Financial Analytics Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Financial Analytics Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

financial analytics Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

FINANCIAL ANALYTICS FINANCIAL MODEL FOR STARTUP INFO

Highlights

The five-year financial model template in Excel is designed for comprehensive financial forecasting and analysis, featuring prebuilt three statements: consolidated projected profit and loss, balance sheet, and cash flow projections. It includes essential financial performance metrics, cash flow forecasting, and key performance indicators, all of which enhance data-driven decision-making. With integrated scenario planning and variance analysis, users can conduct budgeting analysis and sensitivity analysis to better understand potential financial outcomes. The template’s robust investment analysis tools and risk management features allow for effective financial reporting and profitability analysis, while the built-in trend analysis and financial benchmarking capabilities aid in resource allocation and cost-benefit analysis. Unlocked for full customization, this financial analytics business plan template empowers users to estimate required startup costs effectively.

This financial forecasting model addresses critical pain points by leveraging predictive analytics and scenario planning to enhance budgeting analysis and financial statement analysis, allowing users to visualize data effectively and engage in comprehensive variance analysis. Users can perform cash flow forecasting and profitability analysis, ultimately improving financial performance metrics while facilitating risk management and resource allocation through data-driven decision making. The model supports sensitivity analysis and investment analysis, ensuring a robust understanding of key performance indicators and empowering businesses to conduct financial benchmarking and cost-benefit analysis for informed strategic planning.

Description

The financial analytics feasibility study template in Excel offers a comprehensive framework for financial forecasting through predictive analytics, enabling users to create detailed projected profit and loss statements, balance sheets, and monthly cash flow forecasts for both startups and established businesses. This model supports budgeting analysis and scenario planning by allowing for variance analysis and cash flow forecasting over a 60-month period, also incorporating key performance indicators (KPIs) for robust financial performance metrics. It includes essential tools for investment analysis, risk management, and profitability analysis, ensuring data-driven decision making through clear data visualization and trend analysis. Additionally, the model features sensitivity analysis and financial benchmarking for effective resource allocation, making it accessible to users without extensive financial expertise.

FINANCIAL ANALYTICS FINANCIAL MODEL REPORTS

All in One Place

This innovative model enhances your financial forecasting process by seamlessly updating all ~15 sheets with just a few key inputs. By utilizing predictive analytics and data visualization techniques, it provides a comprehensive view of financial performance metrics. The three-way financial model automatically generates cash flow forecasts and supports scenario planning, ensuring clarity and organization of assumptions in a single sheet. With a focus on data-driven decision making, this tool empowers effective budgeting analysis and resource allocation, ultimately driving improved profitability and risk management across your organization.

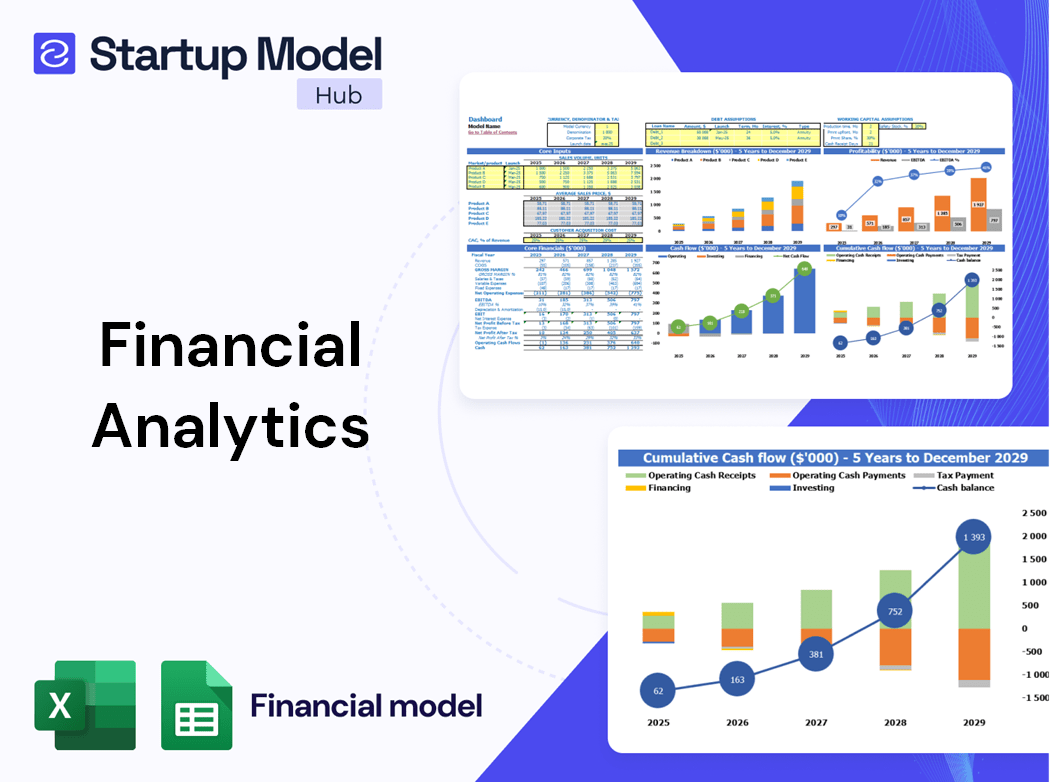

Dashboard

A well-crafted business plan serves as a comprehensive framework for analyzing a company's financial statements and evaluating its success potential. By incorporating financial forecasting, cash flow projections, and profitability analysis, it provides a clear roadmap to achieve objectives. Utilizing data visualization techniques, professionals can present key performance indicators through dynamic charts and graphs, facilitating effective financial reporting and monitoring. An automated dashboard continuously updates these visuals, ensuring real-time insights that enhance data-driven decision-making and resource allocation, ultimately promoting robust risk management and informed scenario planning for sustainable growth.

