Digital Banking Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Digital Banking Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

digital banking Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

DIGITAL BANKING FINANCIAL MODEL FOR STARTUP INFO

Highlights

A robust digital banking strategy is essential for leveraging current financial technology trends, particularly as neobanks increasingly adopt innovative financial models. By incorporating mobile banking solutions and online banking services, banks can enhance customer experience while ensuring regulatory compliance in digital banking. The integration of digital payment systems and cloud-based banking solutions is pivotal for advancing fintech innovations, which include AI in banking operations and blockchain in financial services. Additionally, open banking frameworks and peer-to-peer lending platforms contribute to financial inclusion through technology. By harnessing data analytics in banking and focusing on user interface design, institutions can significantly improve their digital marketing efforts, ultimately strengthening their position in an evolving financial landscape while addressing the critical aspects of cybersecurity in digital finance.

The ready-made financial model in Excel simplifies the digital banking strategy by alleviating common pain points associated with traditional financial planning. It eliminates the need for complex formulas, tedious formatting, and intricate programming, allowing users to focus on leveraging financial technology trends rather than getting bogged down in technical details. With automated inputs and built-in templates, it integrates seamlessly with mobile and online banking services, streamlining data analytics to enhance customer experience in banking. Additionally, the model supports regulatory compliance in digital banking, ensuring that users can create projections that meet industry standards without the expense of hiring external consultants. This approach not only reduces the time required for financial planning but also empowers users to adapt to fintech innovations and enhance their overall operational effectiveness, promoting financial inclusion through technology.

Description

For entrepreneurs looking to launch a digital banking business, a robust financial modeling strategy is crucial for forecasting the future of their venture amidst evolving financial technology trends and banking as a service frameworks. Our dynamic Excel projection model is designed to capture all variables that could potentially impact your operations, ensuring effective management of cash flow and overall financial health in an increasingly competitive landscape. This comprehensive three-statement model enables you to create detailed financial statements, from profit and loss analyses to cash flow projections, while employing data analytics to refine your revenue strategies and operational costs. Utilizing a bottom-up approach, this model streamlines financial planning by simplifying complex calculations, allowing you to focus on enhancing customer experience through innovative mobile banking solutions and maintaining compliance with regulatory requirements in digital banking.

DIGITAL BANKING FINANCIAL MODEL REPORTS

All in One Place

In today's competitive landscape, an effective digital banking strategy is essential for navigating the evolving financial technology trends. This five-year projection plan serves as a comprehensive roadmap, enhancing your management approach. For startups, leveraging our free financial model template in Excel will optimize cash flow management and monitor the cash burn rate—key to ensuring liquidity and sustaining operational duration. By integrating mobile banking solutions and cloud-based banking options, you can elevate the customer experience in banking, fostering financial inclusion through technology while ensuring regulatory compliance and cybersecurity. Embrace the future with confidence and innovation.

