Film Cinema Hotel Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Film Cinema Hotel Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

film cinema hotel Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

FILM CINEMA HOTEL FINANCIAL MODEL FOR STARTUP INFO

Highlights

A comprehensive film cinema hotel proforma business plan template, ideal for both startups and established companies, is crucial for raising funds from investors or banks while effectively calculating funding requirements. This plan incorporates detailed cash flow forecasts, film production budgets, and hotel revenue projections, allowing businesses to assess their film project viability and develop a sustainable cinema investment strategy. By analyzing cinema operating costs, evaluating hotel occupancy rates, and examining cinema market trends, companies can enhance their profitability metrics and operational efficiency. Additionally, integrating film tax incentives and cinema financing options could optimize revenue streams, ensuring a robust film distribution strategy and comprehensive film box office analysis to support the financial forecasting of hotel capital expenditure and overall profitability.

The financial model for the film cinema hotel excels in addressing key pain points by providing a comprehensive framework for managing cinema operating costs and optimizing film production budgets. With features like hotel revenue projections and cash flow forecasts, users can efficiently navigate the complexities of hotel occupancy rates and profitability metrics. The template incorporates cinema market trends and film distribution expenses, ensuring that users can perform detailed film project assessments and analyze cinema box office trends effectively. Furthermore, it offers insights into cinema financing options and potential film tax incentives, making it easier for investors to evaluate film revenue streams and make informed decisions based on industry benchmarks and operational efficiency metrics. By simplifying financial forecasting and enhancing audience analysis, this model enables stakeholders to adapt and thrive in the competitive landscape of the film and hotel industry.

Description

The film cinema hotel financial model comprehensively integrates a cinema investment strategy with hotel revenue projections, enabling detailed film production budget analysis alongside cinema operating costs. This model facilitates a robust film project assessment by evaluating critical factors like film distribution expenses and cinema box office analysis, while also considering hotel occupancy rates and cash flow forecasts to ensure optimal hotel profitability metrics. By incorporating film tax incentives and examining cinema market trends, the template aids in identifying diverse film revenue streams and cinema financing options. Ultimately, this financial model serves as a vital tool for establishing essential financial forecasting, operational efficiency, and industry benchmarks, empowering stakeholders to make informed decisions in the dynamic film and hospitality markets.

FILM CINEMA HOTEL FINANCIAL MODEL REPORTS

All in One Place

A robust startup financial model template integrates the income statement, cash flow statement, and balance sheet, forming a comprehensive projection framework. Regular updates, typically monthly, ensure accuracy in reflecting current operations, while a thorough annual assessment captures all annual changes. Regardless of size, each business must develop a financial projection template to evaluate performance against industry benchmarks and inform future strategies. This holistic approach is essential for cinema investment strategies, ensuring effective film financing models, managing film production budgets, and optimizing hotel profitability metrics through informed hotel cash flow forecasts and occupancy rates.

