Remittance Services Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Remittance Services Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

remittance services Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

REMITTANCE SERVICES FINANCIAL MODEL FOR STARTUP INFO

Highlights

Unlock your potential with a comprehensive five-year remittance financial analysis template designed specifically for startups and entrepreneurs in the remittance market. This tool provides key insights into remittance market trends, operational efficiency in remittance, and customer acquisition for remittance services, enabling you to craft an effective remittance business strategy. With integrated financial forecasting for remittances, you can evaluate your startup costs, understand remittance pricing structures, and optimize cash flow management in remittance. Impress investors with detailed metrics and funding forecasts while ensuring regulatory compliance in remittances and managing risk effectively. Explore innovative digital remittance solutions, analyze remittance transaction fees, and leverage remittance agent networks to enhance your competitive edge in the international money transfer services landscape.

The remittance services business plan template in Excel addresses key pain points faced by providers in the remittance sector, offering a comprehensive framework for financial forecasting that enhances operational efficiency in remittance transactions. By utilizing this model, users can conduct detailed remittance financial analysis to identify market trends and customer segmentation strategies, ultimately leading to better customer acquisition for remittance services. It provides insights into the remittance pricing structure and transaction fees, facilitating effective cash flow management and risk management in remittances. Furthermore, the template supports regulatory compliance in remittances, equipping businesses to navigate complex requirements while prioritizing service innovations that can drive profitability. With built-in features to track the performance of remittance agent networks and analyze cross-border payments models, users can effectively strategize their remittance business, ensuring sustainable growth and enhanced service offerings over the next five years.

Description

The remittance services business plan financial projections template we have developed is designed to facilitate informed decisions by providing comprehensive remittance financial analysis through input tables and charts that reflect key metrics in the remittance pricing structure and profit margins. This template encompasses various essential sheets, including a 60-month forecasted profit and loss statement, projected balance sheet, and cash flow management components, all critical for effective financial forecasting for remittances. By focusing on operational efficiency in remittance and risk management in remittances, users can enhance their remittance business strategy and drive customer acquisition for remittance services while ensuring regulatory compliance. Additionally, insights into remittance market trends and remittance transaction fees help identify opportunities for digital remittance solutions and innovations in remittance channels and platforms, ultimately contributing to the overall remittance service profitability and effective remittance customer segmentation.

