Robotic Process Automation Provider Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Robotic Process Automation Provider Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

robotic process automation provider Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

ROBOTIC PROCESS AUTOMATION PROVIDER FINANCIAL MODEL FOR STARTUP INFO

Highlights

Utilize our five-year financial model template in Excel specifically designed for robotic process automation services. This comprehensive tool includes prebuilt financial statements, such as pro forma profit and loss, balance sheets, and monthly cash flow statements, tailored for assessing RPA implementation costs and operational efficiencies. With essential financial charts, summaries, and automation investment analysis metrics, our template supports effective financial forecasting for automation. It enables a thorough cost-benefit analysis of RPA to highlight long-term savings and competitive advantages, assisting in vendor selection for RPA and guiding your business case for RPA investments. Leverage this resource before acquiring an RPA service provider to secure funding from banks or investors, and experience customizable RPA solutions with robust scalability options. All components are unlocked for easy editing to fit your specific needs.

The ready-made financial model in the Excel template addresses critical pain points for buyers by streamlining decision-making through a comprehensive cost-benefit analysis of robotic process automation (RPA) investments. It clarifies implementation costs and operational expenses associated with various RPA service providers, allowing for effective vendor selection and comparison. By providing a clear framework for RPA ROI calculation, users can evaluate automation efficiency metrics alongside automation software pricing, enhancing financial forecasting for automation. Furthermore, the template aids in understanding the scalability of RPA solutions and long-term savings, equipping stakeholders to build a strong business case for RPA while simplifying the analysis of RPA licensing costs and subscription models, ultimately facilitating informed outsourcing decisions for custom RPA solutions.

Description

The financial model for robotic process automation (RPA) services offers a comprehensive framework aimed at startups, enabling detailed financial planning and projection over a five-year period. It encompasses projected income statements, balance sheets, and cash flow projections, allowing users to perform a cost-benefit analysis of RPA and assess automation investment viability. By integrating automation efficiency metrics and RPA ROI calculations, this model streamlines decision-making while addressing operational risk factors. Additionally, the dynamic nature of the model supports vendor selection and price evaluation, including RPA licensing costs and subscription models, ultimately providing insights into long-term savings and competitive advantages gained through custom RPA solutions and outsourcing. This essential tool empowers robotic process automation providers to effectively manage financial forecasting and enhance business case development for RPA initiatives.

ROBOTIC PROCESS AUTOMATION PROVIDER FINANCIAL MODEL REPORTS

All in One Place

Unlock the potential of your business with our exceptional robotic process automation (RPA) income statement template. This user-friendly, expandable 5-year projection model aligns with your financial expertise, enabling you to refine automation strategies and analyze RPA operational costs. Harness powerful automation efficiency metrics and conduct comprehensive cost-benefit analyses to forecast long-term savings and ROI. Whether you're evaluating vendor selection or exploring custom RPA solutions, our template serves as your roadmap to achieving a competitive advantage in automation. Empower your financial forecasting today and watch your business thrive.

