Franchise Restaurant Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Franchise Restaurant Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

franchise restaurant Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

FRANCHISE RESTAURANT FEASIBILITY STUDY INFO

Highlights

This comprehensive franchise restaurant business plan is designed to facilitate the preparation of essential financial documents, including profit and loss statements, cash flow management spreadsheets, and balance sheets, with both monthly and annual timelines for accurate restaurant financial forecasting. Suitable for new or existing franchise operations, this plan assists in evaluating initial franchise investments and operational costs, helping to determine break-even analysis for franchises. It enables users to create restaurant revenue projections and analyze franchise profitability, while providing insights into variable and fixed costs in restaurants, franchisee financial obligations, and capital requirements. Additionally, the plan includes elements for developing a franchise marketing budget and implementing a robust restaurant expansion strategy, ensuring financial performance benchmarks are met. With a user-friendly interface, it supports comprehensive sales forecasting for restaurants and helps secure franchise funding options from banks, angel investors, and venture capital funds.

The ready-made financial model in Excel template addresses key pain points for franchise restaurant owners by providing a comprehensive framework that simplifies restaurant financial forecasting, including precise revenue projections and operating expenses analysis. With features like break-even analysis for franchises and detailed insights into franchise profitability analysis, users can effortlessly manage their restaurant cash flow and gauge financial performance benchmarks. This template also incorporates sales forecasting for restaurants, allowing for strategic pricing adjustments and effective franchise marketing budget allocation. Moreover, it outlines franchisee financial obligations, initial franchise investment requirements, and operational costs, equipping entrepreneurs with the necessary tools to make informed decisions about franchise funding options and capital requirements, ultimately enhancing their overall financial strategy.

Description

This franchise restaurant business plan includes a sophisticated financial model that enables users to conduct comprehensive restaurant financial forecasting, facilitating the calculation of the initial franchise investment and potential franchise profitability analysis. By leveraging the profit and loss statement for restaurants, operators can closely monitor operating expenses for restaurants alongside variable and fixed costs to develop accurate restaurant revenue projections and effective franchise royalty fees management. The model features a break-even analysis for franchises and incorporates crucial financial metrics for franchises, aiding in restaurant cash flow management and ensuring franchisee financial obligations are met. Additionally, it supports the development of a robust restaurant expansion strategy, while also outlining franchise funding options and necessary restaurant capital requirements, all anchored by a strategic franchise marketing budget.

FRANCHISE RESTAURANT FINANCIAL PLAN REPORTS

All in One Place

This franchise restaurant financial forecasting template serves as a comprehensive guide for aspiring franchisees, highlighting essential components of a successful business plan. It enables users to assess their operating expenses, initial franchise investment, and royalty fees while offering valuable insights into restaurant revenue projections and cash flow management. By providing a clear break-even analysis for franchises, it helps entrepreneurs evaluate financial performance benchmarks and develop a robust restaurant expansion strategy. With a focus on variable and fixed costs, this tool empowers franchisees to make informed decisions regarding their financial obligations and capital requirements, ultimately driving profitability.