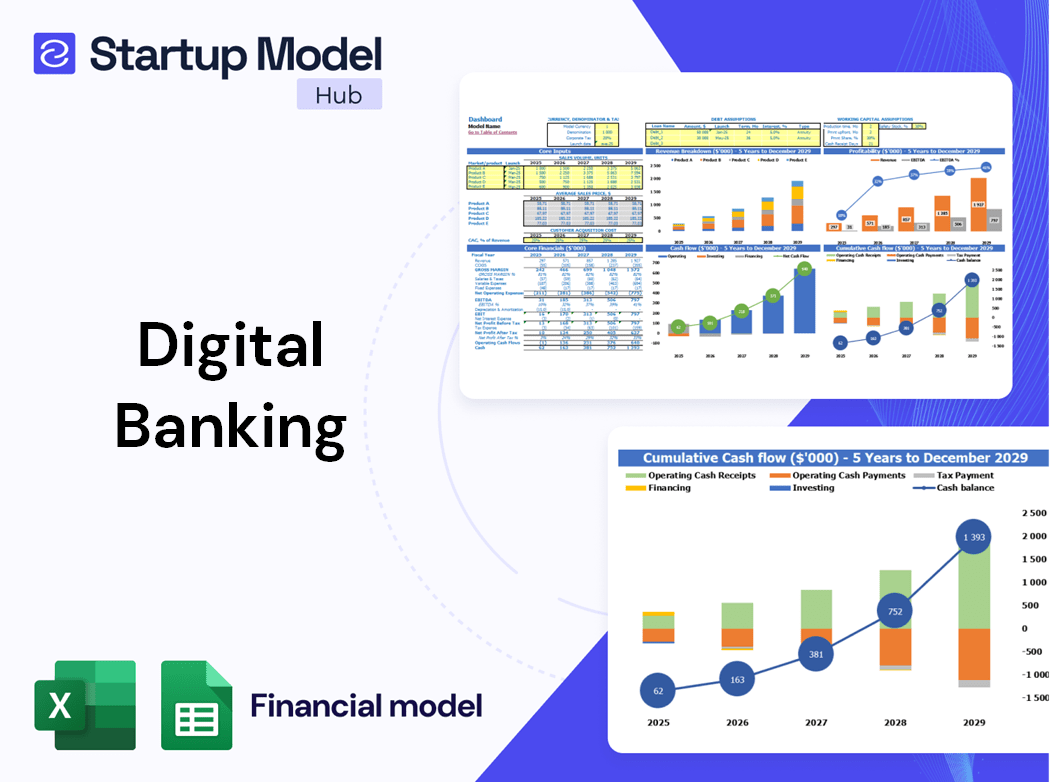

Dashboard

To enhance your digital banking strategy, ensure that all stakeholders have access to the cash flow proforma. Embracing financial technology trends like cloud-based banking solutions and digital payment systems can significantly improve operational efficiency. By integrating data analytics and AI in banking operations, you elevate customer experience and regulatory compliance. Additionally, leveraging online banking services and innovative user interface design can foster financial inclusion through technology. Proactively sharing information not only aligns your team but also makes your financial plan more engaging and effective. Embrace fintech innovations to drive growth and transform your business model.

Business Financial Statements

The Excel financial model features comprehensive proformas for projected balance sheets, income statements, and cash flow analysis. Users can effortlessly generate detailed financial reports on both monthly and annual timelines, utilizing tailored financial assumptions within a five-year projection framework. This capability not only enhances regulatory compliance in digital banking but also enables banks to adapt to evolving fintech innovations, ensuring a superior customer experience. By leveraging data analytics in banking, institutions can refine their digital banking strategy and embrace financial inclusion through technology.

Sources And Uses Statement

Companies increasingly prioritize the source and use of funds as vital indicators of financial health, demonstrating funding origins and cash flow direction. A robust digital banking strategy, aligned with financial technology trends, enhances transparency and operational efficiency. Embracing fintech innovations such as cloud-based banking solutions and digital payment systems fosters improved customer experience in banking. Moreover, integrating data analytics and AI in banking operations enables informed decision-making, while regulatory compliance ensures sustainable growth. By leveraging these tools, businesses can effectively navigate the evolving landscape of digital finance and promote financial inclusion through technology.

Break Even Point In Sales Dollars

This financial model template empowers businesses to conduct a comprehensive break-even analysis, crucial for assessing when revenue will surpass total costs. Understanding this key financial milestone allows businesses to identify when they can expect profitability, which is essential for attracting investors and creditors. By analyzing the interplay between revenue and both fixed and variable costs, businesses can optimize their digital banking strategy, leverage fintech innovations, and ensure regulatory compliance in digital banking. This strategic insight not only enhances the customer experience in banking but also drives financial inclusion through technology and emerging digital payment systems.

