Security Firm Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Security Firm Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

security firm Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

SECURITY FIRM FINANCIAL MODEL FOR STARTUP INFO

Highlights

In the rapidly evolving landscape of security consulting services, developing a robust financial model is crucial for navigating financial risks and optimizing operational costs in security services. By conducting market analysis for security firms, businesses can refine their pricing strategies and improve customer acquisition costs, ultimately enhancing profit margins in security consulting. A comprehensive understanding of the cost structure of security service providers and cash flow management for security companies is essential for long-term sustainability and growth. Moreover, effective investment strategies and valuation methods for security firms can bolster business development, enabling firms to capitalize on the scalability of security firm revenue while ensuring prudent financial projections for security firms in a competitive industry.

The security firm financial model template addresses common pain points faced by new business owners in the security consulting industry, such as the challenge of navigating operational costs and achieving sustainable growth without the need for costly financial services. It simplifies financial projections for security firms by integrating critical elements like customer acquisition costs, profit margins, and cash flow management directly into an intuitive Excel format. This allows users to efficiently analyze the cost structure of security service providers and quickly adjust inputs based on changing market conditions or strategic priorities, ensuring that key financial metrics remain aligned with business objectives. By leveraging this comprehensive template, users can confidently engage in contract negotiation and business development strategies backed by robust financial modeling tailored specifically for the security industry, ultimately reducing financial risks and enhancing scalability of revenue.

Description

The Security Firm Financial Plan For Business Plan is a comprehensive and adaptable tool that encompasses vital financial projections for security firms, facilitating informed decision-making through essential calculations and valuation charts. This financial model allows you to build a robust financial plan, assess initial capital investments, and determine working capital requirements for effective cash flow management in the security industry. It further simplifies the forecasting of monthly sales, expenses, and operational costs, offering a detailed 5-year financial projection that underscores profit margins and scalability of revenue. For start-up and established security firms alike, this template includes a built-in revenue forecast and expense budget while delivering accurate reporting through financial insights calculations. Additionally, the model incorporates a full suite of 60-month period financial reports, KPIs, and valuation metrics, making it a crucial resource for contract negotiation and business development strategies while ensuring sustainable growth in security consulting services.

SECURITY FIRM FINANCIAL MODEL REPORTS

All in One Place

The security firm business forecast template empowers managers and owners with essential financial projections, seamlessly integrating expense and revenue assumptions. This holistic approach supports strategic decision-making, enhancing operational costs analysis and cash flow management. By employing effective pricing strategies and understanding customer acquisition costs, firms can optimize profit margins and scalability. Additionally, the template facilitates a comprehensive market analysis, guiding investment strategies and ensuring sustainable growth in security consulting services. With robust financial modeling and valuation methods, businesses can navigate financial risks and enhance their revenue model for lasting success.