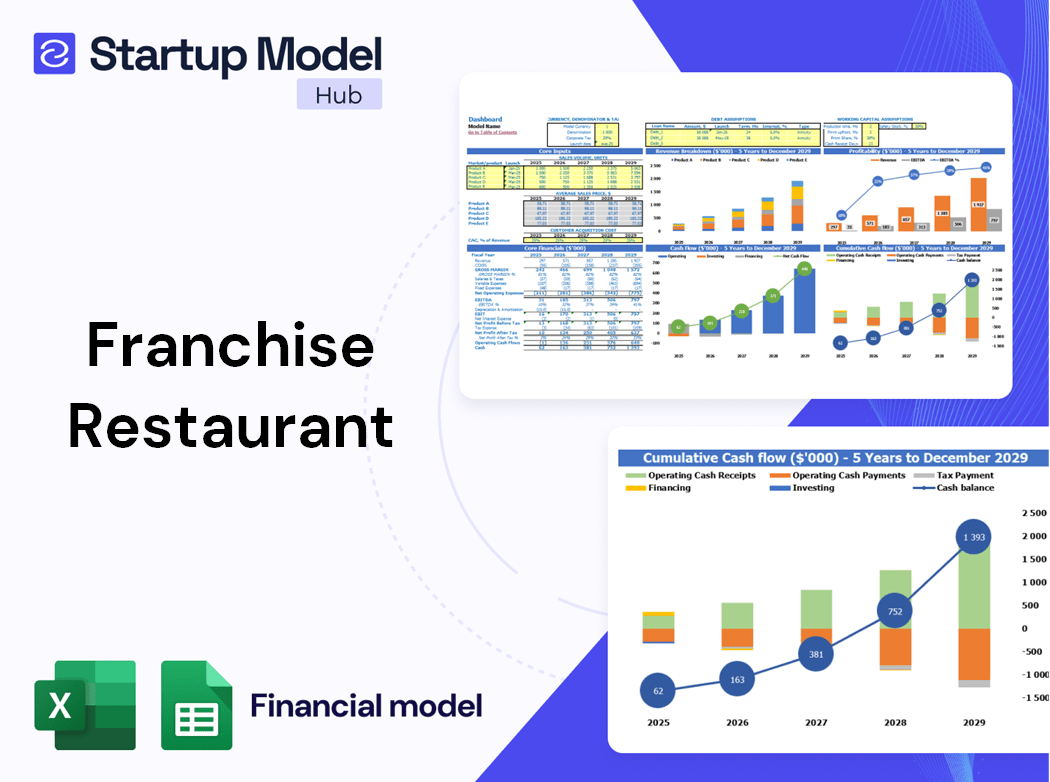

Dashboard

Our franchise restaurant business plan features a specialized dashboard that highlights key financial performance metrics essential for success. This tool simplifies financial modeling, enabling you to effortlessly assess various aspects of your restaurant's operations. By tracking revenue projections, managing operating expenses, and forecasting cash flow, you gain valuable insights into your franchise's profitability. With robust capabilities for conducting break-even analysis and evaluating franchise royalty fees, this dashboard empowers you to make informed decisions, ensuring you stay on track to achieve your financial goals and optimize your franchise's expansion strategy.

Business Financial Statements

Our comprehensive financial model empowers franchise restaurant owners to create detailed financial statements, forecasts, and analyses. By automating calculations, it enables effective communication of business performance to stakeholders. Additionally, the model generates visually appealing presentations with financial graphs and charts, streamlining the process of showcasing restaurant revenue projections, operating expenses, and profit and loss statements. This organized approach enhances your ability to attract potential investors while ensuring clarity in discussing franchise profitability, cash flow management, and financial metrics. Make informed decisions about your restaurant's expansion strategy and funding options with our robust tool.

Sources And Uses Statement

In today’s competitive landscape, a robust financial model is essential for establishing a successful franchise restaurant. Incorporating a comprehensive table in your business plan facilitates precise calculations regarding initial franchise investments and operating expenses. This critical tool enhances restaurant financial forecasting and aids in analyzing franchise profitability, ensuring informed decisions on capital requirements and variable versus fixed costs. Effective restaurant cash flow management and break-even analysis empower franchisees to strategically navigate their financial obligations, while sales forecasting and a well-structured marketing budget support sustainable growth and expansion strategies.

Break Even Point In Sales Dollars

This pro forma template includes a comprehensive break-even analysis chart covering five years. It effectively illustrates the calculations behind the break-even point both numerically and visually. By employing this analysis, franchise restaurant owners can strategically plan for profitability, assess initial franchise investments, and evaluate operating expenses. This tool is essential for understanding financial performance benchmarks and aids in restaurant revenue projections. Utilize this to ensure sound cash flow management and enhance your franchise expansion strategy.

