Invoice Financing Platform Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Invoice Financing Platform Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

invoice financing platform Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

INVOICE FINANCING PLATFORM FINANCIAL MODEL FOR STARTUP INFO

Highlights

Discover a highly versatile and user-friendly invoice discounting platform designed for crafting forecast income statements and cash flow projections in Excel. This fintech invoice solution is tailored for both startups and established businesses in the B2B invoice financing space, enabling effective evaluation prior to a sale. By leveraging alternative financing models and accounts receivable financing tools, this platform supports seamless business cash flow management and liquidity management solutions. Whether you're implementing a working capital financing platform or exploring digital invoice financing services, this comprehensive financial model template is fully editable to meet your unique needs.

The invoice discounting platform Excel Model addresses key pain points faced by businesses seeking cash flow financing solutions by streamlining the process of accounts receivable financing, removing the burdens of complex calculations and formatting. With this user-friendly template, business owners can easily manage their working capital financing needs while leveraging alternative financing models like B2B invoice financing or online invoice factoring without reliance on costly consultants or intricate accounting software. The model incorporates financial technology innovations that facilitate effective liquidity management and enhances business cash flow management, allowing for straightforward planning during the startup phase and throughout operations. Additionally, it supports effective credit risk assessment and robust payment processing, equipping users with the necessary accounts receivable financing tools for optimal growth and presentation to banks or investors.

Description

Our innovative invoice discounting platform is tailored for effective operational management and investment analysis, providing essential tools for financial decision-making. Designed with a focus on the B2B invoice financing sector, our comprehensive business cash flow management model incorporates various financial technology innovations, including digital invoice financing services and accounts receivable financing tools. By leveraging this fintech invoice solution, users can seamlessly analyze crucial financial metrics, such as FCF and NPV, while also conducting credit risk assessments and liquidity management to ensure robust working capital financing. The platform not only simplifies invoice management but also aids in forecasting sales and expenses, making it an invaluable resource for small business financing options and supply chain finance solutions.

INVOICE FINANCING PLATFORM FINANCIAL MODEL REPORTS

All in One Place

Transform your financial projections effortlessly with our innovative online invoice factoring platform. Our user-friendly forecasting tools enable you to create comprehensive startup financial models, effortlessly outlining personnel costs, sales, expenses, and funding needs on a monthly basis. Customize your data just like you would in traditional spreadsheets—add assumptions, adjust figures, and craft a robust 5-year forecast tailored to your business needs. Explore alternative financing models and enhance your business cash flow management with our cutting-edge fintech invoice solutions today!

