Electric Power Transmission Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Electric Power Transmission Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

electric power transmission Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

ELECTRIC POWER TRANSMISSION FINANCIAL MODEL FOR STARTUP INFO

Highlights

Electricity transmission cost analysis plays a crucial role for startups and established companies seeking to raise funds from investors or banks, as it aids in assessing the financial feasibility of transmission infrastructure investments. By integrating renewable energy financial modeling and operational expense projections, businesses can enhance their budgets and make informed decisions about long-term energy contracts. Effective energy market forecasting and utility rate structures are essential for developing accurate cash flow projections, while capital expenditure models and load flow analysis ensure comprehensive risk management in power transmission. Additionally, cost-benefit analysis for projects and transmission line valuation support the evaluation of startup ideas, enabling companies to secure funding from banks, angel investors, and venture capitalists while ensuring the reliability of their grid operations.

The Electric Power Transmission Financial Model addresses key pain points for buyers by offering a comprehensive tool that simplifies electricity transmission cost analysis and enhances transmission network optimization. It integrates renewable energy financial modeling with rigorous capital expenditure and operational expense projections, ensuring that users can effectively assess the financial feasibility of transmission infrastructure investments. By incorporating energy market forecasting and load flow analysis, the model helps users evaluate grid reliability and conduct risk management in power transmission, while also providing detailed insights into power generation cost calculation and long-term energy contracts. Moreover, the inclusion of transmission line valuation and cost-benefit analyses for projects empowers users to make informed decisions, supported by clear visuals and summaries for vital metrics like NPV, IRR, and equity shares.

Description

The electric power transmission business can achieve significant profitability through effective management and insightful financial planning. Prior to launching, it's crucial to conduct a comprehensive cost analysis that encompasses electricity transmission costs, operational expense projections, and capital expenditure models to ensure financial viability. Our financial modeling tool provides an in-depth evaluation of renewable energy financial modeling and power generation cost calculations while focusing on transmission infrastructure investment and grid reliability assessments. By utilizing advanced energy market forecasting and risk management techniques, stakeholders can optimize transmission networks and evaluate long-term energy contracts and power purchase agreements. This model also features detailed load flow analysis and decommissioning cost estimates to aid in the overall electric utility financial analysis, ensuring informed decision-making through cost-benefit analyses and operational assessments based on accurate reporting and performance KPIs.

ELECTRIC POWER TRANSMISSION FINANCIAL MODEL REPORTS

All in One Place

Discover our sophisticated electric power transmission financial model template, designed for comprehensive cost analysis and long-term energy contracts. This versatile model facilitates renewable energy financial modeling, enabling users to assess capital expenditure and operational expenses with ease. Enhance your transmission infrastructure investment strategy by optimizing your transmission networks, conducting grid reliability assessments, and developing risk management plans. Tailor and expand the model to fit your specific needs, regardless of your financial expertise. Empower your electric utility financial analysis today for a sustainable and profitable future.