Top Revenue

This financial model template for startups includes a dedicated tab for in-depth analysis of revenue streams. Users can effortlessly evaluate each product or service category, gaining insights into their financial performance. By leveraging trends in financial technology, such as digital banking strategies and mobile banking solutions, users can enhance their understanding of diverse revenue potentials. This approach aligns with the evolving landscape of digital payment systems and the increasing emphasis on customer experience in banking, ensuring that startups are well-equipped to navigate the dynamic fintech environment.

Business Top Expenses Spreadsheet

The financial projections within the pro forma document clearly outline the company's expenses, categorized for clarity. An 'other' category allows for the inclusion of additional data, enhancing the financial transparency. Utilizing a business plan financial projections template in Excel can empower your digital banking strategy, offering insights into historical performance over five years. This approach not only supports regulatory compliance in digital banking but also enhances customer experience in banking through data analytics and fintech innovations. Embrace these tools to optimize your financial model and drive growth in today's evolving digital landscape.

DIGITAL BANKING FINANCIAL PROJECTION EXPENSES

Costs

A robust financial model Excel template is an essential tool for startups, offering precise expense projections vital for digital banking strategy. By pinpointing critical areas needing attention, businesses can enhance their customer experience in banking. This strategic framework not only strengthens your business plan but also effectively communicates your financial vision to potential investors, facilitating funding or loans. Embrace fintech innovations to drive financial inclusion and ensure regulatory compliance in digital banking with this sophisticated model.

CAPEX Spending

The CAPEX budget outlines investments aimed at enhancing competitiveness and driving innovation in digital banking strategies. It does not encompass staff salaries or operating costs. This analysis highlights areas ripe for investment, particularly in emerging financial technology trends like mobile banking solutions, AI in banking operations, and cloud-based banking solutions. By understanding capital expenditures across various business models, organizations can refine their approaches to online banking services and leverage fintech innovations effectively. This insight is vital for fostering financial inclusion through technology while ensuring regulatory compliance in the evolving landscape of digital finance.

Loan Financing Calculator

Elevate your financial planning with our comprehensive pro forma projection featuring an integrated loan amortization schedule. This tool simplifies your banking experience by calculating repayment amounts based on total loan amount, tenor, and maturity. Access detailed breakdowns of principal and interest in each installment, ensuring enhanced transparency. Stay informed with all essential details, such as interest rates, tenor, maturity dates, and repayment schedules. Seamlessly integrate this into your digital banking strategy to enhance customer experience and streamline operations amidst evolving financial technology trends. Embrace fintech innovations to foster greater financial inclusion and regulatory compliance.

DIGITAL BANKING EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The business projection template offers essential KPIs to track your organization’s performance, focusing on sales, profitability, and growth metrics. In the context of digital banking strategy, selecting relevant KPIs is crucial. For instance, fintech innovations like mobile banking solutions may prioritize metrics such as customer retention rates and transaction volumes, while neobanks may emphasize customer acquisition costs and user interface design. Tailoring KPIs to your financial technology model ensures effective monitoring and enhances customer experience in banking, enabling your business to stay ahead in an evolving digital landscape.

Cash Flow Forecast Excel

A robust cash flow forecasting model is essential for projecting financial activities, particularly when strategizing financing options like loans and capital raising. Effective capital management is crucial for startups, as it equips them to seize opportunities in a competitive landscape. Leveraging digital banking strategies, including AI in banking operations and data analytics in banking, enhances decision-making. Integrating mobile banking solutions and open banking frameworks further streamlines financial planning, ensuring startups remain agile in evolving financial technology trends while maintaining regulatory compliance in digital banking. This proactive approach fosters financial inclusion through technology, ultimately driving sustainable growth.

KPI Benchmarks

A financial projection startup's benchmark tab effectively calculates key performance indicators, offering insights into both business and financial metrics. By comparing these figures with industry averages, startups can assess their performance against established norms. This financial benchmarking is crucial for enhancing financial modeling, particularly for emerging companies. By analyzing successful players in the market, startups can uncover best practices and refine their digital banking strategies. This approach not only drives improved financial results but also fosters innovation through the integration of fintech trends, ultimately enhancing customer experience in banking and ensuring regulatory compliance.