REMITTANCE SERVICES FINANCIAL MODEL REPORTS

All in One Place

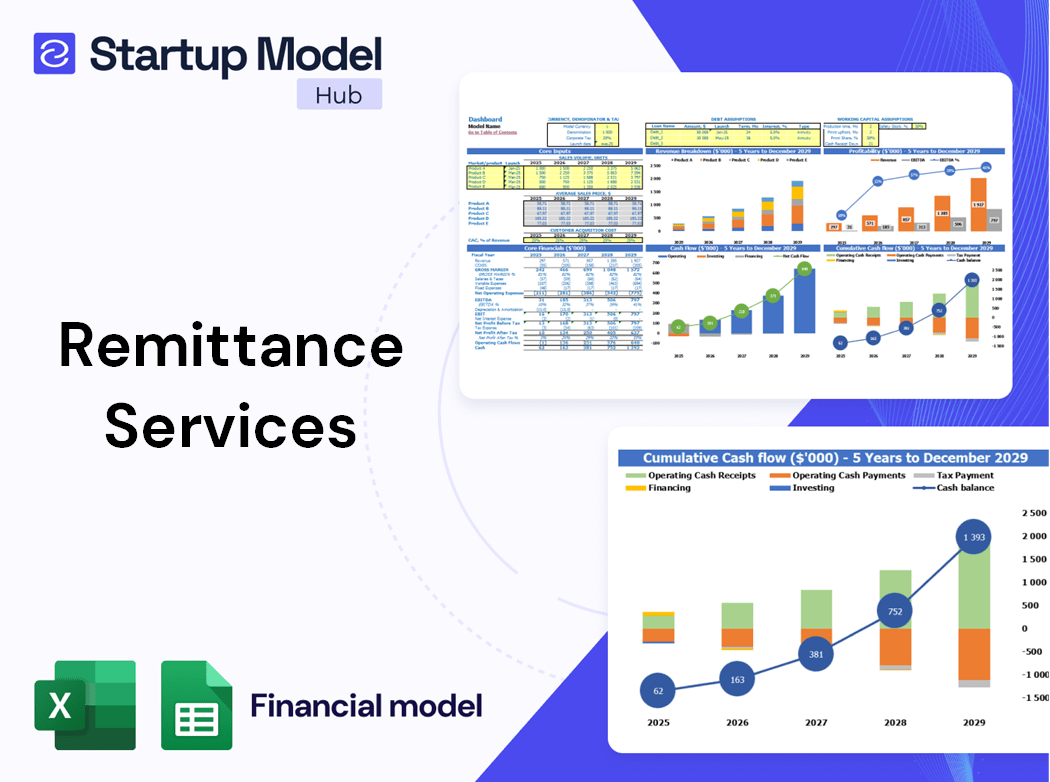

Develop a professional financial model that empowers your remittance service strategy, offering insights into operational efficiency and profitability. Our platform automates critical calculations for financial forecasting, including projected profit and loss statements, balance sheets, and cash flow forecasts. Gain real-time visibility into essential KPIs through a dynamic dashboard that adjusts with your 3-year projections. This comprehensive approach ensures your remittance business can navigate market trends, optimize pricing structures, and enhance customer acquisition while ensuring regulatory compliance and effective risk management in cross-border payments. Drive your innovations and improve cash flow management with confidence.

Dashboard

Our financial model template for remittance service providers features an all-in-one dashboard that enhances operational efficiency. It includes a cash flow proforma, projected balance sheet, and detailed cash flow analysis, allowing for monthly or annual breakdowns. Users can seamlessly access critical insights, including key metrics on remittance transaction fees, customer acquisition strategies, and market trends. This tool supports effective financial forecasting for remittances, enabling businesses to optimize their remittance pricing structure and ensure regulatory compliance. With a focus on profitability and innovative remittance solutions, this template is essential for success in the competitive remittance landscape.

Business Financial Statements

Creating a financial model for your remittance service is crucial for operational efficiency and profitability. It should effectively incorporate key components, such as remittance transaction fees, customer acquisition strategies, and risk management in remittances. An intuitive design allows for seamless collaboration, ensuring all stakeholders can navigate the model easily. By integrating elements like remittance pricing structures and financial forecasting for remittances, you can better analyze market trends and enhance service innovations. Ultimately, this approach will strengthen your cross-border payments model and bolster your strategic position in the competitive remittance landscape.

Sources And Uses Statement

The sources and uses statement in a remittance financial model is essential for summarizing capital origin (Sources) and allocation (Uses). This structured approach ensures that total amounts are balanced, reflecting financial integrity. It plays a pivotal role during recapitalization, restructuring, or mergers and acquisitions (M&A) in the remittance sector. Understanding capital flows aids remittance service providers in evaluating their remittance pricing structure, enhancing operational efficiency, and informing risk management strategies. As the remittance market evolves, adherence to regulatory compliance and innovative digital remittance solutions become increasingly crucial for profitability and customer acquisition.

Break Even Point In Sales Dollars

Our financial projections spreadsheet includes a proforma to determine the break-even point, crucial for remittance service providers. By analyzing unit sales, companies can set a pricing structure that ensures profitability while covering operational costs. This strategic approach enhances financial forecasting for remittances and supports customer acquisition efforts. Understanding the break-even analysis empowers remittance businesses to refine their service offerings, optimize revenue through effective transaction fees, and innovate within their remittance channels. Ultimately, this strengthens risk management while navigating evolving remittance market trends and ensuring regulatory compliance.