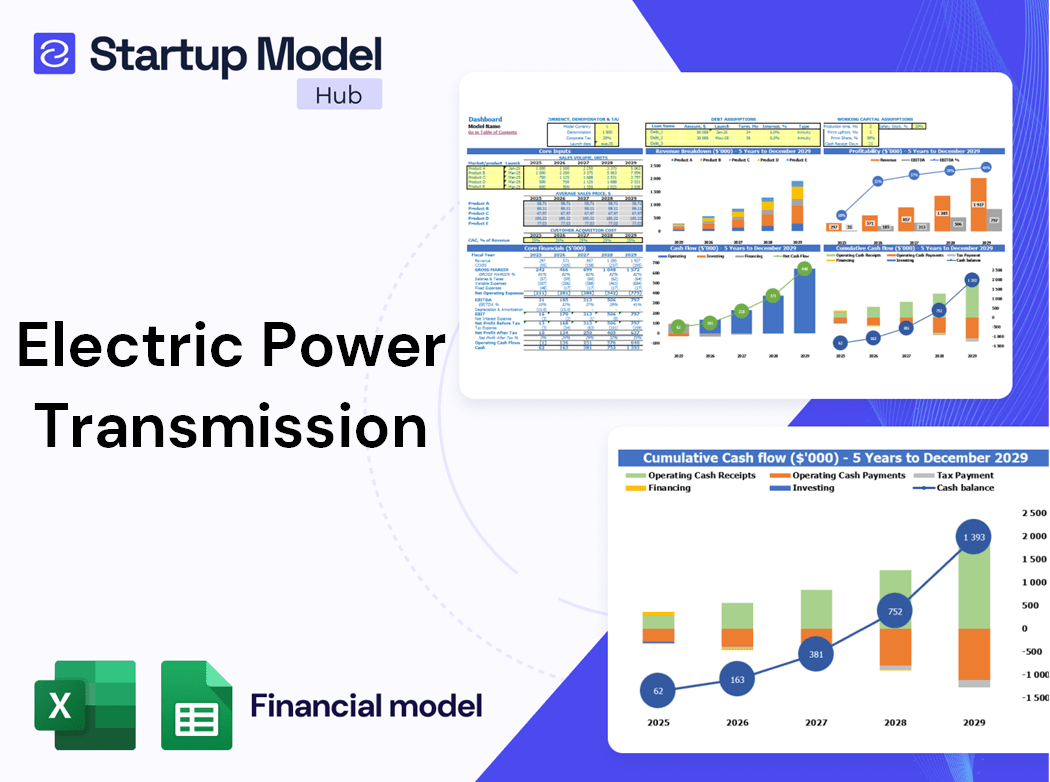

Dashboard

Our innovative tool provides an intuitive dashboard that encapsulates your company’s five-year financial projection template. This comprehensive resource includes elements such as renewable energy financial modeling, electricity transmission cost analysis, and operational expense projections. Effortlessly share these insights with stakeholders to enhance decision-making. By incorporating key components like risk management in power transmission and cost-benefit analysis for projects, we empower you to optimize transmission network investments while ensuring grid reliability. Elevate your financial feasibility studies and drive informed discussions around utility rate structures and long-term energy contracts. Experience a new level of clarity in your electric utility financial analysis.

Business Financial Statements

Our comprehensive financial reporting templates in Excel include three essential statements for electric utility financial analysis: - **Income Statement**: Captures revenue, expenditures, depreciation, taxes, and interest income, providing insights into profitability. - **Balance Sheet**: Displays the company’s assets, liabilities, and shareholders' equity, ensuring the accounting equation holds true. - **Cash Flow Statement**: Highlights cash inflows and outflows, offering a clear view of the firm’s financial health. These templates support critical processes like renewable energy financial modeling, cost-benefit analysis for projects, and risk management in power transmission.

Sources And Uses Statement

The sources and uses template within this three-statement financial model Excel tool effectively outlines the funding sources and expenditure allocations of the company. By integrating elements such as electricity transmission cost analysis and renewable energy financial modeling, this model enhances transparency in capital expenditure and operational expense projections. It facilitates comprehensive financial feasibility studies, ensuring a robust approach to transmission infrastructure investment and energy market forecasting. This valuable resource supports electric utility financial analysis, optimizing transmission network performance and informing long-term energy contracts for sustainable growth.

Break Even Point In Sales Dollars

Break-even analysis is essential for assessing the sales volume needed to cover total costs in electricity transmission. Understanding your break-even point helps electric utilities determine the minimum revenue required to achieve zero profit. By exceeding this threshold, profitability begins. Our financial modeling startup offers tools to create comprehensive break-even charts that illustrate the necessary sales volume to cover all operational expenses and capital expenditures. This analysis aids investors in evaluating required sales to ensure a return on investment while providing critical insights for risk management and long-term energy contracts.

Top Revenue

In developing a proforma business plan, accurate revenue projections are pivotal for effective financial modeling. Revenue drives enterprise value and must be meticulously forecasted, incorporating growth assumptions grounded in historical financial data. Engaging in electricity transmission cost analysis and energy market forecasting can enhance these projections. By integrating insights from renewable energy financial modeling and capital expenditure models, analysts can optimize revenue strategies. Our comprehensive financial projections template offers essential components for strategic revenue planning, ensuring robust assessments of future income streams and fostering sound decision-making in energy infrastructure investments.

