Dessert Bar Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Dessert Bar Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

dessert bar Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

DESSERT BAR FINANCIAL MODEL FOR STARTUP INFO

Highlights

The dessert bar business plan includes a detailed analysis of revenue projections, startup expenses, and a comprehensive cost analysis to ensure financial viability. By employing a robust pricing strategy and evaluating profit margins, the plan outlines key financial metrics and cash flow statements essential for understanding operating costs and expense management. The break-even analysis will highlight the dessert bar's growth potential and investment needs, while our financial forecasting provides insight into funding options and sales strategies. The budgeting process will be streamlined with a 5-year cash flow projection and financial model in Excel designed to attract banks, angel investors, and venture capital. This approach will not only assist in evaluating startup ideas but will also equip stakeholders with the necessary tools to optimize gross revenue and improve overall financial performance.

The dessert bar financial model addresses critical pain points for entrepreneurs by offering a comprehensive framework to streamline expense management and enhance financial forecasting. It simplifies the estimation of dessert bar startup expenses and aids in crafting a robust pricing strategy to optimize profit margins, ensuring that revenue projections are realistic and achievable. By incorporating tools for break-even analysis and cash flow statements, this model empowers business owners to make informed decisions about funding options and to analyze market trends efficiently. Furthermore, the detailed budgeting process allows users to monitor operating costs and financial metrics closely, identifying areas for growth potential and ensuring long-term financial viability for their dessert bar venture.

Description

The dessert bar financial model encompasses a comprehensive framework designed to facilitate effective financial planning and forecasting, emphasizing critical components like dessert bar revenue projections, startup expenses, and operating costs. It provides a detailed three-way financial model that outlines a 5-year monthly and yearly profit and loss statement, projected balance sheet, and projected cash flow statement, ensuring that all essential financial metrics and performance ratios are easily accessible for assessing financial viability and guiding investment needs. Users can effortlessly modify the dessert bar planning model with basic Excel skills, automatically updating financial performance indicators to reflect any changes, while also generating vital reports such as cash flow statements, break-even analysis, and expense management tools that are pivotal for maintaining healthy profit margins and ensuring robust growth potential.

DESSERT BAR FINANCIAL MODEL REPORTS

All in One Place

A comprehensive dessert bar business plan is essential for assessing financial viability. Utilize revenue projections and cost analysis to determine startup expenses, break-even points, and profit margins. Implement a solid pricing strategy and sales strategy, ensuring careful expense management to optimize cash flow. Financial forecasting and a detailed cash flow statement will provide insight into growth potential and investment needs. By employing thorough market analysis and financial metrics, entrepreneurs can confidently navigate funding options and achieve sustainable success in their dessert bar endeavor.

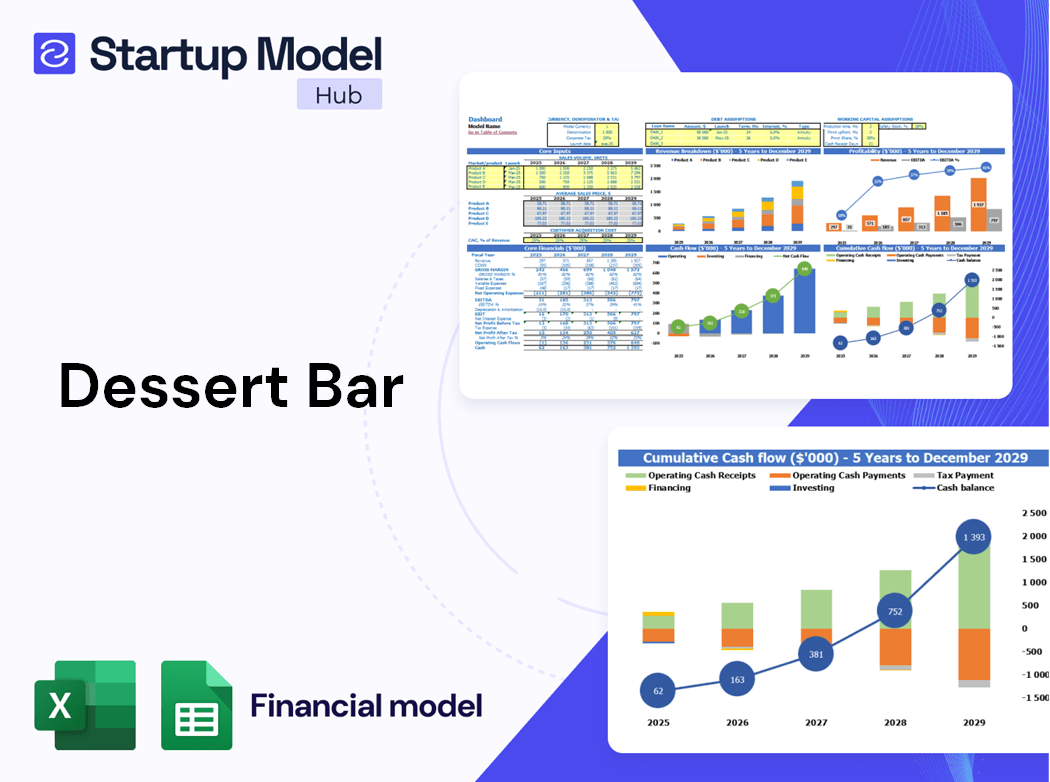

Dashboard

To effectively analyze the financial viability of your dessert bar, a comprehensive business plan is essential. Our startup financial model template organizes vital data, facilitating detailed revenue projections, cost analysis, and budgeting processes. With tools to project a five-year balance sheet and profit and loss statements, you can visualize your dessert bar's financial metrics through customizable graphs and charts. This ensures you have a clear understanding of your cash flow statement, break-even analysis, and potential profit margins, ultimately enhancing your sales strategy and guiding your investment needs for optimal growth.