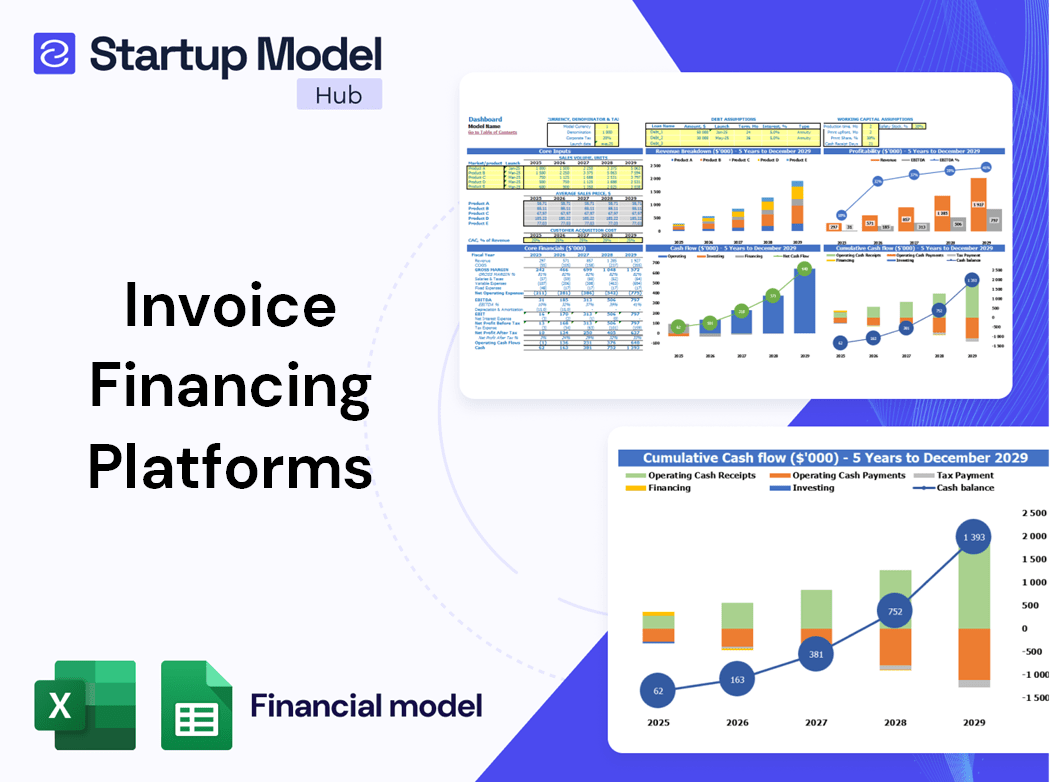

Dashboard

Our innovative financial dashboard, embedded in our business plan template, is an essential tool for financial planning and analysis. It offers dynamic charts and visual representations of accurate financial data, derived from our comprehensive startup costs template. Designed to enhance insights into your accounts receivable and overall financial health, this dashboard empowers stakeholders with vital data for informed decision-making and strategic forecasting. By utilizing fintech invoice solutions and cash flow financing options, you’ll effectively manage liquidity and optimize your working capital through our robust invoice management software. Transform your business cash flow management today!

Business Financial Statements

Creating a robust financial statement is essential for startups, especially when utilizing innovative financing solutions like B2B invoice financing and cash flow financing solutions. An intuitive business projection template, supported by accounts receivable financing tools, enhances clarity for stakeholders. By integrating fintech invoice solutions and liquidity management solutions, your financial plan can effectively showcase the viability of your alternative financing model. Ensure all key components are included, making it easier for others to assess your startup’s potential and make informed decisions. A well-structured approach promotes confidence in your business cash flow management strategies.

Sources And Uses Statement

The sources and uses tab in the financial model template is essential for startups, providing a clear overview of total funding and expenditure. This crucial chart enables businesses to effectively track the deployment of investor capital, ensuring transparency and accountability. By leveraging fintech invoice solutions and cash flow financing options, startups can optimize their working capital through invoice discounting platforms and accounts receivable financing tools. This financial technology innovation empowers them to maintain robust business cash flow management, ultimately supporting their growth and sustainability in a competitive market.

Break Even Point In Sales Dollars

Understanding your break-even point is crucial for strategic planning in an invoice discounting platform. It represents the sales volume needed to cover total costs, both fixed and variable, ensuring your B2B invoice financing model operates profitably. With our advanced financial technology innovations, you can easily create a break-even chart using our Excel financial model. This visual tool helps assess the minimum sales required for your cash flow financing solutions, guiding investors in evaluating potential returns and timelines. Leverage this insight for effective business cash flow management and informed decision-making in your accounts receivable financing strategy.

Top Revenue

Our startup costs spreadsheet’s Top Revenue tab enables you to generate comprehensive demand reports for your invoice discounting platform. These reports help you evaluate various scenarios, enhancing profitability insights. The five-year financial projection template empowers users to model revenue dynamics, adjusting for factors like weekday versus weekend demand. This agile business plan excel template is essential for effective business cash flow management, allowing you to optimize operations by accurately forecasting resource allocation. Leverage our innovative financial technology solutions to refine your strategy and bolster your working capital financing efforts.

