Foreign Currency Exchange Platforms Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Foreign Currency Exchange Platforms Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

foreign currency exchange platforms Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

FOREIGN CURRENCY EXCHANGE PLATFORMS FINANCIAL MODEL FOR STARTUP INFO

Highlights

The highly versatile and user-friendly currency trading platform is designed to support both startups and existing businesses in the foreign exchange market by providing a robust financial model for forecasting income statements, monthly cash flow statements, and balance sheets over a multi-year timeline. This forex trading model aids in the forex profit calculation and offers insights into exchange rate forecasting while allowing for effective currency risk management. Additionally, it includes tools for currency pair analysis and integrates various financial derivatives trading strategies, ensuring compliance with forex regulatory standards. By leveraging forex market analysis tools, online forex brokers can maximize their exchange platform liquidity and optimize hedging strategies in forex, facilitating seamless international money transfers and cross-border payment solutions as well as providing a multi-currency wallet for efficient management of multi-currency exchange rates.

The forex trading model in our Excel template addresses key pain points for users by offering a comprehensive currency trading platform that enhances exchange rate forecasting and currency pair analysis, vital for informed decision-making. It serves as a robust tool for currency risk management, accommodating multi-currency wallets and facilitating seamless international money transfers. With integrated forex market analysis tools and financial derivatives trading capabilities, users can adopt effective hedging strategies in forex while ensuring compliance with forex regulatory standards. The model also provides insights into forex liquidity providers and online forex brokers, streamlining forex profit calculation and maximizing exchange platform liquidity for optimized cross-border payment solutions.

Description

This comprehensive financial model for a foreign exchange trading platform is designed to assess the financial viability of launching or operating in the currency trading market over a five-year horizon. It leverages historical performance data along with assumptions about future trends to produce a detailed forecast that includes projected income statements, pro forma balance sheets, and cash flow projections, focusing on key performance metrics such as Free Cash Flows to the Firm and Internal Rate of Return. The model facilitates currency pair analysis and utilizes forex market analysis tools to estimate multi-currency exchange rates and quantify currency risk management strategies. Investors can evaluate the model’s capabilities in terms of profitability through forex profit calculation and assess the efficiency of hedging strategies in forex, ensuring compliance with forex regulatory compliance while exploring cross-border payment solutions and online forex brokers for enhanced forex liquidity.

FOREIGN CURRENCY EXCHANGE PLATFORMS FINANCIAL MODEL REPORTS

All in One Place

Unlock the potential of your currency trading with our dynamic foreign exchange market model. Our user-friendly, expandable five-year projection template is designed for all levels of financial expertise. Tailored for online forex brokers, it simplifies exchange rate forecasting and currency risk management. Experience seamless integration with multi-currency wallets and optimize your forex profit calculations. Enhance your strategy with robust market analysis tools and discover innovative hedging strategies in forex. Elevate your trading game today and transform your approach to international money transfers and cross-border payment solutions.