Business Financial Statements

When creating financial forecasting templates in Excel, structure is key. Ensure that your business plan includes all vital components, such as financial performance metrics and cash flow forecasting. An intuitive pro forma income statement enhances clarity, essential for effective financial reporting and data-driven decision making. Prioritize elements like variance analysis, scenario planning, and trend analysis to facilitate informed discussions during reviews. A well-designed template not only supports budgeting analysis but also strengthens investment analysis and risk management, paving the way for strategic resource allocation and improved profitability analysis.

Sources And Uses Statement

The sources and uses table within the financial projection template offers a clear overview of capital inflows (the 'Sources') and outflows (the 'Uses'). Ensuring these totals balance is essential for accurate financial forecasting. This statement is especially vital during recapitalizations, restructurings, or mergers and acquisitions (M&A) processes. By utilizing data visualization and scenario planning, organizations can enhance their decision-making and financial performance metrics, ultimately supporting effective risk management and resource allocation strategies.

Break Even Point In Sales Dollars

Curious about the financial milestone necessary for profitability? The break-even analysis is an essential tool that reveals the precise sales threshold where your business, or a specific product, becomes profitable. Utilizing this analysis, you can effectively engage in budgeting analysis, cash flow forecasting, and resource allocation. Our user-friendly P&L Excel template automates the computation of the sales volume required to cover your total operational costs. Empower your data-driven decision making with insights that enhance your financial performance metrics and inform your investment analysis for sustainable growth.

Top Revenue

This business plan financial projections template features a dedicated section for in-depth analysis of the company's income streams. Users can leverage this tool for meticulous budgeting analysis and financial statement analysis, allowing for data-driven decision making. By evaluating each product or service type individually, the template supports effective resource allocation and enhances financial performance metrics. Incorporating predictive analytics and scenario planning, it empowers users to conduct risk management and profitability analysis, ultimately fostering robust financial forecasting and clearer insights into cash flow forecasting. Engage with this template to unlock your business's full potential.

Business Top Expenses Spreadsheet

To enhance your company's productivity and drive exceptional results, effective expense management is crucial. Our financial forecasting template categorizes major expenses into four key areas, with additional costs listed as 'other.' By utilizing data visualization and predictive analytics, you'll gain insights into your financial performance metrics, enabling informed budgeting analysis and scenario planning. This understanding empowers you to optimize operations, ensuring that resource allocation fosters profitability rather than financial loss. Embrace data-driven decision making to direct your investments wisely and achieve sustainable growth.

FINANCIAL ANALYTICS FINANCIAL PROJECTION EXPENSES

Costs

The financial analytics business projection template is a vital tool for effective financial forecasting and budgeting analysis. It enables businesses to assess costs, gauge feasibility, and conduct scenario planning to navigate complex challenges. By utilizing predictive analytics and data visualization, this template identifies financial performance metrics and potential issues, aiding in cash flow forecasting and investment analysis. Moreover, it facilitates data-driven decision making, ensuring informed resource allocation. Ultimately, this structured approach enhances financial reporting and supports effective risk management and profitability analysis, driving successful outcomes in today’s competitive landscape.

CAPEX Spending

The startup budget highlights expenditures targeted at acquiring assets that promise significant future value. Utilizing financial forecasting tools within our Excel financial plan allows for precise capital cost analysis, enabling a clear assessment of long-term growth potential. Business leaders must differentiate capital expenditures from other financial elements, such as startup financial templates or depreciation. Employing data visualization and predictive analytics ensures informed decision-making, while scenario planning and financial performance metrics provide insights into resource allocation and risk management. By integrating these strategies, businesses can effectively navigate their financial landscape and drive profitability.

Loan Financing Calculator

Accurate calculation of loan or mortgage payments is crucial for start-ups aiming for sound financial performance. However, many companies struggle with this task. Our advanced financial planning model offers a comprehensive loan amortization schedule and an intuitive calculator, facilitating effective budgeting analysis. By integrating predictive analytics and scenario planning, businesses can optimize cash flow forecasting and resource allocation. This data-driven decision-making tool streamlines financial statement analysis and variance analysis, empowering companies to enhance their financial outcomes and ensure sustainable growth.