Business Top Expenses Spreadsheet

In the Top Revenue tab of our startup's financial model, users can forecast demand by product or service, enhancing profitability analysis through our innovative receivables financing model. This tool simulates various scenarios, providing insights into potential financial attractiveness. Users can analyze revenue depth and bridges while assessing forecasted demand patterns, such as weekdays versus weekends. By leveraging this data, businesses can optimize resource allocation—be it manpower or inventory—ensuring effective cash flow management and improved working capital financing solutions. Explore our fintech invoice solutions to streamline your financial planning today.

INVOICE FINANCING PLATFORM FINANCIAL PROJECTION EXPENSES

Costs

The 3-Year Financial Projection Template empowers businesses to create robust financial forecasts for up to five years, enhancing cash flow management and budgeting. This versatile tool facilitates cost monitoring by allowing you to allocate expenses into categories such as variable or fixed costs, COGS, wages, and CAPEX. Additionally, it integrates essential financial parameters, including income percentages and payroll, ensuring precision in projections. Harnessing this sophisticated financial model supports strategic planning, driving better liquidity management and informed decision-making for future growth and stability in an evolving fintech landscape.

CAPEX Spending

Effective CAPEX planning and automated depreciation calculations are vital for robust financial modeling. Our innovative platform integrates cutting-edge financial technology solutions, enabling businesses to optimize their capital expenditures. Utilize our comprehensive business cash flow management tools, offering both straight-line and double-declining balance depreciation methods. With our invoice management software, you can enhance your liquidity management strategies and streamline your financial processes. Experience superior accounts receivable financing options and leverage digital invoice financing services to boost your working capital. Join us in transforming your financial planning with our advanced, user-friendly solutions.

Loan Financing Calculator

Our innovative platform incorporates advanced financial technology to streamline your loan amortization process. With embedded formulas, you can effortlessly distinguish between loan principal and interest components. This system provides instant calculations, detailing repayment amounts, interest payments, payment frequency, and overall repayment duration. Ideal for businesses navigating cash flow challenges, our online invoice factoring and receivables financing model enhance liquidity management and optimize working capital financing. Explore our digital invoice financing services to unlock tailored solutions that empower your business cash flow management. Experience a seamless financial journey with our comprehensive accounts receivable financing tools.

INVOICE FINANCING PLATFORM EXCEL FINANCIAL MODEL METRICS

Financial KPIs

An effective invoice discounting platform offers a robust business revenue model that features industry-specific key performance indicators (KPIs). These metrics focus on profitability, cash flow, and liquidity, aligning perfectly with investor interests. By leveraging accounts receivable financing tools and innovative fintech invoice solutions, businesses can enhance their financial health and streamline liquidity management. This alternative financing model empowers companies to manage their cash flow more efficiently, making it an ideal choice for small businesses seeking dynamic financing options. Embrace digital invoice financing services to elevate your business’s financial strategy and attract potential investors.

Cash Flow Forecast Excel

The cash flow statement is crucial for every business, as generating cash flow is a primary objective. Our startup costs template highlights financial consolidation and serves as a tool to attract additional financing. It includes a dedicated section for monitoring cash inflows and outflows. Built on key metrics such as Payable and Receivable Days, annual income, and working capital, this template calculates your net cash flow and cash balances. Perfect for effective cash flow management, it integrates seamlessly with fintech invoice solutions and alternative financing models like B2B invoice financing, enhancing liquidity and financial strategy.

KPI Benchmarks

The benchmark tab of the 3-statement financial model Excel template evaluates key performance indicators, both operational and financial, while integrating industry averages for comparative analysis. This benchmarking is crucial for start-ups, offering insights into best practices within their sector. By leveraging financial technology innovations, businesses can utilize various tools—like cash flow financing solutions and digital invoice financing services—to enhance their financial and strategic management. Understanding relative performance through these metrics empowers companies to optimize their working capital financing strategies and improve overall business cash flow management, driving growth and sustainability.