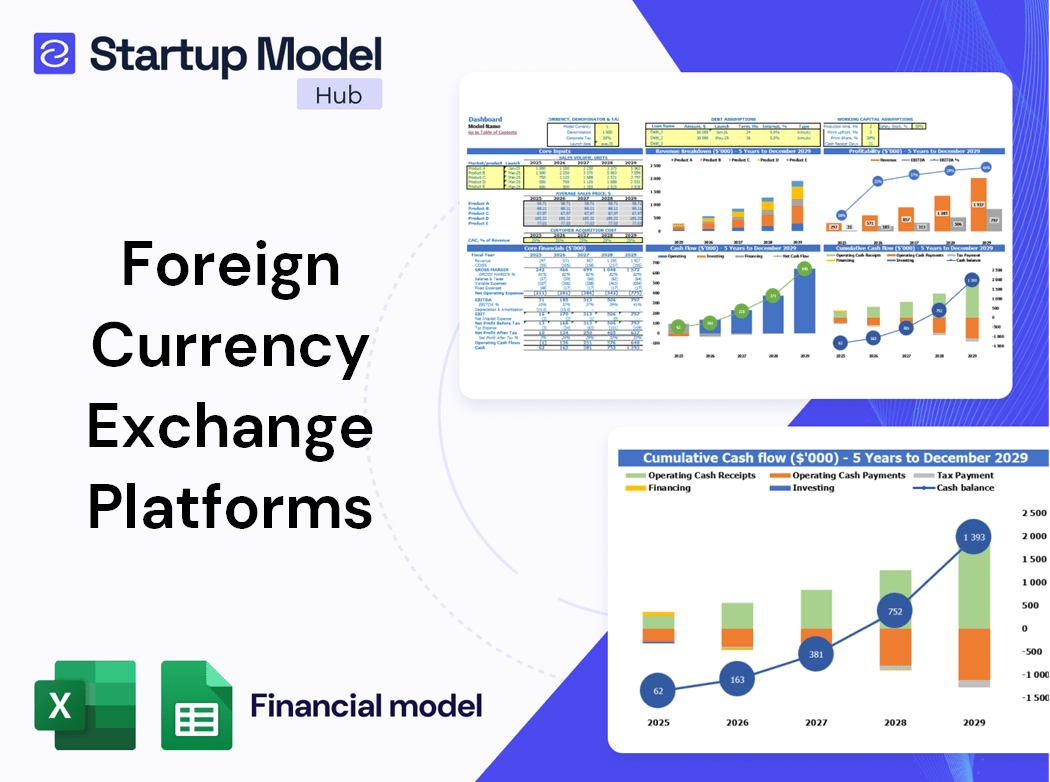

Dashboard

Our innovative financial model offers a dedicated dashboard showcasing vital financial indicators across specified timeframes. It includes a detailed revenue breakdown by year, comprehensive cash flow analysis in Excel format, and robust financial projections. This dashboard facilitates in-depth forex market analysis and enhances currency risk management, critical for optimizing your currency trading platform. By enabling precise forex profit calculation and supporting strategic hedging strategies in forex, it plays a pivotal role in unlocking your startup's financial potential, ensuring regulatory compliance while navigating multi-currency exchange rates and cross-border payment solutions effectively.

Business Financial Statements

Our expertly crafted three-statement model in Excel features a dynamic financial summary that seamlessly integrates data from essential spreadsheets, including projected balance sheets, income statements, and cash flow forecasts. Tailored for your pitch deck, this model enhances your currency trading platform by providing insightful currency pair analysis and supporting effective exchange rate forecasting. By leveraging advanced forex market analysis tools, it empowers you to manage currency risk efficiently and optimize your financial derivatives trading strategy. Let our specialists elevate your forex regulatory compliance and cross-border payment solutions with a professional, engaging approach.

Sources And Uses Statement

The pro forma financial model is essential for analyzing financial activity in the foreign exchange market. It identifies funding sources and highlights key expenditure areas, vital for effective currency risk management. By incorporating various cost structures, including operational facilities, the model offers insights into potential revenue streams from forex trading platforms, investors, and loans. Accurate exchange rate forecasting and currency pair analysis enhance strategic decision-making, ensuring robust financial derivatives trading and compliance with forex regulations. Ultimately, this template supports startups in navigating the complexities of international money transfers and optimizing multi-currency wallet features.

Break Even Point In Sales Dollars

Our financial projection model, featuring an advanced break-even chart, empowers companies to analyze pricing strategies effectively. By integrating currency pair analysis and utilizing a robust currency trading platform, businesses can navigate the foreign exchange market with confidence. This model aids in determining optimal price points that cover costs while considering multi-currency exchange rates and currency risk management. Additionally, leveraging forex market analysis tools enables precise exchange rate forecasting, ensuring that firms can enhance profitability and ensure regulatory compliance in an increasingly globalized economy.