FINANCIAL ANALYTICS EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Earnings Before Interest and Tax (EBIT) is a crucial financial performance metric in the pro forma income statement template. It effectively measures a company's earning power derived from ongoing operations, excluding interest and tax expenses. By focusing on net operating income, EBIT offers valuable insights into operational efficiency, enabling better resource allocation and investment analysis. This data visualization tool plays a key role in financial forecasting, aiding in scenario planning and risk management. Ultimately, EBIT supports data-driven decision-making, enhancing overall profitability analysis and financial benchmarking.

Cash Flow Forecast Excel

The cash flow statement is a critical financial report that provides insight into a company's cash inflows and outflows, offering a clearer perspective than a standard profit and loss statement. This comprehensive three-statement model template incorporates advanced cash flow forecasting tools, enabling predictive analytics over 12 months or extending up to five years. By leveraging data visualization and scenario planning, organizations can enhance budgeting analysis, optimize resource allocation, and strengthen risk management strategies, ensuring informed, data-driven decision making to boost financial performance metrics and profitability analysis.

KPI Benchmarks

This financial model XLS features a dedicated tab for comprehensive financial benchmarking studies. By analyzing key performance indicators and comparing your company's financial performance metrics with industry peers, users can gain valuable insights into competitiveness and operational efficiency. This approach supports data-driven decision-making, enabling effective resource allocation and enhanced risk management. Ultimately, the benchmarking study serves as a powerful tool for identifying areas for improvement and driving profitability analysis, ensuring your organization stays ahead in a dynamic market landscape.

P&L Statement Excel

Every business owner aims to navigate the future with confidence, and analyzing past performance is crucial. Utilizing financial forecasting tools like pro forma profit and loss statements reveals insights into future financial performance. Our comprehensive revenue model template not only highlights net profit percentage but also gross margin as a percentage of sales, facilitating in-depth profitability analysis. By understanding the key performance indicators that drive profit, you can enhance growth strategies and effectively strengthen your business's market position through data-driven decision-making and robust scenario planning.

Pro Forma Balance Sheet Template Excel

The Monthly and Yearly projected balance sheets for startups are intricately connected to cash flow forecasting, monthly profit and loss templates, and essential inputs. The three-statement financial model provides a comprehensive overview of your startup's financial performance, encompassing assets, liabilities, and equity accounts. By leveraging data visualization and predictive analytics, this model empowers data-driven decision-making, enhancing budgeting analysis and scenario planning. Utilize financial performance metrics and variance analysis for effective risk management and resource allocation, ensuring your startup's financial health and sustainability.

FINANCIAL ANALYTICS FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Unlock investor confidence with our pre-built valuation template designed for startups. This tool offers essential financial forecasting insights, including the weighted average cost of capital (WACC) to inform stakeholders about the minimum return expectations. Our free cash flow analysis reveals the available cash flow for all investors, while discounted cash flow techniques illustrate the present value of future cash flows. Leverage this data-driven decision-making approach to enhance financial performance metrics, improve scenario planning, and streamline resource allocation for sustainable growth. Empower your financial reporting with clarity and precision, ensuring you meet investor expectations.

Cap Table

The five-year financial projection template, complemented by a comprehensive cap table model, serves as a critical tool for investors. It effectively summarizes essential information, detailing each investor's share and corresponding financial contributions. By incorporating robust financial performance metrics and cash flow forecasting, this template enhances data-driven decision making. Additionally, it supports scenario planning and investment analysis, ensuring transparent financial reporting and effective resource allocation. Leverage this template for insightful trend analysis and financial benchmarking, enabling you to optimize your company's profitability and manage risks effectively.

KEY FEATURES

Effective financial forecasting enhances decision-making by enabling data-driven scenario planning and robust risk management for improved financial outcomes.

Utilizing cash flow projections enhances data-driven decision making by allowing businesses to visualize financial impacts of various scenarios.

Our financial model enhances data-driven decision making, streamlining budgeting analysis and optimizing resource allocation for improved profitability.

The Startup Pro Forma Template enhances data-driven decision making, freeing up time for product innovation and customer engagement.

Leverage predictive analytics and data visualization to enhance financial performance metrics, driving informed, data-driven decision making for better outcomes.

This financial model enables real-time, data-driven decision making through comprehensive analytics, enhancing financial performance and strategic planning.

A robust financial forecasting model enhances data-driven decision-making by providing accurate insights into cash flow and profitability analysis.

This financial model streamlines your analysis, providing essential reports and data-driven insights for informed decision-making and strategic planning.

Effective cash flow forecasting enhances resource allocation and risk management, ensuring timely customer payments and improved financial performance.

Implementing a cash flow forecasting model enhances financial performance by proactively identifying unpaid invoices and optimizing resource allocation.

ADVANTAGES

Leverage a financial model in Excel for data-driven decision making, enhancing risk management and optimizing resource allocation effectively.

Leverage financial forecasting and predictive analytics for data-driven decision making, empowering startups to optimize resource allocation and enhance profitability.

Leverage our financial model for data-driven decision making, enhancing budgeting analysis and cash flow forecasting for your startup costs.

Demonstrate your repayment potential with a financial model that incorporates predictive analytics and precise cash flow forecasting for lenders.

The financial model's predictive analytics enhances budgeting analysis, enabling proactive decision-making and improved financial performance metrics.