Senior Living Facility Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Senior Living Facility Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

senior living facility Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

SENIOR LIVING FACILITY FINANCIAL MODEL FOR STARTUP INFO

Highlights

A comprehensive five-year senior living financial analysis tailored for startups and entrepreneurs is essential to secure funding from banks and investors while impressing them with robust retirement home revenue projections. This model incorporates key metrics and financial sustainability strategies, focusing on the assisted living cost structure, senior housing financial planning, and long-term care facility profitability. By utilizing a senior living investment model that accounts for operational expenses and cash flow forecasts, this forecast template enables users to assess the impact of occupancy rates and demographic trends on revenue streams, ensuring a thorough profitability analysis of senior living facilities. Furthermore, it emphasizes the importance of understanding elderly care facility budgeting and the associated financial risks, ensuring a well-rounded approach to real estate senior housing investment.

The ready-made financial model template addresses crucial pain points for buyers by providing a comprehensive tool that simplifies senior living financial analysis, ensuring accurate retirement home revenue projections and assisted living cost structure assessments. Designed for users with minimal planning experience, it facilitates effective budgeting for elderly care facilities, offering insights into operational expenses and cash flow forecasts that are vital for long-term care facility profitability. The model incorporates demographic trends and aging population market trends, enabling users to analyze occupancy rate impacts and develop sound financial sustainability strategies for senior housing investments. Furthermore, it highlights potential revenue streams and financial risks in senior care facilities, empowering buyers to conduct profitability analysis and informed real estate investment decisions in the growing senior living market.

Description

The financial analysis for senior living facilities encompasses a comprehensive investment model that addresses key elements such as elderly care facility budgeting, retirement home revenue projections, and assisted living cost structures, ensuring a robust approach to senior housing financial planning. By incorporating cash flow forecasts and profitability analysis, the model evaluates long-term care facility profitability while analyzing the impact of occupancy rates on various revenue streams. It further highlights operational expenses and capital expenditures relevant to senior care facilities, addressing financial sustainability amidst demographic trends affecting aging services. This framework aims to mitigate financial risks associated with senior living investments and supports informed decision-making by providing essential financial metrics and insights into market trends concerning the aging population.

SENIOR LIVING FACILITY FINANCIAL MODEL REPORTS

All in One Place

To gain a comprehensive understanding of your senior living facility's financial health, it's crucial to align key financial statements: the projected income statement, pro forma balance sheet, and cash flow forecast. This integrated senior living investment model empowers you to navigate financial sustainability effectively. By utilizing an accurate senior housing financial planning approach, you can assess long-term care facility profitability, project retirement home revenue, and evaluate operational expenses. Our five-year financial projection template will reveal crucial insights, enabling you to adapt to demographic trends and optimize your revenue streams while managing financial risks.