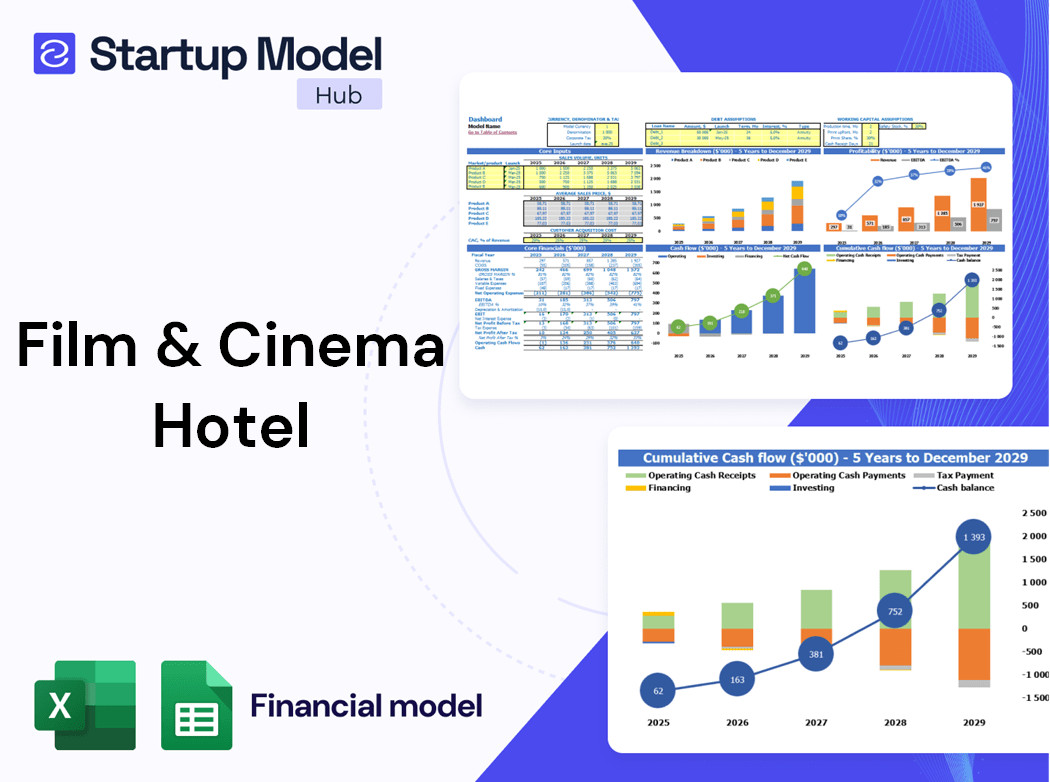

Dashboard

To effectively analyze a company's financial health and make accurate forecasts, comprehensive data is crucial. Our business plan forecast template streamlines this process, encompassing essential elements like film production budgets and cinema operating costs. With a user-friendly Excel format, clients can prepare projected balance sheets and profit and loss forecasts for five years. Additionally, financial data is visually represented in customizable graphs and charts, enhancing operational efficiency. This approach ensures informed decision-making, whether assessing film revenue streams, hotel occupancy rates, or cinema market trends. Embrace strategic financial forecasting for optimal results.

Business Financial Statements

An effective startup financial projection template should incorporate historical and projected financial statements, enabling a thorough film project assessment. Integrating key elements into visual charts enhances clarity for potential investors, making it easier to understand cinema investment strategies and film financing models. Our Excel template offers automatic generation of financial charts, facilitating cinema box office analysis and hotel cash flow forecasts. This streamlined approach not only supports film production budgets but also aligns with cinema operating costs, maximizing operational efficiency and showcasing potential revenue streams through film tax incentives. Engage stakeholders with impactful visuals for informed decision-making.

Sources And Uses Statement

The sources and uses chart in the financial projection Excel provides a concise overview of capital generation and allocation. This essential statement ensures that the total amounts of sources align with the uses, reflecting financial integrity. It's particularly vital during recapitalization, restructuring, or mergers and acquisitions (M&A). By effectively assessing the film production budget alongside cinema financing options, stakeholders gain insights into project viability and potential revenue streams. This analysis supports informed decision-making, crucial for optimizing operational efficiency and enhancing profitability metrics in both the film and hotel sectors.

Break Even Point In Sales Dollars

A thorough BEP calculation encompasses a detailed assessment of a company's revenue and sales dynamics. In the realm of film financing models, it's crucial to distinguish between sales, revenue, and profit. Revenue reflects the total income generated from film production budgets and cinema investment strategies, while profit accounts for all operational costs, including film distribution expenses and cinema financing options. This clarity aids in effective financial forecasting and supports informed decision-making for maximizing film revenue streams and enhancing cinema operational efficiency. Understanding these metrics is vital for navigating market trends and achieving long-term profitability.

