Mini Mart Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Mini Mart Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

mini mart Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

MINI MART FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive mini mart business plan includes a robust framework for retail financial projections, integrating sales forecasting techniques and market analysis for mini mart to optimize revenue streams and enhance operational efficiency metrics. It features a detailed breakdown of startup costs for convenience store, alongside an in-depth operating expenses analysis and inventory management strategies to ensure healthy grocery store profit margins. Additionally, the plan provides insights into shopper demographics to inform a pricing strategy for mini mart, while also implementing break-even analysis for grocery to gauge potential profitability. To support small business cash flow management, this financial modeling template offers essential financial statements for retailers, investment return calculations, and effective convenience store budgeting strategies, ensuring a solid foundation for sustainable business growth.

This mini mart Excel pro forma template efficiently addresses common financial planning pain points by offering a streamlined approach to retail financial projections, convenience store budgeting, and inventory management strategies. Users can easily conduct a break-even analysis for grocery operations and assess startup costs for a convenience store, all while gaining insights into grocery store profit margins and small business cash flow. The integrated design allows for accurate sales forecasting techniques and operational efficiency metrics, which helps identify shopper demographics insights for better pricing strategy for the mini mart. Additionally, the template includes features for comprehensive operating expenses analysis and revenue streams for convenience store operations, while also providing financial modeling templates that facilitate investment return calculations and enhance business growth strategies.

Description

A well-structured mini mart business plan necessitates the use of a dynamic financial model to guide your retail financial projections and convenience store budgeting. This financial forecasting template enables you to conduct thorough market analysis for the mini mart, detailing key aspects such as startup costs for the convenience store and analyzing operating expenses to optimize profitability. By incorporating sales forecasting techniques and pricing strategies for the mini mart, the model helps you identify grocery store profit margins while evaluating shopper demographics insights to enhance customer engagement. It also supports effective inventory management strategies and supply chain management, ultimately facilitating break-even analysis for grocery operations and providing insights into revenue streams for your convenience store. This approach ensures that your small business cash flow is well managed, allowing you to focus on business growth strategies while tracking operational efficiency metrics.

MINI MART FINANCIAL MODEL REPORTS

All in One Place

A comprehensive financial model template for startups encompasses the income statement, cash flow statement, and balance sheet. This extensive model is updated monthly but is fully prepared at the year's end, reflecting all changes over the accounting period. For mini mart business plans, such financial projections are essential, including retail financial projections, inventory management strategies, and break-even analysis for grocery. Regardless of size, all businesses must create an annual financial plan, ensuring operational efficiency and guiding growth strategies in an ever-evolving market landscape.

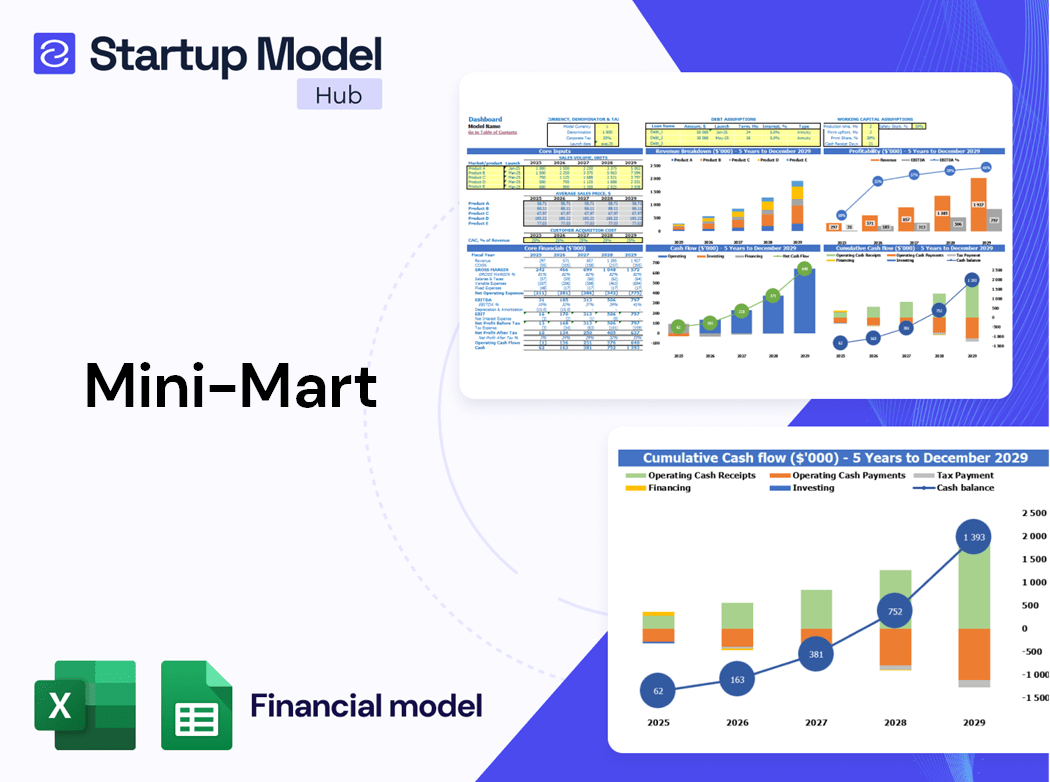

Dashboard

To enhance stakeholder engagement, consider sharing access to the dashboard containing your pro forma cash flow projection. By doing so, you promote transparency and collaborative evaluation of your mini mart business plan. This access allows for a more comprehensive understanding of retail financial projections, operational efficiency metrics, and inventory management strategies. Furthermore, it fosters informed discussions around sales forecasting techniques and pricing strategy for your convenience store, ultimately driving investment return calculations and supporting robust business growth strategies. Empowering your team with this information can significantly improve decision-making processes and overall efficiency.

