Digital Insurance Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Digital Insurance Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

digital insurance Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

DIGITAL INSURANCE FINANCIAL MODEL FOR STARTUP INFO

Highlights

A sophisticated 5-year digital insurance business model financial projection template is essential for leveraging the latest insurance technology trends and ensuring robust profitability analysis in insurance. This model requires minimal previous financial planning experience and only basic Excel knowledge, making it accessible for various stages of development in your insurtech solutions. By utilizing this digital insurance financial model, businesses can enhance their risk assessment models and streamline the underwriting process automation, leading to improved operational efficiency in insurance. This tool not only aids in financial forecasting insurance metrics but also assists in customer acquisition strategies insurance, paving the way for successful product development in insurtech. With fully editable features, this template is designed to help you secure necessary funding from banks or investors before acquiring a digital insurance business.

The ready-made financial model in the Excel template addresses key pain points for buyers in the insurance sector by streamlining the intricacies of financial forecasting in insurance, enabling users to efficiently analyze insurance premium calculations, integrate actuarial modeling, and apply data analytics in insurance for enhanced risk assessment models. This template supports operational efficiency in insurance through its automated processes for claims management systems and underwriting, while also ensuring compliance with regulatory requirements, ultimately enhancing profitability analysis in insurance and facilitating informed decision-making. With comprehensive industry-specific inputs and performance metrics, the template empowers users to conduct thorough insurance market analysis and refine customer acquisition strategies, positioning them to leverage insurtech solutions effectively in a rapidly transforming digital landscape.

Description

The digital insurance financial modeling template is a robust tool designed to streamline financial calculations and enhance business decision-making processes, integrating critical aspects such as insurance revenue models, profitability analysis, and customer acquisition strategies. Utilizing this template, users can effectively develop a comprehensive financial plan that outlines initial capital investments and working capital needs, while also facilitating the forecasting of monthly sales and expenses, supported by advanced data analytics in insurance. The built-in 5-year financial projection is invaluable for both startups and established companies, providing automated calculations for revenue forecasts, expense budgets, and essential financial metrics. This tool also fosters operational efficiency in insurance by generating detailed three-statement reports and key performance indicators, which are instrumental for stakeholder negotiations and strategic planning, ensuring regulatory compliance and optimizing underwriting process automation.

DIGITAL INSURANCE FINANCIAL MODEL REPORTS

All in One Place

Discover our user-friendly and versatile financial projections template designed specifically for the digital insurance business model. This comprehensive Excel tool supports various insurtech solutions, facilitating financial modeling and profitability analysis in insurance. With basic financial skills, users can easily customize and expand the sheets to fit their unique needs. Leverage advanced data analytics and actuarial modeling insights to enhance your customer acquisition strategies and improve operational efficiency. Streamline your underwriting process and optimize your claims management systems with this essential resource, ensuring you stay ahead in the evolving landscape of insurance technology trends.