Top Revenue

Utilize a demand report to enhance your film financing model and cinema investment strategy. By analyzing revenue depth and revenue bridge metrics, you can assess potential profitability across various scenarios. Accurate projections on hotel occupancy rates and operational efficiency will inform your hotel revenue forecasts while considering film distribution expenses and production budgets. This analysis will clarify demand patterns during weekdays and weekends, enabling strategic resource allocation. Ultimately, integrating these insights fosters improved financial forecasting, aligns with film industry benchmarks, and enhances both hotel and cinema profitability metrics.

Business Top Expenses Spreadsheet

Optimizing major expenses is essential for profitability in any venture, including film and hospitality. Our comprehensive spending report within the financial projection Excel tool details the four largest categories of expenses, categorizing others as 'other' for easy tracking. This approach enables users to analyze trends in expenditure fluctuations over time. For both start-ups and established businesses, a robust cinema investment strategy or hotel cash flow forecast is crucial to maintain operational efficiency and ensure sustainable growth. By leveraging these insights, businesses can enhance profitability and effectively navigate cinema market trends and hotel profitability metrics.

FILM CINEMA HOTEL FINANCIAL PROJECTION EXPENSES

Costs

Effective management of start-up costs is crucial for your business's success, particularly in navigating film financing models and cinema investment strategies. By prioritizing a robust film production budget and understanding cinema operating costs, you can mitigate cash losses and funding shortfalls. Our expert financial modeling delivers exceptional Pro-forma templates tailored for expense planning and monitoring, empowering you to maximize film revenue streams, assess projects accurately, and optimize operational efficiency. With our support, you’ll confidently forecast financial health and capitalize on industry benchmarks to enhance profitability and sustainable growth.

CAPEX Spending

The Top Revenue tab in the startup costs template offers a clear and organized view of financial data related to your offerings. It provides a comprehensive annual breakdown of revenue streams, facilitating cinema investment strategy analysis and enhancing film project assessment. This detailed overview includes insights into revenue depth and revenue bridge, essential for evaluating film financing models and optimizing film production budgets. Leveraging this information ensures informed decision-making and effective cinema operational efficiency, ultimately driving profitability metrics and enhancing financial forecasting for both film and hotel ventures.

Loan Financing Calculator

Our financial model includes a comprehensive loan amortization schedule, designed with pre-structured formats and encoded formulas. This tool effectively outlines the repayment trajectory for various debts, providing a detailed breakdown of principal and interest across designated time frames—monthly, quarterly, or annually. By integrating this into your film financing model or cinema investment strategy, you can enhance your project assessments and optimize cash flow forecasts. This clarity not only supports effective decision-making but also aligns with industry benchmarks, ensuring operational efficiency and profitability.

FILM CINEMA HOTEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Understanding the cost of acquiring new customers is vital for effective cinema investment strategy. This metric, integral to our film cinema hotel financial model, is calculated by dividing the annual marketing expenditure by the total number of new customers acquired. By analyzing this figure alongside hotel occupancy rates and cinema operating costs, we can refine our film financing model and enhance operational efficiency. This strategic approach ensures alignment with industry benchmarks, optimizing revenue streams while effectively forecasting cash flow and profitability metrics for sustained growth in both film and hospitality sectors.

Cash Flow Forecast Excel

A pro forma cash flow projection is essential for accurately forecasting your financial activities, particularly regarding liquidity. This tool is crucial when seeking capital or applying for loans, as it aligns with cinema financing options and hotel cash flow forecasts. By detailing expected revenues and expenditures, including film production budgets and cinema operating costs, it enables strategic decision-making. Start-ups can effectively navigate potential cash flow issues, ensuring operational efficiency and financial stability in the competitive landscape of film and hotel investments.

KPI Benchmarks

The benchmark feature in the financial model evaluates key indicators, allowing comparisons against industry averages. By assessing factors such as film production budgets or cinema operating costs, companies gain insights into their performance relative to competitors. Start-ups particularly benefit from this analysis, as it informs their cinema investment strategy and enhances operational efficiency. Through strategic benchmarking, firms can explore effective financing options and optimize their film revenue streams. Accurate financial forecasting of metrics like hotel occupancy rates or film distribution expenses is crucial for long-term success in the competitive landscape of cinema and hospitality.