Business Financial Statements

A comprehensive dessert bar business plan is crucial for assessing financial viability and growth potential. Utilizing financial metrics such as revenue projections, cost analysis, and expense management, you can develop a robust pricing strategy that maximizes profit margins. The budgeting process should include a break-even analysis and an exploration of funding options to ensure effective cash flow management. Additionally, crafting a solid sales strategy, complemented by a pro forma balance sheet and cash flow statement, will enhance your dessert bar's operational efficiency and long-term success.

Sources And Uses Statement

A Sources and Uses of Funds Statement is essential for a dessert bar business plan, providing critical insights into startup expenses and funding needs. This financial document aids in securing bank loans and attracting investors by clearly outlining revenue projections and expense management strategies. For startups, meticulous tracking of each funding source and cost is crucial for financial viability. By effectively summarizing cash flow, operating costs, and potential profit margins, this statement showcases the dessert bar’s growth potential and positions it favorably in investor discussions, ensuring a sound financing strategy for long-term success.

Break Even Point In Sales Dollars

A robust dessert bar business plan incorporates essential financial metrics like break-even analysis and cash flow statements to gauge profitability. By calculating the volume of sales needed to cover startup expenses and operating costs, owners can identify the point at which revenue exceeds costs. This analysis empowers management to optimize pricing strategies and make informed decisions, ultimately enhancing profit margins. Additionally, financial forecasting offers insights into growth potential and funding options, ensuring the dessert bar's financial viability while attracting investment. Effective expense management is key to sustaining long-term success in this competitive market.

Top Revenue

In a dessert bar business plan, focusing on topline revenue and bottom line profit is crucial. Accurate financial forecasting, including dessert bar revenue projections and cost analysis, helps evaluate financial viability. Investors prioritize metrics such as gross revenue and profit margins, making it essential to establish a solid pricing strategy. Regularly monitoring operating costs and cash flow statements ensures effective expense management. Employing a robust sales strategy and conducting a thorough market analysis will unlock growth potential and attract funding options, ultimately leading to sustainable success in the competitive dessert bar landscape.

Business Top Expenses Spreadsheet

The expense report is vital for managing your dessert bar's financial health. It categorizes your startup expenses, providing a clear snapshot of operating costs and facilitating effective expense management. Use this data to craft your three-statement financial model, enabling accurate revenue projections and financial forecasting. By regularly monitoring these metrics, you'll assess whether your costs align with your pricing strategy and profit margins. Adjust your budget accordingly to ensure financial viability and growth potential, ultimately guiding your dessert bar toward sustainable success.

DESSERT BAR FINANCIAL PROJECTION EXPENSES

Costs

Start-up expenses are essential for your dessert bar's growth, but managing them wisely is crucial for long-term success. Our comprehensive business plan includes financial forecasting templates designed to help you track costs, analyze cash flow statements, and ensure sustainable profit margins. With our tools, you can develop an effective pricing strategy, conduct break-even analysis, and evaluate your financial viability. By employing robust expense management and market analysis techniques, you'll be well-equipped to navigate funding options and unlock your dessert bar's growth potential while keeping a keen eye on revenue projections.

CAPEX Spending

A comprehensive dessert bar business plan should include a detailed cash flow statement that assesses capital expenditures (CAPEX). This analysis is vital for tracking investments in fixed assets, encompassing depreciation and any additions or disposals of property, plant, and equipment (PPE). By evaluating these financial metrics, including startup expenses and operating costs, you can enhance your dessert bar's financial viability. Moreover, incorporating thorough dessert bar revenue projections and a solid pricing strategy will ensure sustainable growth and profitability while effectively managing expenses and maximizing profit margins.

Loan Financing Calculator

Our dessert bar business plan includes a detailed financial model featuring a structured loan amortization schedule. This tool effectively outlines the repayment plan for any debts, detailing principal and interest amounts due on a monthly, quarterly, or annual basis. By integrating this analysis into our budgeting process, we ensure clarity in expense management and enhance our overall financial viability. This enhances our dessert bar's revenue projections and solidifies our investment needs, fostering a clear understanding of cash flow and growth potential.