Business Top Expenses Spreadsheet

Utilizing detailed expense reports, organizations can conduct comprehensive electricity transmission cost analysis and assess financial feasibility through capital expenditure models. These reports facilitate insights into operational expense projections, enabling power generation cost calculations and renewable energy financial modeling. By tracking spending patterns, companies can optimize their transmission infrastructure investment and enhance grid reliability through effective risk management strategies. Additionally, aligning budget financial models with energy market forecasting and demand forecasting aids in planning long-term energy contracts and evaluating power purchase agreements. This strategic approach ultimately supports robust financial analysis of electric utilities, driving informed decision-making and business growth.

ELECTRIC POWER TRANSMISSION FINANCIAL PROJECTION EXPENSES

Costs

Start-up costs play a critical role in financial projections for electricity transmission projects. Early identification and continuous tracking of these costs are essential for maintaining financial health and avoiding underfunding. Our comprehensive three-way financial model includes a tailored proforma that enhances visibility into spending and funding levels, enabling electric utility financial analysis. By routinely utilizing this tool, managers can optimize transmission network investments, improve cost-benefit analysis for projects, and bolster long-term energy contract negotiations, ultimately ensuring robust grid reliability and effective risk management in power transmission.

CAPEX Spending

Capital budgeting analysis plays a crucial role in a comprehensive financial model for energy projects. Financial specialists assess startup budgets and monitor investments, ensuring an accurate understanding of initial expenses is critical for quality and financial stability. This analysis aids in estimating capital expenditures within business plan cash flow templates, influencing overall financial planning. A responsible and thorough approach to startup budgeting not only enhances project viability but also supports optimal utility rate structures and long-term energy contracts, ultimately fostering robust financial feasibility studies and efficient energy market forecasting for sustainable growth.

Loan Financing Calculator

Start-ups and early-stage growth companies must meticulously manage loan repayment schedules, detailing amounts and maturity terms. This schedule is vital for cash flow analysis and is reflected on the balance sheet. Principal repayments affect financing activities in the statement of cash flows, while interest expenses influence both cash flow and overall debt balance. Utilizing financial modeling techniques, such as capital expenditure and operational expense projections, can enhance decision-making, ensuring robust financial feasibility studies and effective risk management in power transmission and beyond. Accurate tracking promotes long-term viability and informed investment in transmission infrastructure.

ELECTRIC POWER TRANSMISSION EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Earnings Before Interest, Tax, Depreciation, and Amortization (EBITDA) is a critical financial metric, essential for assessing company profitability. Utilizing a five-year projection template, EBITDA distinguishes itself from cash flow by encompassing both monetary and non-monetary factors. This measure is particularly valuable for industries engaged in electricity transmission cost analysis, renewable energy financial modeling, and utility rate structures, as it highlights potential profitability in capital expenditure models and risk management in power transmission. Understanding EBITDA is vital for informed decision-making in long-term energy contracts and energy market forecasting.

Cash Flow Forecast Excel

A cash flow projection statement offers a comprehensive overview of your business’s cash dynamics over a specified period. It meticulously details both cash inflows and outflows, serving as a vital tool in financial feasibility studies and operational expense projections. This analysis is crucial for assessing the viability of renewable energy projects, optimizing transmission infrastructure investments, and formulating long-term energy contracts. By conducting a thorough financial analysis, businesses can better understand their capital expenditure models, enhance grid reliability assessments, and improve risk management strategies in power transmission.

KPI Benchmarks

This startup financial plan template includes a dedicated tab for conducting financial benchmarking studies. By comparing key financial indicators against industry peers, users can perform an in-depth electricity transmission cost analysis and renewable energy financial modeling. This approach enhances grid reliability assessments and aids in transmission infrastructure investment decisions. By leveraging insights from utility rate structures and capital expenditure models, businesses can improve operational expense projections and risk management in power transmission. Ultimately, this template facilitates informed decision-making and strategic planning for long-term energy contracts and energy market forecasting.