P&L Statement Excel

Every business owner seeks to navigate the future effectively, and analyzing past performance is crucial. For a film cinema hotel, our projected Profit & Loss forecast is vital for assessing future financial health. Our financial modeling Excel template not only reveals net income percentages but also profit margin ratios, providing comprehensive insights into profitability trends. By deepening your understanding of revenue streams and operational efficiency, you can enhance growth and strengthen your business's position in a competitive landscape. Leverage this data to refine your cinema investment strategy and maximize hotel profitability metrics.

Pro Forma Balance Sheet Template Excel

The balance sheet forecast within the financial model provides a comprehensive overview for owners, investors, and stakeholders. It outlines the company's assets and liabilities, illustrating effective cinema investment strategies and film financing models. This analytic tool details the business's capital expenditures, valuable properties, and financial obligations, offering insights into operational efficiency and market trends. By evaluating hotel profitability metrics alongside film production budgets, stakeholders gain a clear understanding of financial health and potential revenue streams, ultimately enhancing the overall project assessment and strategic planning.

FILM CINEMA HOTEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This comprehensive film cinema hotel financial forecast template includes a dynamic startup valuation model that calculates the Weighted Average Cost of Capital (WACC), Discounted Cash Flows (DCF), and Free Cash Flows (FCF). These metrics are vital for stakeholders, including investors and creditors. WACC assesses capital costs based on equity and debt proportions, serving as a key risk indicator for lending institutions. Meanwhile, DCF enables investors to evaluate potential film financing models and compare various investment opportunities by projecting future cash flows, ensuring informed decision-making in a competitive market landscape.

Cap Table

A well-structured cap table is essential for startups, providing a clear overview of investor contributions and share allocations. This analysis is vital for assessing potential film financing models and cinema investment strategies. Accurately summarizing financial data allows filmmakers to evaluate film production budgets and distribution expenses, while helping investors understand their stake in evolving cinema market trends and operational efficiencies. Additionally, incorporating financial forecasting can optimize hotel profitability metrics and occupancy rates, ensuring all stakeholders are aligned on both cinema and hotel cash flow forecasts.

KEY FEATURES

Implementing a robust film financing model enhances budget control, improves cash flow forecasting, and maximizes overall production profitability.

A robust cash flow forecasting model enhances film financing strategies by accurately predicting revenue streams and optimizing production budgets.

This innovative film financing model optimizes revenue streams, ensuring robust returns while minimizing cinema operating costs and distribution expenses.

Implementing a robust film financing model enhances revenue streams while optimizing production budgets and reducing operational costs in cinema.

Implementing a robust film financing model enhances stakeholder trust by ensuring transparent revenue projections and efficient resource allocation.

A robust film financing model boosts investor confidence, ensuring clarity in cash flow and facilitating future capital for projects.

Adopting a robust film financing model enhances revenue streams and optimizes budgeting for successful film production and distribution.

The financial projection model enhances operational efficiency, enabling filmmakers to focus on creativity while optimizing their film financing strategies.

A robust film financing model enhances profitability by optimizing production budgets and minimizing distribution expenses, ensuring sustainable revenue streams.

This comprehensive film cinema hotel pro forma financial model delivers quick, reliable insights for effective film financing and investment strategy.

ADVANTAGES

Utilizing a film cinema hotel pro forma business plan template enhances financial forecasting, maximizing revenue streams and operational efficiency.

The film cinema hotel financial model enhances clarity and precision in assessing revenue streams and operational efficiency for investors.

Unlock robust returns with a comprehensive film financing model that optimizes cinema investment strategy and hotel revenue projections.

The film financing model ensures comprehensive funding, enhancing project viability and maximizing revenue potential in a competitive industry.

A robust film financing model enhances investment confidence by clearly demonstrating potential revenue streams and effective budget management.