DESSERT BAR EXCEL FINANCIAL MODEL METRICS

Financial KPIs

EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, is a crucial financial metric for your dessert bar business plan. It directly reflects your startup expenses and overall profitability, distinguishing itself from cash flow by encompassing both monetary and non-monetary factors. By leveraging EBITDA in your cost analysis, you can assess the financial viability of your dessert bar, guiding your pricing strategy and expense management. This insight is invaluable for financial forecasting, ensuring sustainable profitability and aiding in break-even analysis while identifying growth potential in the competitive dessert market.

Cash Flow Forecast Excel

Creating a robust cash flow statement is essential for your dessert bar business plan. This financial forecasting tool allows you to track cash inflows and outflows, ensuring accurate expense management and effective budgeting. Your projected cash flow statement should encompass all financial metrics, including gross revenue, operating costs, and profit margins. By leveraging both direct and indirect cash flow methods, you can refine your financial analysis, facilitating break-even analysis and assessing growth potential. Ultimately, this comprehensive approach enhances the dessert bar's financial viability and informs strategic decisions around pricing, funding options, and sales strategy.

KPI Benchmarks

Our Excel financial plan template includes a comprehensive benchmarking tool, enabling clients to compare their dessert bar's performance against industry standards and successful competitors. This resource assists in identifying areas for improvement, ensuring optimal revenue projections, and enhancing overall financial viability. By utilizing this template, you can refine your cost analysis, evaluate startup expenses, and develop effective pricing strategies. Ultimately, this empowers you to boost profit margins and unlock your dessert bar's growth potential while effectively managing cash flow and operating costs.

P&L Statement Excel

The monthly pro forma profit and loss statement is essential for evaluating your dessert bar’s financial viability. By prioritizing calculation accuracy and utilizing effective formats, you gain insights into revenue projections, operating costs, and profit margins. This data not only aids in crafting a robust dessert bar business plan but also supports annual gross profit reports. With a focus on financial metrics and expense management, you can navigate the budgeting process and enhance your sales strategy, ultimately driving growth potential and ensuring sustainable success for your dessert bar venture.

Pro Forma Balance Sheet Template Excel

A well-crafted dessert bar business plan is essential for determining financial viability and growth potential. Utilizing a projected balance sheet template, you can assess current and long-term assets, liabilities, and equity. This financial forecasting tool aids in financial metrics evaluation, ensuring informed decisions regarding startup expenses and operating costs. By incorporating detailed revenue projections and cost analysis, you can refine your pricing strategy and enhance profit margins. Investors will appreciate your thorough break-even analysis, cash flow statement, and expense management approach, positioning your dessert bar for sustainable success.

DESSERT BAR FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Investors will find critical insights within the dessert bar business plan's comprehensive financial model. It includes a detailed startup valuation, showcasing the weighted average cost of capital (WACC) to inform stakeholders of expected returns. The Free Cash Flow (FCF) analysis highlights available cash for all investors, while the Discounted Cash Flow (DCF) method accurately projects future cash flows at their present value. This structured approach not only enhances financial forecasting but also addresses dessert bar revenue projections, operating costs, and potential profit margins, ensuring robust decision-making for funding options and growth strategies.

Cap Table

Our dessert bar business plan includes advanced financial forecasting tools that streamline your budgeting process. With built-in proformas for discounted cash flow calculations, you can easily evaluate your dessert bar's revenue projections and operating costs. This template assists in assessing profit margins, crafting an effective pricing strategy, and ensuring financial viability. Use the cap table for startups to explore funding options or omit it without affecting essential financial metrics. This comprehensive approach enables you to calculate your break-even analysis and forecasts for gross revenue, ensuring a clear path to sustainable growth and investment returns.

KEY FEATURES

A robust financial model enhances cash flow management, ensuring your dessert bar can address customer payment issues effectively.

Utilizing a cash flow model helps track customer payments, ensuring timely collections and bolstering the dessert bar's financial viability.

A solid financial model enhances your dessert bar business plan, ensuring informed decisions on revenue, expenses, and growth potential.

A robust dessert bar financial model showcases profitability, ensuring investor confidence and guiding strategic growth decisions effectively.

A comprehensive dessert bar business plan enhances decision-making through precise financial forecasting and effective expense management strategies.

Developing a comprehensive cash flow statement enables informed decisions, ensuring optimal allocation between staff investments and necessary equipment purchases.

A comprehensive dessert bar business plan enhances financial forecasting, ensuring informed decisions that save time and maximize profits.

A comprehensive financial model streamlines your dessert bar planning, eliminating costly consultants while you focus on strategy and creativity.

A robust financial model reveals your dessert bar's profitability potential, attracting investors and ensuring sustainable growth.

Utilizing the dessert bar financial model enhances your credibility, helping you attract investors and secure essential funding effectively.

ADVANTAGES

A robust financial model enhances your dessert bar business plan, boosting decision-making and ensuring financial viability for sustainable growth.

A robust financial model identifies potential shortfalls in dessert bar cash balances, ensuring sustainable operations and informed decision-making.

A robust financial model enhances dessert bar startup expenses management, ensuring informed decisions for sustainable growth and profitability.

A solid financial model enhances your dessert bar's profit loss projection, empowering you to navigate challenges with confidence.

Implementing a comprehensive financial model enhances your dessert bar’s decision-making and ensures sustainable growth and profitability.