Paint Coating Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Paint Coating Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

paint coating Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

PAINT COATING FINANCIAL MODEL FOR STARTUP INFO

Highlights

The paint coating market analysis reveals significant growth potential driven by emerging automotive paint coating trends and a deep dive into the financials of industrial paint coatings. As the industry navigates through environmental regulations, companies are strategizing to enhance profit margins through innovative coating application technologies and optimizing their paint manufacturing cost structure. A comprehensive paint coating demand forecast indicates strong revenue streams for coatings, while market segmentation highlights opportunities within the polymer paint coatings market. The competitive landscape in coatings is evolving, prompting investment analysis for coatings that focuses on the cost of raw materials and strategic planning among coating brands. Ultimately, the financial metrics for coating companies suggest a robust future, bolstered by advancements in product pricing strategy and a thorough paint coating supply chain analysis that anticipates shifts in global paint coating trends.

The paint coating market analysis template offers buyers a robust solution for addressing various pain points in the paint coatings industry, such as the need for accurate demand forecasts and insights into competitive landscape dynamics. By integrating key elements like market segmentation, revenue streams, and cost structures for paint manufacturing, this model facilitates strategic planning and investment analysis with ease. It enables users to effectively manage environmental regulations impact and raw material costs, while providing a clear overview of automotive paint coating trends and industrial paint coating financials. With automatic updates across all metrics, users can quickly adapt their strategies based on changing market conditions, ensuring that their financial frameworks remain relevant and accurate amid the coatings market's growth potential and innovations.

Description

The financial model for the paint coating industry developed by our team offers a comprehensive framework tailored for robust financial planning and forecasting, reflecting current automotive paint coating trends and industrial paint coating financials. This dynamic Excel template allows users to project five years of monthly and yearly financial statements, including a forecast income statement, balance sheet, and cash flow statement, while also integrating a discounted cash flow valuation based on forecasted free cash flows. With attention to essential financial performance ratios and KPIs necessary for securing investments, this adaptable model can be easily updated by individuals with basic Excel skills, ensuring an accurate reflection of the paint manufacturing cost structure and raw material prices. Furthermore, it generates vital financial reports such as a startup cash flow statement, break-even analysis, and monthly profit and loss statement, facilitating strategic planning and piquing interest for potential revenue streams in paint coatings.

PAINT COATING FINANCIAL MODEL REPORTS

All in One Place

This projected cash flow statement template for the paint coating market serves as a vital tool for entrepreneurs, illuminating key business aspects and informing strategic planning. By detailing cash flows and identifying the cash burn rate, it provides insights crucial for understanding financial health. This analysis is particularly important for startups, as it highlights how long capital may sustain operations and outlines achievable milestones amid evolving automotive paint coating trends and environmental regulations. Utilizing this roadmap, businesses can navigate the competitive landscape and capitalize on the growth potential within the coatings industry.