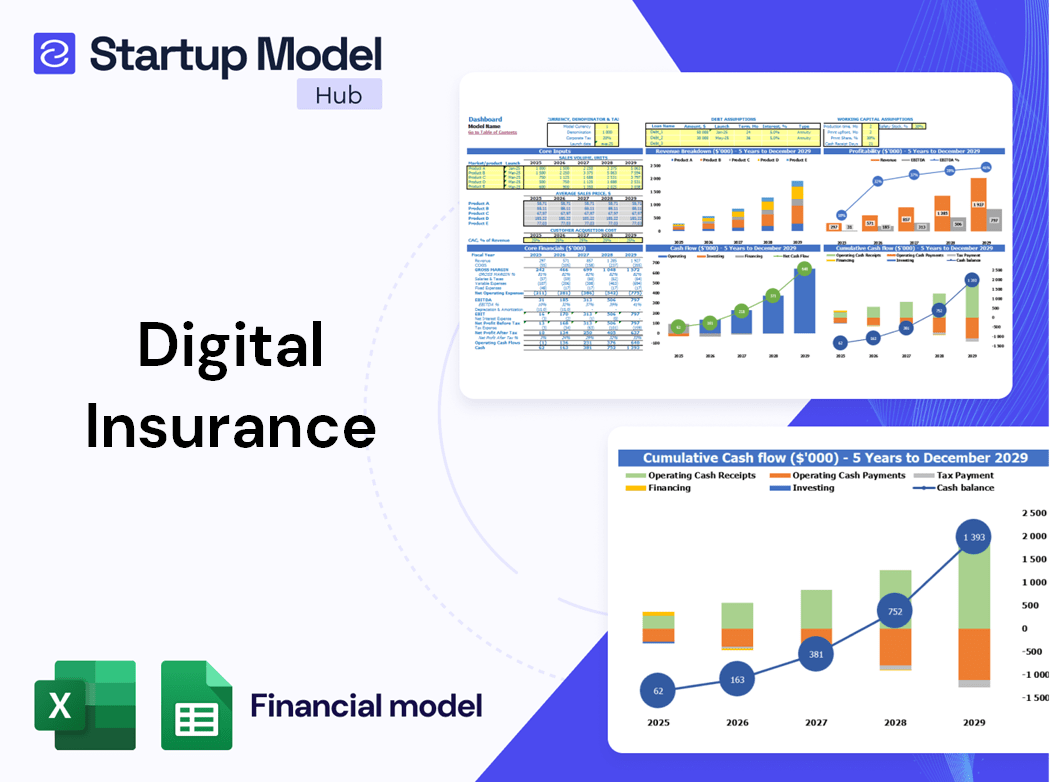

Dashboard

The comprehensive dashboard in this financial projection Excel streamlines your digital insurance business model. It showcases essential financial metrics, including a five-year projected balance sheet, income statement, and cash flow model. Tailored for insurtech solutions, the dashboard enhances operational efficiency in insurance, making it easier to analyze revenue models and profitability. For stakeholder presentations, data can be visually represented through dynamic graphs and charts, elevating your insurance market analysis and aiding in financial forecasting. Employing actuarial modeling and risk assessment models, this tool supports informed decision-making in the digital transformation of your insurance operations.

Business Financial Statements

Our financial planning model streamlines the creation of pro forma balance sheets, profit and loss statements, and cash flow statements in Excel, enhancing operational efficiency in insurance. Users can input historical or forecasted data to assess various scenarios, facilitating informed decision-making. This template supports insurance technology trends by showcasing the impact of management choices, such as pricing strategies, on overall profitability. By integrating actuarial modeling and data analytics, stakeholders can gain valuable insights into the insurance revenue model and optimize customer acquisition strategies, ensuring regulatory compliance and robust financial forecasting.

Sources And Uses Statement

This financial projection model template features a comprehensive Sources and Uses tab, illustrating your digital insurance business model's funding structure. It provides an in-depth analysis of how funds are allocated, enhancing operational efficiency in insurance and supporting effective financial forecasting. By integrating insurance technology trends, such as data analytics and insurtech solutions, this tool aids in assessing profitability, streamlining the underwriting process, and ensuring regulatory compliance. Leverage this model for strategic insights into your insurance revenue model and improve customer acquisition strategies while optimizing risk assessment models.

Break Even Point In Sales Dollars

This financial modeling Excel template includes a break-even analysis chart that forecasts when your digital insurance business model will begin to generate profits. By utilizing data analytics in insurance, the CVP chart integrates projected revenues and expenses, providing insights into the financial forecasting process. It identifies the critical period when revenue surpasses costs, supporting operational efficiency and profitability analysis in insurance. This tool is essential for effective risk assessment models and enhances decision-making in product development within the insurtech sector.

Top Revenue

The top line and bottom line are crucial indicators in a company's proforma income statement, attracting keen interest from investors and analysts alike. "Top-line growth" signifies an increase in gross sales or revenues, reflecting a robust insurance revenue model. This growth, bolstered by advancements in insurance technology trends and data analytics, can enhance operational efficiency in insurance and improve overall financial forecasting. As companies navigate digital transformation in insurance, monitoring changes in these financial metrics becomes essential for sustaining profitability and adhering to regulatory compliance.