Top Revenue

In the dynamic landscape of remittance service providers, the top line—representing revenues—plays a crucial role in financial forecasting for remittances. Investors closely analyze this metric, as top-line growth indicates a rise in international money transfers, directly influencing profitability and operational efficiency. An increase in gross sales not only enhances cash flow management but also reflects effective customer acquisition strategies. Staying attuned to remittance market trends and regulatory compliance is vital for success, as these factors can drive innovations in digital remittance solutions and optimize remittance transaction fees, ensuring sustainable growth in this competitive sector.

Business Top Expenses Spreadsheet

To enhance profitability, remittance service providers must focus on optimizing their largest expenses. Our five-year cash flow projection template includes a comprehensive spending report, highlighting the four major expense categories while categorizing others as 'miscellaneous.' This tool enables users to effectively track cost trends annually. For both startups and established firms, diligent financial forecasting for remittances is essential. By analyzing expenditures and adopting innovative remittance business strategies, companies can improve operational efficiency and ensure regulatory compliance, ultimately driving customer acquisition and increasing profitability in the competitive cross-border payments landscape.

REMITTANCE SERVICES FINANCIAL PROJECTION EXPENSES

Costs

Effective financial forecasting is crucial for remittance service providers, enabling detailed projections of expenses and budgets over the next five years. Utilizing a comprehensive remittance financial analysis approach, businesses can monitor cost fluctuations by examining key parameters such as income percentages, payroll, and recurring expenses. By categorizing costs as Variable, Fixed, COGS, Wages, or CAPEX, companies can enhance operational efficiency and optimize their remittance business strategy. This strategic tool aids in cash flow management, aligning with remittance market trends and improving profitability through informed decision-making and risk management in remittances.

CAPEX Spending

Capital expenditure (CAPEX) is crucial for enhancing operational efficiency in remittance service providers. It reflects investments in fixed assets, vital for developing a robust remittance business strategy. Comprehensive financial analysis ensures effective cash flow management and supports financial forecasting for remittances. CAPEX impacts profitability and must align with remittance pricing structures and transaction fees. Properly planned expenses facilitate customer acquisition and compliance with regulations while revealing market trends. Ultimately, a well-structured CAPEX plan is integral to optimizing remittance channels, driving service innovations, and sustaining long-term growth in international money transfer services.

Loan Financing Calculator

Start-ups and growing companies often require capital to scale operations, making remittance service providers crucial for their financial strategies. By leveraging digital remittance solutions, firms can enhance operational efficiency and optimize cash flow management. Incorporating a robust remittance financial analysis into their business model, including transaction fees and customer segmentation, enables firms to forecast financial performance accurately. Compliance with regulatory standards and effective risk management in remittances ensures profitability. Ultimately, understanding remittance market trends helps businesses innovate and adapt their remittance channels for improved customer acquisition and engagement.

REMITTANCE SERVICES EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Key performance indicators (KPIs) are essential for business owners and investors to grasp the success factors of remittance service providers. Utilizing a projected cash flow statement template in Excel enables users to monitor financial performance and evaluate operational efficiency in remittance pricing structures. This model aids in assessing cost management and developing a robust remittance business strategy. Additionally, it helps maintain focus on established targets, ensuring effective risk management in remittances and optimizing customer acquisition channels for international money transfer services. Embrace innovation in remittance solutions to enhance service profitability and meet evolving market trends.

Cash Flow Forecast Excel

Effective cash flow management is vital for remittance service providers, enabling them to forecast profitability and manage cash streams efficiently. Financial forecasting for remittances helps ensure sufficient liquidity to meet obligations, crucial for securing loans. Emphasizing operational efficiency and regulatory compliance, a robust remittance business strategy can enhance customer acquisition and build stronger remittance agent networks. By analyzing remittance market trends and transaction fees, businesses can innovate their offerings and improve their pricing structure, ultimately increasing profitability in the competitive landscape of international money transfer services.

KPI Benchmarks

This pro forma template includes a dedicated tab for conducting financial benchmarking studies focused on remittance service providers. By analyzing key financial indicators alongside industry peers, businesses can gain insights into their remittance pricing structure, operational efficiency, and profitability. This comparative analysis helps firms identify market trends, enhance their remittance business strategy, and improve customer acquisition efforts. Ultimately, it fosters effective financial forecasting for remittances, ensuring regulatory compliance and robust risk management in cross-border payments, while optimizing cash flow management and driving innovations in digital remittance solutions.