Top Revenue

In the Top Revenue tab of this pro forma template, users can forecast demand for products and services, enhancing profitability simulations across various scenarios. This analysis empowers effective currency pair analysis and aids in shaping hedging strategies in forex. By examining forecasted demand levels—such as weekdays versus weekends—organizations can optimize resource allocation, including manpower and inventory. Leverage this tool alongside forex market analysis tools for improved exchange rate forecasting and a robust framework for currency risk management in the dynamic foreign exchange market. Experience streamlined financial derivatives trading and informed decision-making with this comprehensive resource.

Business Top Expenses Spreadsheet

To ensure optimal success in the foreign exchange market, effective financial management is essential. Employing a comprehensive forex trading model, businesses can categorize costs into distinct groups, including 'other' for miscellaneous expenses. This systematic approach allows for thorough analysis and monitoring of financial outlays, crucial for enhancing profitability. By utilizing tools like currency pair analysis and forex market analysis tools, companies can implement robust currency risk management and hedging strategies. Ultimately, efficient cost control not only fosters financial stability but also maximizes potential gains in forex trading, paving the way for significant rewards.

FOREIGN CURRENCY EXCHANGE PLATFORMS FINANCIAL PROJECTION EXPENSES

Costs

Our 5-year financial projection template is a vital tool for users engaged in currency trading. It enables accurate forecasting of costs associated with forex trading models, offering insights into potential gains and currency risk management strategies. This well-structured budgeting framework helps identify weaknesses in trading operations, guiding users toward sound financial decisions. Especially beneficial for startups in the foreign exchange market, this template aids entrepreneurs in securing loans or attracting investors by presenting a clear pathway to achieving financial objectives and facilitating effective cross-border payment solutions.

CAPEX Spending

Capital expenditures (CapEx) reflect investments in long-term assets, such as property, plant, and equipment, crucial for growth strategies. Our financial projection platform includes a dedicated tab for CapEx calculations, empowering users to assess expansion plans effectively. Understanding the interplay between CapEx, depreciation, and financial reporting is vital for business owners and financial specialists alike. With robust forex market analysis tools and currency pair analysis, our platform also enhances your currency risk management and multi-currency wallet strategies, ensuring you make informed decisions in an increasingly globalized economy.

Loan Financing Calculator

Our advanced financial model includes a comprehensive loan amortization schedule, tailored for effective currency risk management. This dynamic template utilizes pre-built formulas to forecast expected repayments, detailing installment amounts, principal, and interest over monthly, quarterly, or annual periods. With insights drawn from currency pair analysis and forex market analysis tools, businesses can enhance their cross-border payment solutions and ensure forex regulatory compliance. Ideal for any currency trading platform, this model empowers users to optimize their financial derivatives trading strategies while managing exposure to multi-currency exchange rates.

FOREIGN CURRENCY EXCHANGE PLATFORMS EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The gross profit margin is a crucial financial ratio within the revenue model, serving as an indicator of a company’s financial health. It measures the proportion of profit—revenue after deducting the cost of sales—against total revenue. An increasing gross margin percentage signifies enhanced profitability, driven by either reduced expenses in goods or services or higher sales revenue. This essential metric can be beneficial for online forex brokers, enabling effective currency risk management and informed decisions in the foreign exchange market, particularly in exchange rate forecasting and currency pair analysis.

Cash Flow Forecast Excel

Today, the cash flow forecasting model in Excel is an essential tool for effective financial management. This model ensures precise tracking of money inflow and outflow, crucial for businesses engaging in forex trading. By utilizing various currency trading platforms and forex market analysis tools, companies can enhance their exchange rate forecasting and currency pair analysis. Additionally, integrating a multi-currency wallet streamlines international money transfers while mitigating currency risk. Embracing these strategies facilitates informed decision-making in the dynamic world of currency trading and enhances overall financial resilience.

KPI Benchmarks

Benchmarking is vital for accurate P&L forecasting in currency trading platforms. It involves comparing key performance indicators with industry leaders to assess potential and refine strategies, particularly in the foreign exchange market. Metrics such as unit costs, profit margins, and productivity are pivotal for startups aiming to enhance their forex trading model. This comprehensive analysis not only aids in currency risk management but also optimizes financial derivatives trading and hedging strategies in forex. By leveraging insights from successful peers, businesses can improve exchange rate forecasting and maximize their multi-currency wallet effectiveness.