Top Revenue

The Top Revenue tab empowers you to generate comprehensive demand reports for your café offerings. It provides insights into profitability and financial metrics based on your specific assumptions. You can easily analyze revenue depths and create a revenue bridge within the financial projection model. The template facilitates projections for various time frames, such as weekdays versus weekends. Armed with these detailed revenue reports, you can strategically determine when to allocate resources effectively and identify areas needing enhancement, ensuring informed decision-making for optimal financial performance and growth.

Business Top Expenses Spreadsheet

Our franchise restaurant business plan template is designed to streamline your financial management. The Top Expenses tab categorizes annual operating expenses into four groups, providing a comprehensive breakdown of fixed and variable costs, including customer acquisition and franchise royalty fees. By understanding your spending patterns, you can enhance cash flow management and improve profitability. This proactive approach enables you to make informed decisions about your restaurant expansion strategy, ensuring you meet franchisee financial obligations while optimizing your marketing budget and maximizing revenue projections.

FRANCHISE RESTAURANT FINANCIAL PROJECTION EXPENSES

Costs

A comprehensive franchise restaurant business plan is vital for success, enabling effective management of costs and financial forecasting. Utilizing a robust financial plan template allows franchisees to conduct break-even analysis, assess initial franchise investment, and project restaurant revenue. This essential tool provides insights into operating expenses, variable and fixed costs, and helps in crafting a strategic restaurant pricing strategy. By incorporating financial performance benchmarks and cash flow management, franchisees can make informed decisions, attract investors, and foster profitable growth in their franchise venture.

CAPEX Spending

A capital expenditure plan outlines long-term assets expected to deliver value beyond one year, like computers, which are included in financial forecasting. Operating expenses, such as electricity costs, feature in the projected profit and loss statement. Each asset has a useful life, with a portion of its cost written off annually as depreciation, impacting the balance sheet and income statement. Understanding initial franchise investment and ongoing operating expenses is crucial for franchise profitability analysis. Stakeholders gain insight into total expenditures, aiding in effective restaurant cash flow management and informed decision-making for future growth strategies.

Loan Financing Calculator

A well-structured loan amortization schedule is crucial for managing a franchise restaurant's financial health. Our comprehensive business financial model template includes a pre-built loan amortization schedule, detailing your repayment plan. It seamlessly calculates each installment, breaking down principal and interest amounts due monthly, quarterly, or annually. This tool is essential for effective cash flow management, enabling franchisees to understand their financial obligations and plan for operating expenses. By incorporating this into your franchise restaurant business plan, you can enhance financial forecasting and ensure profitability from the outset.

FRANCHISE RESTAURANT INCOME STATEMENT METRICS

Financial KPIs

For start-ups, customer acquisition costs are a critical financial metric that should be integral to your franchise restaurant business plan. By calculating the marketing expenses divided by the number of customers acquired annually, you gain insight into initial franchise investment effectiveness. This figure not only highlights the efficiency of your franchise marketing budget but also aids in sales forecasting for restaurants. Ultimately, understanding these costs will enhance your restaurant revenue projections and inform your pricing strategy, ensuring sustainable growth and profitability in your franchise operation.

Cash Flow Forecast Excel

An effective cash flow analysis is crucial for any franchise restaurant business plan. It ensures sufficient cash inflows to meet ongoing financial obligations, such as staff salaries and operational expenses. By detailing accumulated cash, this analysis helps determine whether existing funds are adequate or if additional financing is necessary. Incorporating restaurant revenue projections and break-even analysis provides a comprehensive view of financial health, supporting strategic decisions surrounding franchise profitability analysis and operational costs. Monitoring cash flow is vital for maintaining a sustainable and profitable restaurant venture.

KPI Benchmarks

The financial benchmarking section of this franchise restaurant business plan's projections template enables companies to evaluate their financial performance benchmarks against industry standards. By utilizing effective financial metrics, such as sales forecasting for restaurants and operating expenses for franchises, businesses can enhance their strategies. Benchmarking reveals best practices within the sector, empowering companies to optimize their franchise profitability analysis and break-even analysis for franchises. This essential tool is invaluable for start-ups, aiding in efficient restaurant cash flow management and informed decision-making regarding franchise funding options and initial franchise investments.