P&L Statement Excel

Our financial projections template provides a comprehensive profit and loss analysis, enabling remittance service providers to effectively summarize income and expenses. Tailored for the remittance industry, it supports monthly or annual forecasting, enhancing operational efficiency and cash flow management. By integrating insights on remittance pricing structures and transaction fees, users can refine their business strategy while ensuring regulatory compliance. Leverage this tool to identify market trends, optimize customer acquisition, and bolster profitability in your remittance business. Embrace innovative digital remittance solutions to stay competitive within evolving cross-border payments models.

Pro Forma Balance Sheet Template Excel

Effective financial forecasting for remittances is crucial for startups focusing on international money transfer services. A well-structured balance sheet integrated with cash flow management allows for a comprehensive remittance financial analysis. It aids in assessing profitability ratios, such as return on equity and return on invested capital, which are critical for attracting investors. This proactive approach enhances operational efficiency in remittances and supports informed remittance business strategies. By understanding remittance market trends and customer segmentation, businesses can optimize their remittance pricing structure and innovate digital remittance solutions to improve customer acquisition and foster regulatory compliance.

REMITTANCE SERVICES FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our startup pro forma template offers a comprehensive remittance financial analysis, detailing projected investment value through a thorough review of revenues, costs, and cash flow timing. By understanding remittance market trends and the remittance pricing structure, we can enhance operational efficiency and improve customer acquisition for remittance services. This strategic approach supports effective financial forecasting for remittances, ensuring robust risk management in remittances while maximizing service profitability. Ultimately, our template aids in developing a solid remittance business strategy aligned with regulatory compliance and innovation in digital remittance solutions.

Cap Table

For startups, a cap table is essential for managing investor data, calculating ownership shares, and tracking investments. This financial tool is crucial for effective cash flow management, ensuring that the remittance service providers can optimize their business strategy. By understanding the intricacies of their financial forecasting, including remittance transaction fees and pricing structures, startups can enhance operational efficiency. Additionally, a thorough analysis of customer acquisition strategies and compliance with regulatory requirements can drive innovations in digital remittance solutions and improve profitability in the competitive remittance landscape.

KEY FEATURES

Implementing effective remittance financial analysis enhances operational efficiency, ensuring greater profitability and value for customers in cross-border payments.

Utilize our proven financial model for remittance services to enhance profitability and operational efficiency without hidden costs.

A robust cross-border payments model enhances operational efficiency, driving customer acquisition and profitability for remittance service providers.

Effective financial forecasting for remittances enhances operational efficiency and strategic planning, driving growth and profitability in cross-border payments.

Effective financial forecasting for remittances identifies cash gaps and surpluses, enhancing operational efficiency and profitability for providers.

Effective financial forecasting for remittances enables timely decision-making, helping businesses manage cash flow and seize growth opportunities.

Our all-in-one dashboard enhances operational efficiency and profitability for remittance service providers through insightful financial analysis and market trends.

A comprehensive financial model enhances operational efficiency, drives profitability, and ensures regulatory compliance for remittance service providers.

Effective financial forecasting for remittances enhances operational efficiency, ensuring compliance and profitability for international money transfer services.

A robust financial model enhances remittance service profitability, ensuring effective cash flow management and regulatory compliance for sustainable growth.

ADVANTAGES

A robust financial model enhances remittance service profitability by optimizing pricing structures and improving operational efficiency across various channels.

Implementing a robust remittance financial analysis model enhances operational efficiency and profitability while ensuring regulatory compliance in cross-border payments.

Leverage a robust remittance financial model to enhance risk management and optimize profitability in your international money transfer services.

Evaluate your remittance business strategy with a bottom-up financial model to enhance profitability and optimize operational efficiency.

The financial model startup enables remittance service providers to effectively analyze expenses and income, enhancing operational efficiency and profitability.