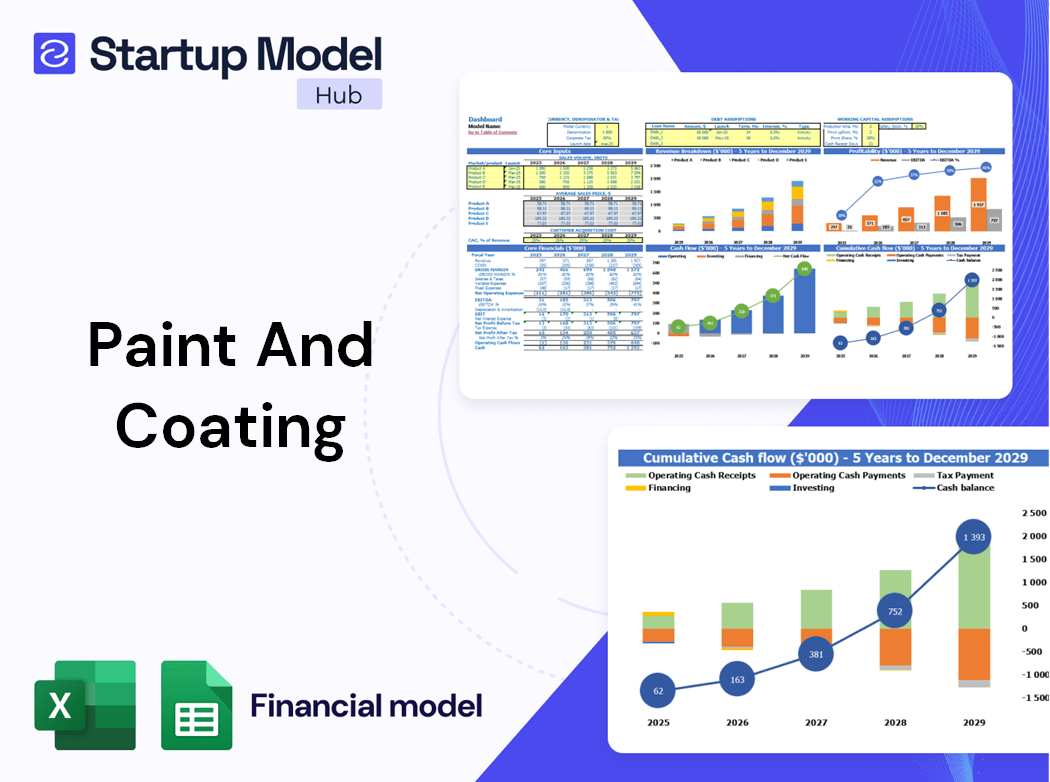

Dashboard

Our comprehensive five-year financial projection dashboard offers essential financial KPIs and critical metrics for effective paint coating market analysis. It consolidates key financial highlights from projected balance sheets, P&L statements, and cash flow charts in an accessible Excel format. To enhance stakeholder presentations, users can transform this data into visually engaging graphs and charts, facilitating strategic planning in coating brands and decision-making. This tool not only streamlines financial reporting but also underscores profit margins, revenue streams, and market segmentation trends within the dynamic paint coatings industry.

Business Financial Statements

Our comprehensive financial model synthesizes crucial data for a robust financial summary, seamlessly integrating elements like startup financial statements, projected balance sheets, profit and loss forecasts, and cash flow analyses. You don’t need to be an Excel expert; our experienced team has pre-configured formulas to create this insightful summary for your pitch deck. This model is vital for a nuanced understanding of market segmentation in paint coatings, driving strategic planning and investment analysis in the competitive coatings landscape. Unlock the growth potential of the paint coating market with data-driven insights tailored for your success.

Sources And Uses Statement

The paint coating profit and loss statement, available in Excel format, effectively outlines the sources and uses of cash, providing a clear picture of a company's funding structure. This tool is essential for paint manufacturers seeking to optimize their financial metrics and strategically plan for growth in the competitive coatings landscape. By analyzing the cost structure and revenue streams in paint coatings, businesses can align their strategies with current automotive paint coating trends, innovations, and environmental regulations, ensuring a robust approach to market segmentation and demand forecasting.

Break Even Point In Sales Dollars

Break-even analysis is crucial for understanding financial stability in the paint coating market. This point—where total revenue equals total costs—indicates neither profit nor loss. Utilizing a CVP chart in Excel can effectively illustrate the relationship between variable and fixed costs, aiding strategic planning in coating brands. Companies with a lower fixed cost structure typically achieve a break-even point more swiftly, enhancing their financial metrics and optimizing revenue streams. This insight is vital for navigating automotive paint coating trends and innovations while adapting to environmental regulations and market segmentation dynamics.

Top Revenue

In developing a three-way financial model template, revenue stands as a critical element for assessing a company's value, particularly in the paint coating market. Financial analysts must focus on crafting effective strategies for forecasting future income streams, leveraging historical data and market trends. This includes analyzing automotive paint coating trends and innovations in application technologies, while also considering external factors like environmental regulations. Our comprehensive financial model template equips users with essential components for informed revenue stream planning, enhancing strategic decision-making in the competitive coatings landscape.

Business Top Expenses Spreadsheet

To enhance your company's productivity and drive profitability, it’s crucial to manage expenses effectively. Our five-year projection template breaks down major expense categories, highlighting areas where optimization can yield significant savings. By analyzing financial metrics and understanding your cost structure, you can align investments with market trends, such as innovations in paint coatings and evolving coating application technologies. This strategic planning will not only guide your operations but also enhance your revenue streams within the competitive coatings landscape, ensuring you capitalize on growth potential while navigating environmental regulations and raw material costs.

PAINT COATING FINANCIAL PROJECTION EXPENSES

Costs

Our paint coating financial projection template streamlines the summarization of costs, essential for any startup in the coatings market. By incorporating a projected income statement, this tool facilitates effective financial management, mitigating the risks associated with high startup expenses that can threaten overall business health. Users can efficiently track expenses and analyze financial metrics, enabling a clear forecast of their company’s financial future. This proactive approach supports strategic planning in paint coatings, ensuring a competitive edge in a landscape shaped by evolving automotive paint coating trends and environmental regulations.

CAPEX Spending

Capital expenditure (CAPEX) is pivotal for businesses, impacting the paint coating market analysis and production capabilities. This investment covers property, plant, and equipment (PPE), forming a vital part of financial models. Effective capital expenditure planning incorporates depreciation and adjustments related to fixed assets, directly influencing the paint manufacturing cost structure. Our Excel-based financial model accounts for all elements of CAPEX, enhancing strategic planning for coating brands. Through this approach, businesses can better navigate the competitive landscape in coatings and optimize revenue streams while adapting to automotive paint coating trends and environmental regulations.

Loan Financing Calculator

Our five-year financial projection template includes a comprehensive loan amortization schedule that details both principal and interest calculations. This tool enables your company to assess payment obligations effectively, incorporating key factors such as loan amount, interest rate, duration, and payment frequency. By understanding these financial metrics, businesses in the paint coating market can enhance their strategic planning and investment analysis, ensuring they navigate competitive landscapes and optimize revenue streams amidst evolving automotive and industrial paint coating trends.