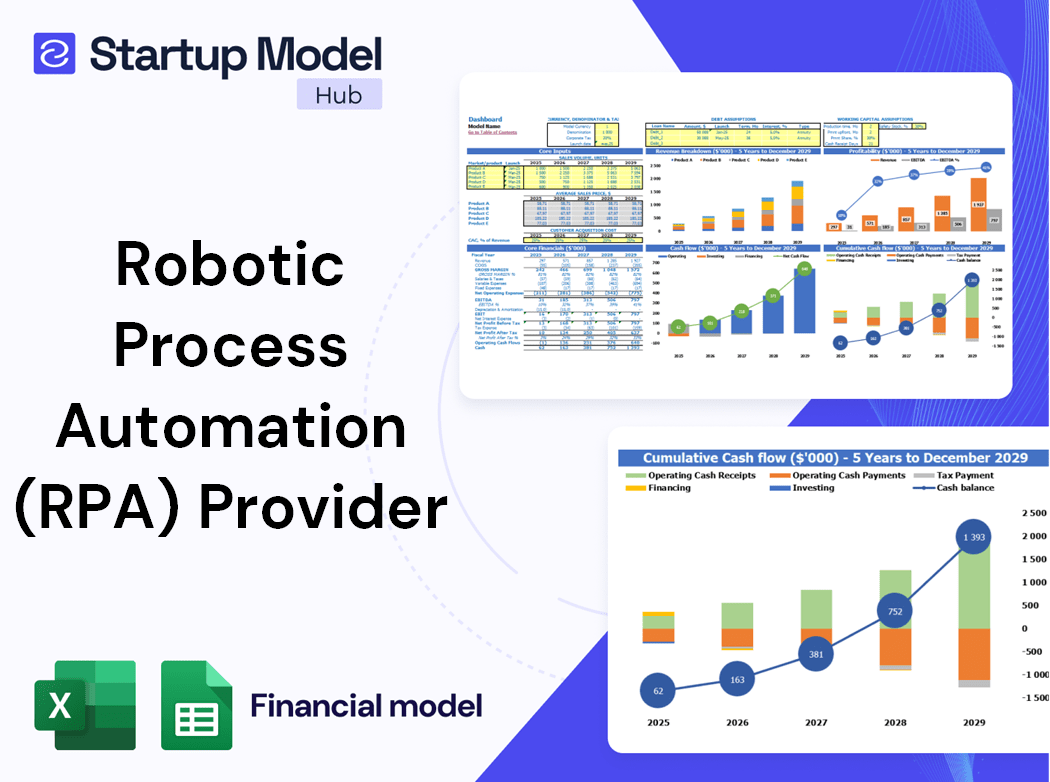

Dashboard

This Excel-based financial model template offers a dedicated panel that highlights vital financial indicators over set periods. It provides detailed revenue breakdowns, cash flow forecasting tools, and robust financial projections. This analytical framework is essential for assessing overall financial flows and is integral to optimizing your company's financial potential. By leveraging this model, businesses can enhance their RPA investment analysis, gauge operational costs, and create a compelling business case for RPA. Ultimately, it serves as a cornerstone for strategic planning and financial forecasting for automation initiatives.

Business Financial Statements

Our robust three-statement financial model Excel template empowers entrepreneurs to craft vital financial statements, projections, and analyses. It facilitates the creation of compelling presentations featuring dynamic financial charts, effectively communicating key findings to stakeholders. These visual aids not only summarize complex data but also enhance discussions with potential investors, providing clarity on the business case for RPA and its long-term savings. By incorporating RPA financial model strategies, users can leverage automation efficiency metrics for informed decision-making, paving the way for scalable RPA solutions and a competitive advantage in their industry.

Sources And Uses Statement

The sources and uses template is a crucial element of the three-statement financial model, providing insight into funding sources and cash distribution. For businesses considering robotic process automation (RPA) services, integrating this template aids in evaluating costs, such as RPA licensing and implementation expenses, against potential long-term savings and ROI. By conducting a thorough cost-benefit analysis and exploring various RPA subscription models, companies can make informed decisions about outsourcing RPA solutions and selecting the right vendor. This strategic approach enhances automation efficiency, ensuring a competitive advantage in the market.

Break Even Point In Sales Dollars

This financial model features a break-even point analysis, crucial for identifying when your company’s revenue surpasses total costs, marking the beginning of profitability. Understanding the interplay between revenue, fixed, and variable costs is essential for success. Utilizing a Cost-Volume-Profit (CVP) graph empowers management to determine optimal sales levels and pricing strategies to cover operational costs. Additionally, it aids in forecasting financial outcomes and enhances your business case for RPA, ensuring informed decisions that lead to long-term savings and a competitive advantage.