P&L Statement Excel

Calculating profit and loss projections is essential for effective business operations, yet it can be complex. Our automated financial modeling simplifies this process, allowing you to efficiently assess your revenue streams. With our pro forma income statement, you can effortlessly evaluate actual and projected revenues, enabling informed decisions. Whether you're analyzing electricity transmission costs, forecasting energy demand, or conducting cost-benefit analyses for projects, our tool streamlines financial feasibility studies, optimizing your utility's capital and operational expenditures. Empower your strategic planning with our reliable automated solution!

Pro Forma Balance Sheet Template Excel

A balance sheet forecast is essential for assessing the financial health of any business. It details current and long-term assets, liabilities, and equity, serving as a foundation for critical financial analyses. Utilizing a pro forma balance sheet template in Excel enables the calculation of key ratios, supporting efforts in electricity transmission cost analysis, renewable energy financial modeling, and utility rate structures. This comprehensive financial insight is crucial for optimizing transmission infrastructure investment, conducting risk management in power transmission, and evaluating long-term energy contracts and power purchase agreements.

ELECTRIC POWER TRANSMISSION FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our electric power transmission startup costs spreadsheet employs dual valuation methodologies, incorporating discounted cash flow (DCF) and weighted average cost of capital (WACC) analyses. This tool enhances renewable energy financial modeling by providing a clear view of the company's projected financial performance, offering insights for utility rate structures and transmission infrastructure investment. By integrating elements such as energy demand forecasting and capital expenditure models, we facilitate informed decision-making, ensuring effective risk management in power transmission and supporting comprehensive financial feasibility studies. Ultimately, this analysis aids in optimizing your transmission network and evaluating long-term energy contracts.

Cap Table

The capital table is a crucial tool for understanding ownership within a company, detailing investor contributions and equity stakes. Accurate assessment of each investor's percentage share is essential for robust financial documentation and cash management. By integrating this information, one can conduct thorough electricity transmission cost analysis and evaluate the financial modeling of renewable energy initiatives. Additionally, such clarity aids in operational expense projections, capital expenditure models, and risk management in power transmission, ensuring informed decision-making and optimizing long-term energy contracts.

KEY FEATURES

Effective renewable energy financial modeling enhances decision-making by providing essential forecasts needed for external stakeholders like banks.

A robust financial model enhances electricity transmission cost analysis, ensuring informed investment decisions and improved grid reliability assessments.

Our renewable energy financial modeling enhances grid reliability through precise electricity transmission cost analysis and optimized capital expenditure models.

A robust financial model enables precise forecasting, allowing for strategic adjustments that enhance cash flow management and investment decisions.

Our financial modeling identifies cash gaps and surpluses early, optimizing transmission infrastructure investment and enhancing grid reliability.

Effective financial modeling enables proactive cash flow management, preventing deficits and optimizing reinvestment opportunities for sustained business growth.

Our financial modeling enhances utility rate structures and improves risk management in power transmission, optimizing electricity transmission cost analysis.

Implementing a robust financial model enhances cash flow visibility, enabling proactive management of late payments and improved financial stability.

Our financial modeling enhances investment decisions, ensuring optimal transmission infrastructure and robust grid reliability while maximizing returns and minimizing risks.

Elevate your financial negotiations with an Excel model that clearly communicates metrics, enhancing investment opportunities for renewable energy projects.

ADVANTAGES

Utilizing renewable energy financial modeling enhances grid reliability and optimizes transmission infrastructure investments while minimizing risks and costs.

Our financial model enhances electricity transmission cost analysis, ensuring optimal investment decisions for sustainable grid reliability and efficiency.

The financial model empowers strategic decision-making by optimizing electricity transmission costs and enhancing project viability and profitability.

Reduce risk and enhance decision-making with our electric power transmission financial projection model, optimizing infrastructure investments and forecasting costs.

Maximize investment efficiency with our electric power transmission financial model, enhancing grid reliability and optimizing transmission network performance.