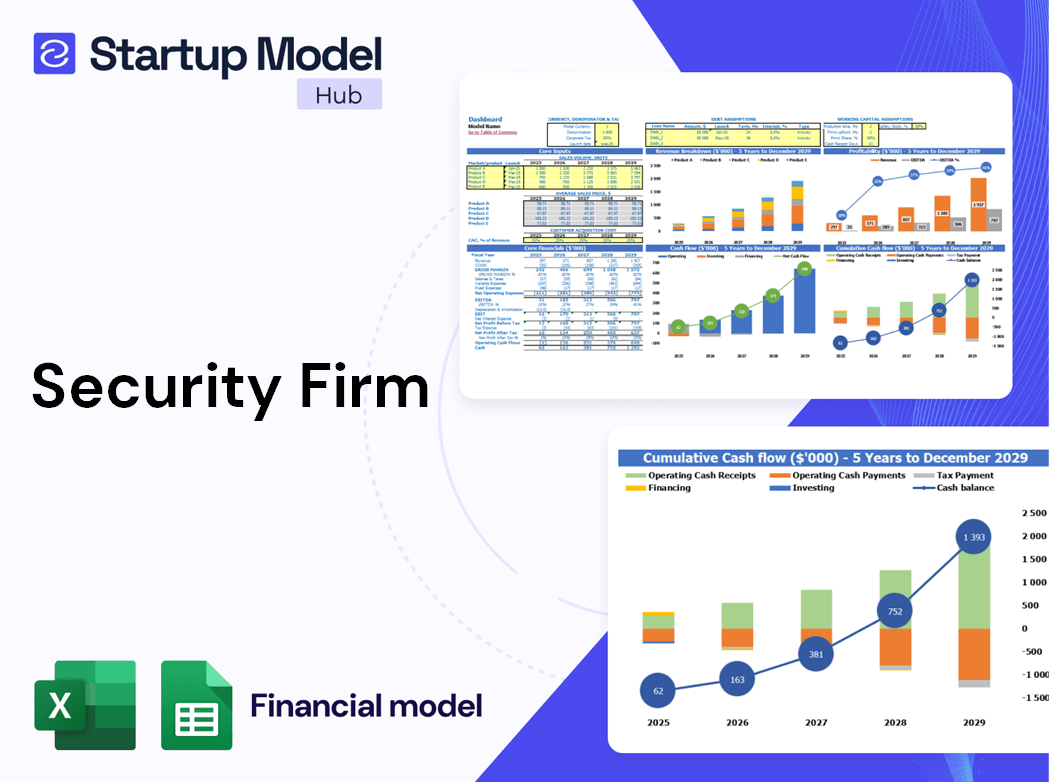

Dashboard

The Dashboard tab offers a dynamic overview of your financial landscape, featuring key financial metrics for security companies, illustrated through engaging graphs, ratios, and charts. This visual representation simplifies the analysis of operational costs in security services, profitability, and cash flow management for security firms. By leveraging these insights, you can develop effective pricing strategies and investment approaches, enhancing your security agency revenue model while ensuring sustainable growth in security consulting services.

Business Financial Statements

Our financial reporting templates in Excel streamline your analysis of security consulting services. The Income Statement details income and expenditures, incorporating cash and non-cash transactions like depreciation and taxes. The Balance Sheet offers a snapshot of assets, liabilities, and shareholders' equity, adhering to the fundamental equation: assets = liabilities + equity. Lastly, the Cash Flow Statement delineates cash inflows and outflows from operating, investing, and financing activities. These tools facilitate effective financial modeling, enabling security firms to optimize cash flow management, understand operational costs, and drive sustainable growth.

Sources And Uses Statement

In financial modeling for security firms, the Sources and Uses of Capital statement offers a clear overview of capital inflows (Sources) and expenditures (Uses). Ensuring that these amounts balance is essential, especially during pivotal events like recapitalization, restructuring, or mergers and acquisitions. This statement not only aids in cash flow management but also provides insights into operational costs in security services, supporting effective contract negotiation and strategic investment strategies. A well-structured Sources and Uses table is critical for maximizing profitability and fostering sustainable growth in security consulting.

Break Even Point In Sales Dollars

Breakeven analysis is crucial for security firms to assess when they will cover operational costs and achieve profitability. This involves identifying fixed costs, such as rent and salaries, which remain constant regardless of sales, and variable costs that fluctuate with sales volume, like inventory and shipping expenses. By understanding these cost structures, security agencies can effectively navigate financial risks and develop robust pricing strategies. This analysis not only aids in cash flow management but also informs investment strategies and supports sustainable growth in security consulting, ensuring strategic positioning in a competitive market.

Top Revenue

This financial projection model features a dedicated tab for a comprehensive analysis of your security firm's income streams. Users can leverage this template to evaluate revenue sources for each specific service or product, facilitating a deep market analysis for security firms. By understanding customer acquisition costs and operational costs in security services, you can optimize your security agency revenue model. This tool aids in crafting effective pricing strategies and enhances cash flow management, ultimately supporting sustainable growth in your security consulting business.

Business Top Expenses Spreadsheet

In our financial modeling for security agencies, we categorize operational costs into four main segments for clarity. This Profit and Loss Projection highlights essential expenditures, including annual customer acquisition costs and employee salaries. By analyzing these key financial metrics, security firms can better understand their cost structure and improve cash flow management. This comprehensive approach supports sustainable growth in security consulting, allowing for strategic investment and contract negotiation to enhance profitability and scalability. Ultimately, effective budgeting guides security firms in making informed decisions for long-term success.

SECURITY FIRM FINANCIAL PROJECTION EXPENSES

Costs

Our Financial Plan Excel is designed specifically for security firms, offering insights into operational costs and cash flow management. By providing a clear view of your cost structure and enabling effective expense monitoring, you can preemptively address financial risks and shortfalls. This tool not only aligns with your business development strategies but also aids in preparing impactful presentations for investors. Leverage this financial modeling resource to enhance scalability, improve profit margins, and drive sustainable growth in your security consulting services. Make informed decisions that position your firm for success in a competitive market.

CAPEX Spending

To achieve sustainable growth in security consulting, companies must consistently invest in their development through capital expenditure forecasts. These investments enhance operational efficiency and expand service offerings, driving revenue scalability. CAPEX is reflected in the projected balance sheet as depreciated assets over several years, underscoring its importance in financial modeling for security firms. By prioritizing these expenditures, security agencies can optimize their cost structures and improve profitability, ensuring robust cash flow management and competitive positioning in the market. This strategic approach not only enhances performance but also mitigates financial risks associated with the security industry.

Loan Financing Calculator

Our financial plan template features a comprehensive loan amortization schedule, designed to streamline cash flow management for security firms. Located in the 'Capital' tab, this template includes proformas with pre-built formulas for precise financial modeling. Users can effortlessly track loans, interest, and equity, enabling informed decision-making that supports sustainable growth in security consulting. With a focus on optimizing operational costs and enhancing profit margins, this tool is essential for effective budgeting and strategic financial planning in the competitive security industry.