P&L Statement Excel

The primary goal of any franchise restaurant is to achieve profitability, effectively captured in a comprehensive profit and loss statement. However, creating this statement can be challenging due to intricate calculations involved in restaurant financial forecasting. To simplify this process, we offer a profit and loss projection template designed to streamline calculations and provide accurate restaurant revenue projections. This tool not only aids in understanding initial franchise investment and operational costs but also enhances restaurant cash flow management and supports strategic decisions related to franchise profitability analysis and expansion strategies.

Pro Forma Balance Sheet Template Excel

The projected balance sheet for a franchise restaurant outlines essential assets, including cash, inventory, and fixed assets, alongside current and non-current liabilities. This financial snapshot is critical for assessing initial franchise investment and determining operating expenses. A well-structured pro forma balance sheet is vital when approaching creditors, such as banks, as they require a clear understanding of your franchise's financial position, including owners' equity and liabilities, to evaluate loan applications effectively. This clarity aids in securing franchise funding options and supports overall financial forecasting.

FRANCHISE RESTAURANT INCOME STATEMENT VALUATION

Startup Valuation Model

Utilizing our comprehensive financial plan startup valuation report template, franchisees can efficiently conduct a Discounted Cash Flow valuation with minimal input on the Cost of Capital. This tool supports effective restaurant financial forecasting, enabling users to analyze initial franchise investments against operating expenses. With insights on profit and loss statements, break-even analysis, and revenue projections, franchise owners can craft robust restaurant expansion strategies. It empowers stakeholders to evaluate franchise profitability, manage cash flow, and navigate funding options, ensuring a clear understanding of financial metrics and obligations within the franchise restaurant business plan.

Cap Table

Utilizing a pro forma capitalization table enhances your franchise restaurant business plan by meticulously tracking all securities, including common and preferred stock, warrants, and options. This comprehensive oversight of investor shareholdings is crucial for restaurant financial forecasting and managing cash flow effectively. By understanding the allocation of funds and aligning with financial performance benchmarks, you can refine your franchise profitability analysis and optimize operating expenses. Ultimately, this strategic approach ensures better decisions regarding initial franchise investments and supports a robust restaurant expansion strategy for sustainable growth and profitability.

KEY FEATURES

Leveraging a comprehensive financial model enhances decision-making by providing accurate revenue projections and insights into franchise profitability.

Utilizing a cash flow budget template enables informed decisions on staffing versus equipment investments, optimizing restaurant profitability and growth.

A robust financial model demonstrates your restaurant's profitability and secures funding by showcasing reliable cash flow and revenue projections.

A solid cash flow forecast can impress lenders by clearly demonstrating your ability to repay the loan and manage expenses.

Unlock your franchise's potential with a robust financial model, enhancing profitability analysis and guiding strategic restaurant expansion efforts.

This comprehensive financial model empowers franchise restaurant owners to strategically plan for profitability and manage cash flow effectively.

A solid financial model streamlines restaurant revenue projections, ensuring efficient franchise profitability analysis and effective cash flow management.

The financial model simplifies essential calculations, empowering you to focus on building a robust franchise restaurant business plan.

A solid financial model enhances franchise profitability analysis, optimizes cash flow management, and supports strategic restaurant expansion decisions.

A solid financial model streamlines franchise profitability analysis, guiding decisions on operating expenses and revenue projections for sustained success.

ADVANTAGES

A robust financial model enables precise restaurant revenue projections and effective cash flow management, ensuring franchise profitability and sustainability.

Utilizing a comprehensive financial model enhances transparency and confidence for investors in your franchise restaurant business plan.

A robust franchise restaurant pro forma income statement template streamlines financial forecasting, ensuring strategic planning and informed decision-making for profitability.

A robust financial model empowers franchise restaurant owners to accurately project revenue and manage cash flow for sustained profitability.

Leverage a comprehensive financial model to enhance your franchise restaurant business plan and drive profitability through strategic insights.