PAINT COATING EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Utilizing key financial performance indicators (KPIs) is essential for monitoring your company's health in the competitive paint coating market. This paint coating pro forma template in Excel effectively visualizes these KPIs through engaging charts, enabling strategic planning for coating brands. By analyzing automotive paint coating trends, manufacturing cost structures, and the impact of environmental regulations, you can refine your paint product pricing strategy. This approach enhances revenue streams and maximizes profit margins while addressing the growth potential within market segments. Strengthening your insights allows for informed investment analysis and a robust coating supply chain.

Cash Flow Forecast Excel

A startup cash flow statement illustrates the dynamic shifts in cash balances over a specified period, detailing crucial inflows and outflows. This financial tool is essential for understanding revenue streams in paint coatings, particularly within the competitive landscape and market segmentation. By analyzing the cost of raw materials for paint and evaluating paint manufacturing cost structures, businesses can make informed strategic planning decisions. An effective cash flow overview aids in navigating automotive paint coating trends and innovations, positioning startups to capitalize on growth potential in the coatings market while adhering to environmental regulations.

KPI Benchmarks

Benchmarking is a vital tool for assessing performance in the paint coating market, allowing businesses to compare financial metrics such as profit margins and cost structures against industry standards. By analyzing indicators like productivity and cost per unit, companies can identify their position relative to competitors and uncover growth opportunities. In the dynamic coatings industry, strategic benchmarking informs investment analysis and aids in understanding innovations, market trends, and supply chain dynamics. Ultimately, it empowers startups to enhance their competitive edge and drive profitability within the ever-evolving paint coatings landscape.

P&L Statement Excel

Financial forecasting is essential in the paint coating market analysis, helping entrepreneurs evaluate business models before committing resources. A well-structured financial plan outlines projected profit margins, guiding decisions on investment in innovations and strategic planning. Utilizing tools like Excel templates to project gross and net profit percentages allows businesses to assess their revenue streams effectively. Understanding the demand forecast and cost of raw materials enhances visibility into profit potential within the competitive landscape. Ultimately, a robust financial forecast empowers coating companies to navigate industry trends and capitalize on growth opportunities with confidence.

Pro Forma Balance Sheet Template Excel

The pro forma balance sheet for a startup offers a comprehensive overview of the financial health of the business, detailing assets, liabilities, and equity accounts. This essential tool aids in strategic planning for coating brands, enabling insights into revenue streams and market segmentation in paint coatings. By analyzing data such as paint manufacturing cost structure and the impact of environmental regulations, startups can effectively navigate the competitive landscape. This financial metrics framework is crucial for assessing market growth potential and investment analysis within the evolving paint coating market.

PAINT COATING FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our startup valuation calculator streamlines valuation calculations by effectively organizing key metrics, including the Weighted Average Cost of Capital (WACC) and Discounted Cash Flows (DCF). WACC reflects the average financing cost for a company, balancing equity and debt, and serves as a critical risk assessment tool for lenders. DCF evaluates the present value of future cash flows, providing insights into investment opportunities. Together, these financial metrics enable strategic planning for paint coating companies, offering a comprehensive analysis of market trends, cost structures, and growth potential within the coatings industry.

Cap Table

The capitalization table serves as a vital tool for businesses, offering insights into shareholder ownership dilution. It provides comprehensive data on funding rounds, which can be analyzed individually or collectively for accurate financial forecasting. In the context of the paint coating market, understanding capitalization is essential for navigating market segmentation and competitive landscape dynamics. As companies explore revenue streams and strategic planning in coatings, effective use of this cap table can enhance investment analysis and financial metrics, ultimately fostering sustainable growth in a rapidly evolving industry.

KEY FEATURES

Understanding the paint coating market analysis enhances strategic planning, boosting profit margins and optimizing revenue streams for companies.

Our paint coating financial model offers reliable projections and resources, empowering businesses to navigate the competitive landscape confidently.

A robust financial model enhances investment analysis for paint coatings, driving strategic planning and optimizing profit margins in the competitive landscape.

A sophisticated three-statement financial model for paint coatings delivers quick insights, ensuring informed strategic planning and investment decisions.

A robust financial model in the paint coating market ensures strategic decision-making, minimizes risks, and enhances profit margins.

A robust cash flow forecasting model empowers businesses to navigate market fluctuations and optimize financial stability in paint coatings.

A robust financial model for the paint coating market enhances revenue forecasting and identifies customer payment issues efficiently.

A robust financial model enhances cash flow projections, enabling companies to swiftly address unpaid invoices and improve revenue streams.

A robust financial model in the paint coating market reveals lucrative growth avenues and enhances investor confidence through informed decision-making.

Utilize a robust financial model to impress investors, streamline negotiations, and accelerate funding for your paint coating innovations.

ADVANTAGES

The financial model empowers paint coating companies to optimize investment analysis, enhancing strategic planning and maximizing profit margins.

A robust financial projection model empowers paint coating companies to effectively navigate market trends and optimize their investment strategies.

Utilizing a robust financial model allows effortless forecasting of cash levels through accurate paint coating profit and loss projections.

A robust financial model empowers coating companies to navigate market trends and optimize revenue streams effectively.

The financial model enhances strategic planning in the paint coating market by forecasting demand and optimizing revenue streams.