Top Revenue

The Top Revenue tab in the financial projection template provides a comprehensive overview of your offerings' financial metrics. Utilizing this tool, you can analyze annual revenue streams, highlighting key aspects like revenue depth and revenue bridge. This data is essential for crafting a robust business case for RPA, enabling you to conduct a thorough cost-benefit analysis. As you evaluate options, focus on automation software pricing, licensing costs, and the long-term savings associated with custom RPA solutions. Leverage these insights for strategic vendor selection and to maximize the scalability and efficiency of your robotic process automation services.

Business Top Expenses Spreadsheet

For fast-growing or startup companies, effective expense management is crucial to avoid potential losses. Our comprehensive pro forma template categorizes expenses into four key areas, enhancing specificity and convenience. Costs not fitting these categories can be allocated to an 'other' section, allowing flexibility. By closely monitoring these expenses—particularly those tied to robotic process automation (RPA)—businesses can conduct a thorough cost-benefit analysis, ensuring a strong business case for RPA adoption. This strategic oversight paves the way for long-term savings and a competitive advantage in the market.

ROBOTIC PROCESS AUTOMATION PROVIDER FINANCIAL PROJECTION EXPENSES

Costs

Maximize your financial assessment with our advanced three-way financial model, designed to illuminate your organization's potential with exceptional clarity. This tool is essential for strategic planning, securing creditor approvals, and presenting results to investors. By integrating cost-benefit analysis for RPA and examining automation investment analysis, you can make informed decisions about outsourcing RPA solutions, scalability of RPA, and RPA licensing costs. Equip yourself with the insights to demonstrate the long-term savings and competitive advantages that robotic process automation services can bring to your business. Achieve your objectives with confidence using our sophisticated financial model.

CAPEX Spending

Capital expenditure (CAPEX) is a vital component of any financial model for startups. Financial experts meticulously evaluate CAPEX to track investments in fixed assets, addressing aspects like depreciation, acquisitions, and disposals of property, plant, and equipment (PPE). Additionally, the CAPEX budget encompasses enhancements to company assets, including those under financial leasing. By strategically managing CAPEX, organizations can enhance their automation investment analysis, ensuring optimal resource allocation and long-term savings, while positioning themselves for competitive advantages through effective robotic process automation (RPA) integration.

Loan Financing Calculator

Loan repayment schedules are critical for startups and growing businesses. They detail essential information, including principal amounts, terms, maturity periods, and interest rates. As loan repayments directly affect cash flow, they play a crucial role in cash flow analysis and financial forecasting for automation. These repayments not only influence cash flow projections but also appear in the balance sheet and monthly cash flow statements. Monitoring them ensures a business remains financially agile, supporting long-term financial health and operational efficiency. Understanding these metrics forms a solid foundation for effective financial management.

ROBOTIC PROCESS AUTOMATION PROVIDER EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Revenue growth, gross margin, and EBITDA margin are essential KPIs for assessing profitability and sales in your three-year financial projection. This template also tracks vital metrics like cash burn rate, runway, and capital requirements to monitor cash flow and investment needs. For SaaS businesses, key performance indicators include customer lifetime value (LTV), customer acquisition costs (CAC), LTV/CAC ratio, and churn rate. Focusing on these metrics will enhance your automation investment analysis, demonstrating the business case for RPA and showcasing long-term savings and competitive advantages in your organization.

Cash Flow Forecast Excel

A projected cash flow statement is essential for effective financial forecasting in any business start-up. It reveals spending and income patterns, enabling owners to refine their monetary strategies. By analyzing this data, you can enhance automation efficiency metrics, leading to improved capital turnover and increased revenue. Utilizing a cash flow forecast template in Excel can optimize operations and contribute to a strong business case for RPA. This approach not only aids in identifying long-term savings but also enhances your competitive advantage through informed decision-making and strategic investments in automation solutions.

KPI Benchmarks

Our financial projection template features a benchmarking module, allowing clients to assess their operational efficiency against industry standards and successful peers. By leveraging this tool, businesses can identify areas for improvement to achieve optimal results. Incorporating RPA financial model strategies, this template also facilitates cost-benefit analysis and RPA ROI calculation, supporting informed decision-making. Whether evaluating automation investment analysis or exploring custom RPA solutions, our template empowers firms to refine their approach and gain a competitive advantage in their sector.