Business Top Expenses Spreadsheet

To maximize profitability in the digital insurance business model, a thorough analysis of service costs is essential. Our financial modeling startup features a streamlined expense overview, highlighting the top four expenses while categorizing others under "Other." This clarity enables companies to swiftly assess and strategize for cost optimization annually. For both startups and established firms, monitoring operational efficiency in insurance and implementing effective customer acquisition strategies are critical for sustained profitability. Emphasizing financial forecasting and profitability analysis ensures that businesses remain competitive in the evolving insurtech landscape.

DIGITAL INSURANCE FINANCIAL PROJECTION EXPENSES

Costs

Effortlessly forecast your fixed operating expenses, including R&D and SG&A, with our intuitive financial modeling tool tailored for the digital insurance business model. This Excel sheet streamlines your financial planning process, featuring automated formulas that eliminate the hassle of manual updates. Stay ahead in the insurtech landscape by enhancing operational efficiency, supporting effective risk assessment models, and aligning with insurance technology trends. Optimize your insurance premium calculation and claims management systems while ensuring regulatory compliance. Experience seamless digital transformation in insurance with a solution designed for scalability and profitability analysis.

CAPEX Spending

Capital expenditure (CapEx) plays a crucial role in financial modeling within the digital insurance business model. It enables businesses to effectively manage investments in fixed assets, including property, plant, and equipment (PPE). CapEx considerations encompass depreciation, asset additions, and disposals. This strategic investment is pivotal for insurtech solutions, enhancing operational efficiency in insurance and supporting innovations in product development. By integrating data analytics in insurance with robust financial forecasting, companies can optimize their insurance revenue model and improve profitability analysis while ensuring regulatory compliance.

Loan Financing Calculator

Start-up and early-stage growth companies must diligently manage loan repayment schedules to ensure financial stability. These schedules provide a detailed breakdown of principal amounts and maturity terms, essential for effective cash flow analysis. By integrating principal repayments into their monthly cash flow statements, companies can enhance operational efficiency and maintain accurate financial forecasting. Additionally, interest expenses reflected in the debt schedule influence overall cash flow projections and balance sheets. For insurtech firms, leveraging data analytics in insurance can optimize their financial management and regulatory compliance, ultimately driving profitability through informed decision-making.

DIGITAL INSURANCE EXCEL FINANCIAL MODEL METRICS

Financial KPIs

A robust startup financial projection template is essential for monitoring key performance indicators (KPIs) over five years. For effective analysis in the digital insurance business model, track critical metrics such as EBITDA/EBIT, reflecting earnings before interest, tax, depreciation, and amortization. Additionally, evaluate cash flows to gauge incoming and outgoing cash, while keeping an eye on the projected cash balance for specific periods. Leveraging data analytics in insurance enhances financial modeling and boosts operational efficiency, ultimately guiding profitability analysis and strategic decision-making in this evolving insurtech landscape.

Cash Flow Forecast Excel

In today's digital insurance landscape, effective cash flow analysis is essential for strategic planning and risk assessment. A comprehensive business plan not only highlights costs and profits but also integrates advanced financial modeling and insurance technology trends. Utilizing data analytics in insurance enhances accuracy in premium calculations and facilitates operational efficiency. Moreover, these insights enable insurtech solutions to streamline the underwriting process and optimize customer acquisition strategies. By embracing digital transformation and leveraging actuarial modeling, businesses can create robust financial forecasting, ensuring compliance while fostering sustainable growth and profitability in a competitive market.

KPI Benchmarks

The financial benchmarking study within the 5-year projection template serves as an essential tool for competitive analysis in the digital insurance business model. By evaluating losses and performance metrics against industry peers, business owners gain valuable insights into their operational efficiency and financial health. This analysis highlights key areas for improvement, guiding customer acquisition strategies and informing product development in insurtech. Understanding these financial metrics empowers startups to harness data analytics and actuarial modeling, ultimately paving the way for sustained profitability and success in the evolving insurance landscape.

