams, aligning with your company’s objectives. Enhance your annual operating budget planning and investment analysis for cruise ships while ensuring the profitability of shipboard amenities. Make informed decisions for optimal guest experience evaluation and financial performance metrics.

CRUISE SHIP HOTEL FINANCIAL PROJECTION EXPENSES

Costs

This innovative three-way financial model streamlines the oversight of FTE and PTE allocations within your team, incorporating a comprehensive template for salary costs and operational expenses. Effortlessly manage group or individual budgets with automated, end-to-end formulas that eliminate manual updates, ensuring seamless data flow. This tool not only enhances financial performance metrics but also aligns with industry dynamics, supporting effective planning around cruise line operating expenses, guest demographics analysis, and investment analysis for cruise ships in the ever-evolving maritime tourism landscape. Experience accuracy and efficiency in your financial forecasting efforts.

CAPEX Spending

CAPEX start-up expenses encompass the significant costs associated with acquiring essential assets for the cruise ship industry. These investments are crucial for optimizing operations and enhancing technological capabilities, ultimately impacting hotel financial forecasting and financial performance metrics. Properly reflecting these CAPEX expenses in pro forma balance sheets is vital for accurate analysis during investment evaluations. Additionally, they influence projected profit and loss statements and cash flow projections, aligning with strategic objectives like cruise package value assessment and guest experience evaluation within maritime tourism revenue streams. This ensures sustainable growth in a competitive hospitality market.

Loan Financing Calculator

Start-ups and early-stage growth companies must meticulously track their loan repayment schedules, detailing each loan's amount and maturity terms. This schedule plays a pivotal role in cash flow analysis and is reflected on the balance sheet. Principal repayments and interest expenses are key components of the financial model, influencing both the cash flow template and overall debt balance. Effectively managing these financial performance metrics ensures sustainable growth, particularly within the evolving cruise ship industry dynamics, where factors like maritime tourism revenue and operating expenses can significantly impact profitability and strategic planning.

CRUISE SHIP HOTEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Key performance indicators (KPIs) in the pro forma income statement are essential for cruise ship industry dynamics and hotel financial forecasting. These metrics empower company owners and investors to track financial performance, evaluate efficiency in operating expenses, and assess guest demographics analysis. By focusing on KPIs, stakeholders can enhance maritime tourism revenue, optimize onboard entertainment revenue streams, and evaluate the profitability of shipboard amenities. This strategic focus ensures informed decision-making in annual operating budget planning and investment analysis for cruise ships, ultimately driving sustainable growth and guest experience evaluation in a competitive hospitality market.

Cash Flow Forecast Excel

The pro forma cash flow statement template serves as a vital financial tool for the cruise ship industry, illustrating the dynamics of maritime tourism revenue. This template highlights cash flow generation, emphasizing the importance of managing cruise line operating expenses and port fees. By evaluating annual operating budgets and investment analysis for cruise ships, businesses can better understand their financial performance metrics. Ultimately, this tool aids in fiscal planning, ensuring sufficient liquidity to support ongoing sustainability initiatives and enhance guest experience through improved shipboard amenities and entertainment offerings.

KPI Benchmarks

Benchmarking is a vital strategic management tool, especially for emerging businesses in the cruise ship industry. By assessing key financial performance metrics—such as profit margins and operating expenses—companies can compare their indicators to those of industry leaders. This process not only aids in evaluating economic and business efficiency but also enhances hotel financial forecasting and guest experience evaluation. With insights into nautical lodging trends and cruise itinerary pricing, businesses can optimize their annual operating budget planning and improve sustainability initiatives, ultimately driving up maritime tourism revenue and onboard entertainment revenue streams.