P&L Statement Excel

Our pro forma template revolutionizes financial calculations, offering a streamlined approach for businesses to manage cash flow effectively. Integrated with built-in formulas, it simplifies complex calculations, presenting results in intuitive reports and charts. The projected profit and loss statement is crucial for monitoring profitability while allowing businesses to identify and address weak areas. Leverage this tool alongside alternative financing models, such as B2B invoice financing and accounts receivable financing tools, to enhance your café's financial health and optimize working capital. Embrace these fintech invoice solutions for superior liquidity management and business cash flow management.

Pro Forma Balance Sheet Template Excel

A pro forma balance sheet for a startup serves as a vital tool for assessing its financial health. It highlights key assets, including cash, inventory, and fixed assets, alongside current and non-current liabilities. This transparency is crucial when seeking financing options, as creditors, like banks, require a clear understanding of the company's asset and liability structure before approving loans. Incorporating a robust invoice discounting platform or online invoice factoring can enhance cash flow management, making your startup more appealing to potential lenders. Overall, a comprehensive balance sheet aids in optimizing your business's financial strategy.

INVOICE FINANCING PLATFORM FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our financial model Excel template features a robust three-statement framework, incorporating advanced valuation methodologies. With integrated discounted cash flow (DCF) and weighted average cost of capital (WACC) calculations, this tool provides insightful projections of a company's financial performance. Enhance your decision-making with our innovative financial technology solutions that streamline business cash flow management and optimize working capital. Whether you're exploring alternative financing models or leveraging B2B invoice financing, our comprehensive tools support effective liquidity management and credit risk assessment, ensuring your enterprise is well-equipped for sustainable growth.

Cap Table

The cap table for startups is a vital tool that outlines ownership stakes, investor contributions, and equity distribution. Understanding each investor's percentage share is crucial for effective cash flow management and maintaining accurate financial records. This transparency not only supports strategic decision-making but also enhances investor relations, making it easier to navigate alternative financing models like B2B invoice financing or receivables financing. Utilizing fintech innovations and digital invoice financing services can further optimize liquidity management, ensuring your startup remains agile and poised for growth in a competitive landscape.

KEY FEATURES

Unlock immediate cash flow with our innovative B2B invoice financing platform, empowering small businesses to thrive and grow.

Unlock seamless cash flow management with our fintech invoice solutions, simplifying receivables financing for small businesses without complex setups.

Utilize our B2B invoice financing platform to enhance cash flow, empowering your business to optimize spending and stay within budget.

Utilizing a receivables financing model enhances cash flow management, empowering businesses to meet their financial obligations with confidence.

Unlock immediate cash flow with an innovative invoice discounting platform, empowering businesses to optimize working capital effortlessly.

Our invoice discounting platform empowers small businesses with enhanced cash flow management and risk mitigation for future growth.

Unlock faster cash flow with our innovative B2B invoice financing platform, empowering your business with immediate liquidity solutions.

Utilize our invoice discounting platform to enhance cash flow, empowering your business with flexible working capital financing options.

Streamline your liquidity management with an innovative invoice discounting platform, enhancing cash flow and empowering your business growth.

Our invoice discounting platform enhances cash flow management, enabling businesses to reinvest and meet financial obligations promptly.

ADVANTAGES

A robust invoice discounting platform enhances cash flow, empowering businesses with effective receivables financing solutions for sustainable growth.

Utilizing an invoice discounting platform enhances cash flow management, empowering businesses with immediate access to capital for growth.

Leverage an invoice discounting platform to enhance cash flow management and unlock immediate working capital for your business.

Start your business effortlessly using our innovative invoice financing platform, ensuring improved cash flow and flexible funding solutions.

The online invoice factoring platform provides quick access to cash flow financing solutions, enhancing liquidity management for small businesses.