P&L Statement Excel

The Monthly profit and loss template for digital insurance is an essential tool for regular financial reporting. It delivers a comprehensive pro forma statement, detailing revenue streams, gross and net earnings, and crucial revenue analysis, facilitating accurate insights. In the competitive insurtech landscape, understanding profitability relies on sound financial modeling and forecasting. This annual projection not only highlights operating expenses but also includes vital metrics, such as ratios and margins, empowering business owners to assess performance effectively. Stay ahead in the digital transformation of insurance with this user-friendly and visually engaging reporting solution.

Pro Forma Balance Sheet Template Excel

A pro forma balance sheet is an essential financial tool for digital insurance business models, capturing the company's position at a specific moment. It highlights current and long-term assets, liabilities, and stockholders' equity. This financial modeling in insurance aids investors and analysts in deriving key metrics, such as profitability and liquidity ratios. By leveraging data analytics in insurance and integrating insurtech solutions, businesses can enhance their financial forecasting and operational efficiency, ultimately optimizing their claims management systems and underwriting processes for improved customer acquisition strategies.

DIGITAL INSURANCE FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

The pre-revenue company spreadsheet incorporates critical financial metrics, including the Weighted Average Cost of Capital (WACC), Discounted Cash Flow (DCF), and Free Cash Flow (FCF). WACC serves as a vital risk assessment model, indicating the cost of capital through a weighted mix of equity and debt, often analyzed by banks pre-loan approval. Meanwhile, DCF analysis provides a framework for valuing future cash flows, essential for informed investment decisions. These financial modeling techniques are fundamental for digital transformation in insurance, enhancing operational efficiency and profitability analysis in the evolving insurtech landscape.

Cap Table

The Capitalization Table in the financial forecasting model illustrates the dynamics of financial flows within the digital insurance business model. It provides critical insights into the various financial instruments at play and enables a comprehensive analysis of how strategic decisions impact profitability. By incorporating data analytics in insurance, this model enhances operational efficiency and supports effective risk assessment models. As insurtech solutions continue to evolve, understanding these financial metrics becomes essential for informed decision-making and optimizing the underwriting process.

KEY FEATURES

A robust financial modeling insurance framework enhances profitability analysis, ensuring optimal management of surplus cash for strategic growth.

Effective financial modeling empowers insurance companies to strategically manage surplus cash for reinvestment and debt repayment opportunities.

A robust financial modeling insurance framework enhances profitability analysis, driving informed decisions and operational efficiency in a digital insurance landscape.

Unlock reliable insights and drive growth with our user-friendly digital insurance financial model, tailored for any business stage.

Leveraging advanced financial modeling in insurance enhances profitability analysis and operational efficiency, saving valuable time for strategic decision-making.

A robust financial model streamlines insurance revenue analysis, enabling focus on product development and exceptional customer acquisition strategies.

A robust financial modeling insurance framework enhances profitability analysis, ensuring informed decision-making and strategic growth in the insurtech landscape.

Elevate your insurance business with a strategic digital financial model that enhances profitability and impresses investors consistently.

A robust financial modeling insurance solution enhances profitability analysis, enabling effective risk assessment and strategic decision-making in the insurtech landscape.

A robust financial modeling insurance strategy enhances operational efficiency, allowing businesses to proactively manage cash flow and adapt to market changes.

ADVANTAGES

A robust financial modeling approach enhances profitability analysis in insurance, driving informed decisions and operational efficiency in insurtech solutions.

Utilizing a digital insurance financial model enhances profitability analysis and supports effective decision-making in insurtech ventures.

Leverage financial modeling for insurance to enhance profitability analysis, drive operational efficiency, and optimize customer acquisition strategies.

Enhancing profitability analysis in insurance through a robust financial model streamlines decision-making for digital transformation initiatives.

The digital insurance financial model empowers businesses to enhance profitability through precise forecasting and data-driven decision-making.