P&L Statement Excel

Our financial planning startup streamlines complex financial calculations, enhancing your digital banking strategy. Equipped with advanced data analytics, it simplifies reporting through intuitive charts and graphs. Our projected income statement not only tracks profitability but also identifies areas for improvement, maximizing revenue opportunities. By embracing fintech innovations, our platform elevates the customer experience in banking, ensuring regulatory compliance and robust cybersecurity. With cloud-based banking solutions and integrating AI in banking operations, we empower your café business to thrive in an increasingly competitive landscape.

Pro Forma Balance Sheet Template Excel

A balance sheet forecast provides a vital snapshot of your organization’s financial health, detailing assets, liabilities, and shareholders' equity over a specific period. This pro forma document enables businesses to evaluate their ownership and obligations, serving as a key tool in developing a robust digital banking strategy. By leveraging data analytics and adopting innovative financial technology trends, organizations can enhance their financial inclusivity and regulatory compliance, ultimately improving customer experience. Utilize our balance sheet forecast to strategically assess your financial position and stay ahead in the competitive landscape of digital finance.

DIGITAL BANKING FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

When presenting to investors, a robust digital banking strategy is essential. Our advanced digital banking business forecast template features integrated valuation tools tailored for today’s fintech innovations. Showcase the minimum return on invested capital with our weighted average cost of capital (WACC) analysis. Highlight total cash flow available for all stakeholders with our free cash flow valuation. Additionally, leverage our discounted cash flow template to illustrate the present value of future cash flows, ensuring you meet regulatory compliance in digital banking while enhancing the customer experience. Empower your presentation with cutting-edge insights and cloud-based banking solutions.

Cap Table

In our fintech startup, a capitalization table (cap table) is essential for understanding ownership structure. This dynamic spreadsheet outlines company shares, options, and respective valuations paid by investors, providing insights into each investor's ownership percentage. As we implement a robust digital banking strategy, leveraging financial technology trends and cloud-based banking solutions, our cap table is crucial for achieving regulatory compliance and ensuring transparency. By integrating data analytics in banking and innovative mobile banking solutions, we aim to enhance the customer experience while fostering financial inclusion through technology.

KEY FEATURES

Neobanks leverage a streamlined financial model to enhance customer experience through innovative mobile banking solutions and lower costs.

Our platform creates a comprehensive five-year financial model, enhancing decision-making through real-time insights into digital banking strategies and performance.

Neobanks' financial model enhances customer experience through innovative mobile banking solutions and seamless digital payment systems.

Utilizing a cash flow projection allows businesses to dynamically assess financial impacts, enhancing strategic planning and decision-making efficiency.

Neobanks leverage agile financial models to enhance customer experience through innovative mobile banking solutions and seamless digital payment systems.

The neobanks financial model enhances customer experience in banking by offering seamless, mobile banking solutions tailored to individual needs.

Neobanks' financial model enhances customer experience in banking by offering innovative digital solutions and lower fees through technology.

Exploring diverse funding options enhances your financial model, driving growth and ensuring stability for future business opportunities.

Neobanks' financial model enhances customer experience in banking by offering seamless mobile banking solutions and innovative digital payment systems.

Neobanks' financial model enhances efficiency, enabling businesses to focus on product development and customer engagement, rather than cash flow management.

ADVANTAGES

Adopting a neobanks financial model enhances customer experience through innovative mobile banking solutions and streamlined online banking services.

Leverage a digital banking strategy to enhance customer experience and streamline repayments with an innovative financial model template.

The neobanks financial model enhances customer experience in banking by leveraging innovative fintech solutions and streamlined digital payment systems.

Leverage the neobanks financial model to enhance customer experience in banking through innovative digital banking strategies and technologies.

The neobanks financial model enhances customer experience in banking through innovative mobile banking solutions and seamless digital payment systems.