Business Financial Statements

Our advanced model effortlessly produces essential annual financial statements for your mini mart. By linking core financials to key assumptions, any adjustments to these inputs seamlessly update your retail financial projections. This dynamic approach enables precise budgeting, enhances operational efficiency metrics, and facilitates effective sales forecasting techniques. Whether analyzing startup costs for your convenience store or conducting a break-even analysis for grocery, our tool provides valuable insights, ensuring you make informed decisions for sustainable business growth. Experience streamlined inventory management strategies and optimize your pricing strategy with our comprehensive financial modeling templates.

Sources And Uses Statement

The sources and uses of cash statement plays a vital role in the financial projection model for a mini mart. This document provides comprehensive insights into funding sources and cash distribution, facilitating effective cash flow management. By incorporating inventory management strategies and operational efficiency metrics, retailers can enhance their insights into startup costs and operating expenses. Understanding these elements is essential for developing an effective business plan, conducting accurate sales forecasting, and ensuring sustainable growth in the competitive convenience store market.

Break Even Point In Sales Dollars

This comprehensive five-year financial projection template includes an Excel-based break-even analysis formula for your mini mart business plan. It visually represents break-even points through both numeric calculations and engaging charts. By utilizing effective retail financial projections, you can enhance inventory management strategies and develop a sound pricing strategy for your convenience store. This tool also aids in analyzing operating expenses, sales forecasting techniques, and provides insights into shopper demographics. Elevate your small business cash flow management and investment return calculations with this essential resource for retailers.

Top Revenue

Revenue is a cornerstone of any business, especially for a mini mart. A robust mini mart business plan should include detailed retail financial projections and revenue streams analysis. Effective sales forecasting techniques and pricing strategies are essential for optimizing grocery store profit margins. Our financial modeling templates incorporate assumptions based on historical data, ensuring accurate projections. Additionally, focus on operational efficiency metrics and inventory management strategies to enhance financial performance. Equip your convenience store with the right tools to conduct operating expenses analysis and break-even analysis for grocery, paving the way for sustainable growth and success.

Business Top Expenses Spreadsheet

The expense summary tab outlines essential operating costs for your mini mart, enabling effective expense organization for strategic planning. Use this comprehensive report to develop your startup financial model and guide your convenience store budgeting. By analyzing total expenses over specific periods—monthly, quarterly, or yearly—you can monitor financial performance against projections. This insight allows for timely adjustments to your pricing strategy and inventory management, ensuring operational efficiency while maximizing grocery store profit margins. Leverage this data to enhance your business growth strategies and improve overall cash flow management.

MINI MART FINANCIAL PROJECTION EXPENSES

Costs

Measuring startup costs is crucial for any mini mart business. Our Mini Mart Financial Projection Excel template simplifies this process, keeping your finances organized and under control. Avoiding high costs is essential to prevent negative impacts on your business. With this automated financial planning tool, you can effortlessly track expenses and produce insightful reports. Adjust assumptions seamlessly to fine-tune your sales forecasting and enhance operational efficiency. This pro forma helps you assess your financial health, ensuring smart decision-making for profitable growth and robust inventory management strategies. Take charge of your convenience store's future today!

CAPEX Spending

Capital expenditure is a critical component of your mini mart business plan. Financial specialists develop a startup budget, closely monitoring investments and analyzing operating expenses. Understanding these startup costs is essential for optimizing cash flow and ensuring operational efficiency. Accurate forecasting allows you to project capital expenditures, inform your financial statements, and influence revenue streams effectively. By employing robust budgeting techniques and investment return calculations, you can enhance the financial health of your convenience store. A responsible approach to your startup budget lays the foundation for future growth and sustainable profitability.

Loan Financing Calculator

Our three-statement model template includes an integrated loan amortization schedule, detailing both principal and interest calculations. This comprehensive tool helps streamline your mini mart business plan by providing essential insights into your company's payment obligations. It efficiently calculates payment amounts based on the loan's principal, interest rate, duration, and repayment frequency. Utilize this template to enhance your retail financial projections, improve cash flow management, and support your overall financial modeling for operational efficiency and growth strategies. Equip your convenience store for success with precise financial insights and strategic budgeting.