P&L Statement Excel

This user-friendly financial model Excel spreadsheet is ideal for both novices and seasoned professionals in robotic process automation (RPA). It offers a comprehensive pro forma profit and loss forecast, delivering crucial insights into income and expenses. This detailed analysis is essential for creating a robust financial strategy, enabling businesses to evaluate automation investment, assess RPA operational costs, and project long-term savings. By utilizing this model, organizations can enhance their RPA ROI calculation and strengthen their business case for RPA, ultimately gaining a competitive advantage through improved automation efficiency metrics.

Pro Forma Balance Sheet Template Excel

The financial plan template integrates monthly and annual pro forma balances with cash flow and profit and loss projections. This cohesive setup allows users to achieve a comprehensive overview of assets, liabilities, and equity, ensuring alignment across all financial statements. Leveraging this template can facilitate cost-benefit analysis for robotic process automation (RPA), aiding in vendor selection and providing insights into RPA operational costs, licensing, and potential ROI. Ultimately, it supports informed decision-making for automation investment, contributing to long-term savings and a competitive advantage in your business strategy.

ROBOTIC PROCESS AUTOMATION PROVIDER FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our startup costs template employs two integrated valuation methodologies: discounted cash flow (DCF) and weighted average cost of capital (WACC). These approaches not only enhance financial forecasting for automation but also effectively illustrate the expected financial performance of your RPA initiatives. By leveraging robust automation investment analysis, businesses can make informed decisions regarding vendor selection for RPA, evaluate implementation costs, and assess potential long-term savings. Embracing automation software pricing models that align with RPA operational costs allows for a comprehensive understanding of overall scalability and return on investment, providing a competitive advantage in the market.

Cap Table

The cap table startup serves as a robust tool for analyzing four rounds of financing, enabling businesses to visualize and assess the impact of investors' shares on overall earnings. This comprehensive calculator updates data after each funding round, showcasing the dynamic changes in equity distribution. By integrating automation software for financial forecasting, companies can enhance decision-making while conducting cost-benefit analyses of RPA. With scalability and custom RPA solutions, organizations can achieve long-term savings and a competitive advantage in their financial modeling strategies.

KEY FEATURES

A well-structured RPA financial model enables startups to project long-term savings and assess ROI with confidence.

The financial model delivers a concise summary to effectively highlight long-term savings with RPA in your pitch deck.

Implementing RPA financial model strategies enhances cost-benefit analysis and forecasts long-term savings, ensuring a competitive advantage for businesses.

A robust financial model for RPA enables informed decisions, highlighting the potential for long-term savings and enhanced automation efficiency.

Implementing RPA financial model strategies enables businesses to optimize automation investment analysis, ensuring long-term savings and competitive advantage.

Utilizing a financial model for RPA enables accurate adjustments, enhancing forecasting and maximizing long-term savings with automation solutions.

Effective RPA financial model strategies reveal long-term savings and competitive advantages, making a compelling business case for automation investments.

Utilizing the RPA financial model strategies will enhance your business case for automation, attracting potential investors effortlessly.

Leverage our RPA financial model strategies to maximize automation efficiency and achieve long-term savings with tailored RPA solutions.

The RPA financial model strategies ensure precise forecasting and analysis, maximizing long-term savings and competitive advantage for businesses.

ADVANTAGES

Optimize your cash flow with strategic RPA financial model strategies to maximize long-term savings and efficiency.

Leverage RPA financial model strategies to enhance cost-benefit analysis for automation, ensuring long-term savings and competitive advantage.

Utilizing a robust financial model for robotic process automation ensures long-term savings and maximizes your competitive advantage in automation.

The RPA financial model strategies ensure clarity on investment returns and long-term savings with robotic process automation services.

The RPA financial model strategies provide insightful comparisons of costs and long-term savings, enhancing automation investment analysis.