P&L Statement Excel

The monthly profit and loss statement template captures both cash and non-cash transactions, such as asset depreciation, reflecting their impact on financial performance. Unlike cash flow projections, which only track actual cash movements, this statement offers a comprehensive view by incorporating all incurred expenses for the period. This holistic approach aids in accurate forex profit calculation and enhances currency risk management for online forex brokers, ensuring compliance with forex regulatory standards. By leveraging advanced forex market analysis tools, traders can make informed decisions on currency pairs, optimizing their strategies in the dynamic foreign exchange market.

Pro Forma Balance Sheet Template Excel

The projected balance sheet template is essential in conjunction with the pro forma income statement, as it illuminates the necessary investment to sustain projected sales and profits. A balance sheet forecast offers invaluable insights into the company's future financial landscape, complementing tools like currency pair analysis and forex market analysis tools. Understanding these projections aids in effective currency risk management and informs strategies for foreign exchange market operations, including hedging strategies in forex and exchange rate forecasting. This holistic view supports informed decision-making in a dynamic trading environment.

FOREIGN CURRENCY EXCHANGE PLATFORMS FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

The valuation report template embedded in this comprehensive three-statement financial model Excel tool empowers users to conduct a discounted cash flow (DCF) valuation effectively. To initiate the DCF analysis, users simply input the necessary rates into the cost of capital section. This streamlined process enhances accuracy and allows for deeper insights into investment opportunities, making it an essential resource for forex market analysis and currency risk management. Perfect for forex trading models, it supports informed decision-making in currency trading and financial derivatives trading. Elevate your evaluation with this professional-grade template.

Cap Table

The equity cap table serves as a comprehensive calculator for analyzing multiple financing rounds, highlighting the influence of investors' shares on a company's performance. This dynamic tool showcases data after each funding stage, illustrating the evolving landscape of equity distribution. By effectively evaluating ownership stakes, it equips stakeholders with invaluable insights to inform strategic decisions. Embrace this tool to enhance your understanding of financial derivatives trading and optimize your approach to currency risk management in the foreign exchange market.

KEY FEATURES

Utilizing a robust forex trading model enhances currency risk management and optimizes profit calculations for currency trading platforms.

Utilizing a dynamic cash flow projection model empowers your forex trading platform to enhance accuracy in exchange rate forecasting.

Utilizing a robust forex trading model enhances currency risk management and optimizes profit calculations for currency trading platforms.

Easily refine your foreign exchange market model by adjusting inputs, enhancing profitability and mitigating currency risk effectively.

Our integrated forex trading model enhances profitability through advanced currency pair analysis and effective currency risk management strategies.

Our financial model template seamlessly integrates assumptions and calculations, streamlining your forex trading strategies for enhanced investor clarity and confidence.

Utilize a robust forex trading model for effective currency risk management and optimized accounts receivable in international transactions.

Utilizing a forex trading model enables precise exchange rate forecasting, enhancing currency risk management and optimizing international money transfers.

The forex trading model enhances profitability through expert currency pair analysis and effective currency risk management strategies.

Leverage a proven forex trading model to enhance currency risk management and optimize international money transfers effortlessly.

ADVANTAGES

The three-statement model enhances credibility and attracts attention from online forex brokers and investors in currency trading platforms.

Our business plan financial template streamlines payroll and expenses, enhancing efficiency and ensuring accurate tax compliance for optimal financial management.

Choose a robust currency trading platform to enhance exchange rate forecasting and optimize currency risk management for better returns.

Utilizing a robust forex trading model enhances exchange rate forecasting accuracy, ensuring effective currency risk management for businesses.

The financial projection model effectively anticipates cash shortages and surpluses, enhancing decision-making in foreign exchange market operations.