MINI MART EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Earnings growth and net income metrics are crucial for a robust mini mart business plan. Monitoring growth through a pro forma income statement effectively tracks your company’s development. This financial modeling template enables you to assess sales and revenue growth, enhancing convenience store budgeting and retail financial projections. By incorporating comprehensive inventory management strategies and operational efficiency metrics, you can better understand your market analysis for the mini mart, thereby ensuring sustainability. Emphasizing these key elements will equip you to optimize pricing strategies, manage operating expenses, and drive business growth effectively.

Cash Flow Forecast Excel

A robust cash flow analysis is essential for your mini mart business plan, showcasing your ability to manage cash streams effectively. This financial modeling template not only outlines startup costs for your convenience store but also demonstrates capacity to cover liabilities. For lenders, it’s vital to see that your retail financial projections indicate sufficient cash flow to service any loans. Incorporating inventory management strategies and operating expenses analysis in your projections will further bolster your credibility and enhance your chances of securing funding.

KPI Benchmarks

This financial modeling template includes a dedicated benchmark tab that facilitates a comprehensive benchmarking study. By analyzing your mini mart's performance against industry peers, you gain valuable insights into productivity, operational efficiency metrics, and overall effectiveness. This approach is essential for optimizing your retail financial projections, enhancing convenience store budgeting, and driving business growth strategies. Leverage these insights to refine inventory management strategies and adjust your pricing strategy for the mini mart, ultimately enabling more informed decision-making and maximizing your grocery store profit margins.

P&L Statement Excel

The profit and loss (P&L) forecast is essential for modeling both expenses and revenues in real-time, providing a comprehensive view of your mini mart's financial health. Unlike cash flow projections, which track actual cash movements, the monthly P&L statement incorporates non-cash items such as depreciation, important for a more accurate financial picture over multiple years. This approach supports effective inventory management strategies and aids in analyzing operating expenses, ultimately enhancing your convenience store's revenue streams and guiding investment return calculations for sustainable growth.

Pro Forma Balance Sheet Template Excel

The pro forma balance sheet is essential for any mini mart business plan, detailing all current and long-term assets, liabilities, and equity. This report is crucial for analyzing operating expenses and aids in financial modeling templates. By providing key insights, it enables effective calculations of vital financial ratios, supporting sales forecasting techniques and inventory management strategies. Understanding this will enhance your convenience store budgeting, ultimately leading to informed business growth strategies and improved operational efficiency metrics. Ensure that your startup costs for convenience store operations are clearly outlined to maximize investment return calculations.

MINI MART FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This mini mart business plan incorporates two key valuation methods for thorough financial projections. You can choose between a discounted cash flow (DCF) analysis or a weighted average cost of capital (WACC) calculation to forecast your retail performance. By utilizing these robust financial modeling templates, you can ensure accuracy in your sales forecasting techniques, operating expenses analysis, and break-even analysis for grocery. This strategic approach not only enhances operational efficiency metrics but also supports informed decision-making for sustainable business growth and investment return calculations.

Cap Table

Are you curious about the simple cap table? This essential tool streamlines the analysis and management of cash flow, providing critical insights into your mini mart's financial landscape. It offers data on stocks, investments, promissory notes, and additional financial sources, enabling you to make informed decisions. By incorporating effective inventory management strategies and retail financial projections, you can optimize your convenience store budgeting and enhance your overall profitability. Leverage this powerful resource to elevate your business growth strategies and achieve operational efficiency in your retail venture.

KEY FEATURES

A simple-to-use financial model enhances decision-making by providing clarity on cash flow, profit margins, and operational efficiency for your mini mart.

A sophisticated mini mart financial model ensures quick, reliable insights on startup costs and revenue streams for strategic growth.

Utilizing financial modeling templates enhances decision-making, ensuring optimized retail financial projections and improved cash flow management for your mini mart business.

Implementing a financial model ensures sustainable growth by accurately projecting cash flow and minimizing risks in your mini mart business.

A robust financial model enhances your mini mart business plan by optimizing budgeting, boosting profit margins, and ensuring cash flow stability.

The Excel Financial Model Template streamlines your mini mart business plan, enhancing clarity in retail financial projections and investment return calculations.

A robust financial model provides clear insights into profitability and cash flow, ensuring informed investment decisions for your mini mart.

Elevate your pitches and secure financing faster with a tailored financial model showcasing your mini mart's operational and revenue potential.

A robust financial model enhances operational efficiency, ensuring accurate retail projections and smarter budgeting for your mini mart's success.

Utilize our proven mini mart pro forma business plan template to streamline your financial modeling and enhance investment return calculations.

ADVANTAGES

A robust mini mart startup financial plan enhances operational efficiency and boosts investor confidence through precise revenue streams and budgeting insights.

Our financial modeling templates enable precise sales forecasting, ensuring strategic planning for increased profitability and improved cash flow management.

A comprehensive financial model for your mini mart enhances decision-making, ensuring effective budgeting and maximizing profit margins.

Empower your team with a robust financial model to enhance retail financial projections and drive informed decision-making.

A comprehensive financial model reveals potential cash shortfalls early, enhancing operational efficiency and guiding strategic decisions for your mini mart.