P&L Statement Excel

To make informed decisions in the cruise ship industry, utilizing a projected profit and loss statement is essential. This robust financial model empowers professionals to create accurate reports grounded in effective forecasting tools. By leveraging these insights, you can thoroughly assess hotel financial performance, including guest experience evaluation and maritime tourism revenue. Understanding the strengths and weaknesses of your cruise line's operating expenses, shipboard amenities profitability, and cruise itinerary pricing will enhance strategic planning amid evolving maritime regulations and trends. This approach ensures optimized annual operating budget planning for sustainable growth in the competitive hospitality market.

Pro Forma Balance Sheet Template Excel

The projected balance sheet is essential for understanding your business's financial health, detailing assets, liabilities, and capital. Accurate assumptions are crucial for this statement. Historical data, ideally spanning several years, informs forecasts and reflects performance trends, vital for stakeholders. Assumptions for the pro forma balance sheet, particularly for maritime tourism, are interconnected with the monthly profit and loss statement, influencing working capital and capital expenditures. Integrating each financial component—like cruise line operating expenses and onboard entertainment revenue streams—will significantly impact your overall financial performance metrics and operational planning in the cruise ship industry.

CRUISE SHIP HOTEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our dynamic financial model features a robust valuation tab designed for seamless Discounted Cash Flow analysis. With minimal input requirements—primarily focusing on the Cost of Capital—users can effortlessly navigate this sophisticated calculation. This tool enhances investment analysis for cruise ships, aligning with the hospitality market research needs, ensuring stakeholders effectively assess financial performance metrics amidst the evolving cruise ship industry dynamics. By optimizing this process, users are better equipped to evaluate potential returns and make informed decisions, ultimately impacting overall maritime tourism revenue and operational strategies.

Cap Table

A well-structured capitalization table is crucial for understanding a cruise line's financial performance. It provides insights into the company's shares, options, and their origins, allowing for detailed investment analysis. This essential document enables stakeholders to assess ownership percentages, track invested capital, and evaluate the impact on overall operating budgets. By linking financial forecasting with maritime tourism revenue and operating expenses, stakeholders can better navigate industry dynamics, ensuring informed decisions that enhance profitability across shipboard amenities, guest experiences, and onboard entertainment revenue streams.

KEY FEATURES

A robust financial model empowers stakeholders to strategically navigate cruise ship industry dynamics and enhance profitability through informed decision-making.

Our financial model enhances planning and risk management, ensuring sustainable growth and profitability in the cruise ship industry dynamics.

A robust financial model enhances investment analysis for cruise ships, maximizing profitability and sustainability while optimizing guest experience evaluation.

Our financial model provides essential insights for optimizing cruise line operating expenses and enhancing maritime tourism revenue through strategic planning.

An effective financial model enhances cruise ship industry dynamics by optimizing operating expenses and maximizing maritime tourism revenue through strategic planning.

A robust financial model enhances cruise ship industry dynamics by optimizing operating expenses and maximizing maritime tourism revenue.

A robust financial model enhances decision making by optimizing cruise line operating expenses and maximizing maritime tourism revenue.

Utilize financial modeling to confidently evaluate investment decisions and enhance profitability in the cruise ship industry dynamics.

Implementing a robust financial model enhances the cruise ship industry's operational efficiency and optimizes maritime tourism revenue streams effectively.

Our advanced cruise ship financial forecasting model empowers businesses to achieve quick, reliable insights for improved profitability and decision-making.

ADVANTAGES

Maximize profitability by leveraging financial forecasting to navigate cruise ship industry dynamics and enhance guest experience evaluation.

Optimizing accounts payable and receivable through a three-way financial model enhances cash flow and supports sustainable cruise ship industry dynamics.

A robust financial model for cruise ships enhances investment analysis, ensuring sustainable profitability and strategic decision-making in a competitive market.

Enhance your strategic decisions with a cruise ship hotel financial model to optimize profitability and forecast maritime tourism revenue effectively.

The financial model effectively forecasts maritime tourism revenue, enhancing investment analysis for cruise ships and optimizing operating expenses.