SECURITY FIRM EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Revenue growth rate, gross margin, and EBITDA margin are crucial key financial metrics for security firms to assess sales and profitability. Effective cash flow management in security consulting involves tracking cash burn rate, runway, and capital requirements. Selecting relevant KPIs, such as customer acquisition costs (CAC) and customer lifetime value (LTV), can enhance business development. Security agencies should focus on optimizing customer retention and understanding the LTV/CAC ratio to drive sustainable growth. By implementing strategic financial modeling and valuation methods, security firms can better navigate industry financial risks and improve their overall operational efficiency.

Cash Flow Forecast Excel

Cash flow forecasting tools are essential for any security consulting firm, enabling you to strategically plan for enhanced performance and profitability. Effective cash flow projections are critical not only for sustainable growth but also for securing bank loans and attracting investors. They demonstrate your business's ability to meet financial obligations and manage risks. By incorporating these tools, security firms can better understand their operational costs, optimize pricing strategies, and enhance customer acquisition efforts, ultimately driving scalability and improving profit margins. Investing in robust financial modeling is crucial for the long-term success of any security agency.

KPI Benchmarks

Our five-year financial projection model for security consulting services includes a comprehensive benchmarking template, allowing clients to analyze key financial metrics against industry competitors. By evaluating operational costs, revenue models, and pricing strategies, firms can identify strengths and weaknesses. This enables informed decisions for sustainable growth and improved cash flow management. With insights into investment strategies and customer acquisition costs, security agencies can enhance profitability and scalability. Utilize our model to optimize your financial modeling and ensure your business development efforts align with industry standards for long-term success.

P&L Statement Excel

To maintain a clear view of your security firm’s financial health, developing a projected profit and loss statement is essential. This financial modeling approach allows you to assess net operating profit margins effectively. Using a tailored P&L Excel template, you can manage operational costs, track customer acquisition expenses, and analyze cash flow. This robust tool promotes sustainable growth by offering insights into your revenue model and enhancing decision-making in contract negotiations and business development. Stay proactive in monitoring key financial metrics to drive profitability and scalability in your security consulting services.

Pro Forma Balance Sheet Template Excel

The included five-year projected balance sheet within the Excel pro forma template is essential for security firms. It details current and long-term assets, liabilities, and equity, providing crucial insights into financial health. This comprehensive forecast enables professionals to effectively calculate key financial metrics, supporting strategic decision-making in areas such as cash flow management, operational costs, and investment strategies. By utilizing this balance sheet, security agencies can enhance their financial modeling, improve customer acquisition costs, and develop sustainable growth initiatives within the competitive landscape.

SECURITY FIRM FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our P&L template excels through two integrated valuation methodologies: discounted cash flow (DCF) and weighted average cost of capital (WACC). These tools provide robust financial projections for security firms, enabling precise cash flow management and insightful market analysis. By understanding the cost structure and operational costs in security services, companies can optimize pricing strategies and enhance profit margins. This approach not only ensures sustainable growth in security consulting but also aids in evaluating financial risks and developing effective investment strategies to boost agency revenue.

Cap Table

Our Excel financial model includes a comprehensive cap table template, essential for security consulting services. This spreadsheet effectively outlines your company’s ownership structure, detailing shares, options, and the investment costs associated with each stake. By providing clarity on ownership percentages, it aids in evaluating operational costs and supports robust financial projections for security firms. Understanding these key financial metrics is crucial for effective contract negotiation, sustainable growth, and optimizing your security agency's revenue model. Leverage this tool to fine-tune your investment strategies and enhance cash flow management in the security industry.

KEY FEATURES

A robust financial model enhances strategic decision-making, enabling security firms to optimize profit margins and manage operational costs effectively.

A financial planning model allows security firms to easily adjust projections for sustainable growth and enhanced cash flow management.

A robust financial model enhances decision-making for security firms, enabling sustainable growth through informed revenue and cost strategies over five years.

A robust financial model empowers security firms to optimize revenue, manage costs, and enhance decision-making for sustainable growth.

Effective financial modeling for security firms helps identify cash gaps and surpluses proactively, ensuring sustainable growth and stability.

Utilizing financial modeling for security agencies allows proactive cash flow management, ensuring strategic reinvestment and protection against potential deficits.

Leverage a robust financial model to enhance cash flow management and optimize profitability in your security consulting services.

Leverage our comprehensive financial model to optimize your security firm's revenue, enhance profitability, and ensure sustainable growth.

A robust financial model enhances profitability and guides strategic decisions for sustainable growth in security consulting services.

A robust financial model empowers security firms to focus on business development while optimizing operational costs and maximizing profit margins.

ADVANTAGES

A strong financial model enhances credibility, showcasing sustainable growth potential and informed decision-making in security consulting services.

Utilizing financial models in security consulting enhances sustainable growth by accurately predicting operational costs and maximizing profit margins.

Implementing a three-statement financial model enhances scalability, enabling security firms to optimize revenue and reduce operational costs effectively.

Implementing a robust financial model enhances cash flow management and boosts profitability for security firms, fostering sustainable growth and scalability.

Utilizing a startup pro forma template enables security firms to effectively project financial scenarios and enhance strategic growth decisions.