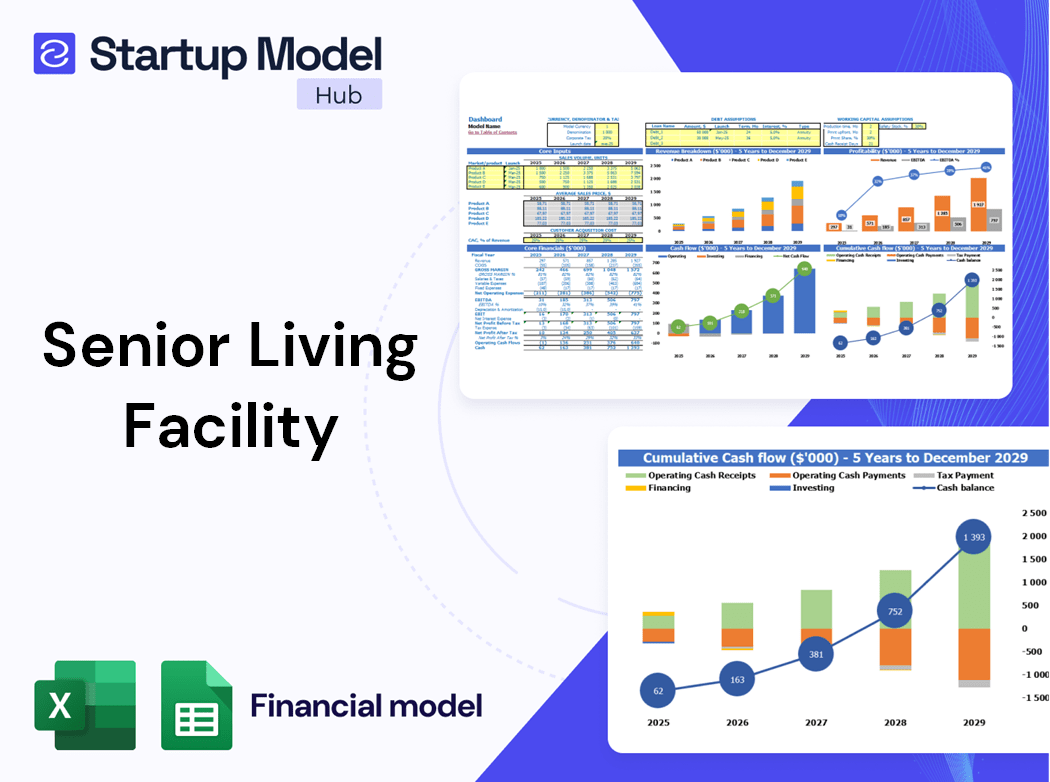

Dashboard

An Excel-based financial model serves as a powerful tool for senior living financial analysis, enabling precise cash flow forecasting and effective budgeting for elderly care facilities. It provides clients with essential financial statements—monthly or annually—tailored for retirement community revenue projections. The user-friendly dashboard presents data visually, enhancing understanding of senior housing operational expenses, occupancy rates, and revenue streams. This resource supports senior care facility financial planning, ensuring an insightful profitability analysis and mitigating financial risks associated with the aging population market trends. Capital expenditures and healthcare costs for seniors are managed efficiently, promoting long-term financial sustainability.

Business Financial Statements

Developing a robust financial analysis for senior living involves integrating key factors such as occupancy rates, revenue streams, and operational expenses. Utilize a flexible 5-year cash flow forecast to address the unique cost structures of assisted living and long-term care facilities. This comprehensive approach will empower stakeholders to understand retirement home revenue projections and capital expenditures, ensuring financial sustainability. By aligning with demographic trends and market demands, you can effectively mitigate financial risks and enhance profitability metrics, making your investment model appealing to investors and lenders in the aging services sector.

Sources And Uses Statement

The Sources and Uses of Funds statement is crucial for senior living financial analysis, offering a clear overview of how funds will be acquired and allocated. This template allows stakeholders to discern funding sources and operational expenses, ensuring that total sources align with uses. A balanced report indicates financial sustainability, while excess sources suggest potential expansion opportunities. Conversely, if uses exceed sources, it signals the need for additional equity. By accurately documenting funding and budgeting for elderly care facilities, operators can strategically plan for retirement community revenue projections and assess overall profitability in the aging population market.

Break Even Point In Sales Dollars

Integrating a break-even point calculation into your senior living financial analysis is essential for understanding the sales volume or units needed to cover all operational costs. This key metric not only assesses fixed and variable expenses but also informs your occupancy rate impact and revenue projections. A comprehensive break-even analysis is central to financial planning in the senior housing sector, enabling effective budgeting for assisted living facilities and ensuring long-term care profitability. By accurately assessing these financial parameters, you can optimize your revenue streams and mitigate financial risks associated with the aging population market trends.

Top Revenue

Discover a comprehensive annual breakdown of revenue streams with our profit and loss projection tool. The Top Revenue tab delivers insightful financial metrics for each service, while our financial plan Excel provides a detailed view of revenue depth and bridges. Perfect for senior living financial analysis, this tool empowers retirement home operators to make informed decisions on budgeting and capital expenditures. Enhance your understanding of occupancy rate impacts and operational expenses, ensuring long-term care facility profitability and financial sustainability in the evolving landscape of elderly care. Maximize your strategy with our tailored analysis for senior housing investment.

Business Top Expenses Spreadsheet

This five-year financial projection template features a dedicated "Top Expenses" tab, highlighting your organization's four primary expense categories, with all remaining costs categorized as "Other." This streamlined approach allows for effective senior living financial analysis, facilitating strategic decision-making around budgeting, operational expenses, and capital expenditures. By incorporating retirement home revenue projections and cash flow forecasts, you can assess long-term care facility profitability and mitigate financial risks. Leverage this tool to navigate the evolving demographic trends and ensure financial sustainability for your senior care facility in an increasingly competitive market.

SENIOR LIVING FACILITY FINANCIAL PROJECTION EXPENSES

Costs

Start-up costs are pivotal in senior living financial analysis, impacting long-term care facility profitability. Monitoring these expenses diligently is essential to mitigate financial risks and prevent underfunding. Our comprehensive Pro forma within the five-year cash flow forecast for senior care outlines critical funding and spending levels. Utilizing our business plan financial template allows for robust financial sustainability and precise budgeting tailored to the aging population market trends. This proactive approach ensures optimal operational expenses management and enhances revenue projections across various senior living investment models, leading to sustained growth and improved occupancy rates.

CAPEX Spending

Capital expenditures (CapEx) encompass a company's investments in acquiring and developing assets, critical for senior living financial analysis. These significant expenditures play a vital role in senior living operational expenses and are reflected in the projected balance sheet for elderly care facility budgeting. Rather than recognizing the entire investment in one period, these costs contribute to long-term profitability and financial sustainability of retirement communities. Effective senior living investment models and occupancy rate impacts are essential for accurate cash flow forecasts, ensuring robust retirement home revenue projections while addressing the financial risks posed by demographic trends in aging services.

Loan Financing Calculator

Start-ups and emerging companies must meticulously oversee their loan repayment schedules, detailing amounts, maturity terms, and other critical information. This schedule plays a vital role in senior living financial analysis, influencing cash flow forecasts and operational expenses. Interest expenses impact the overall financial health, feeding into the balance sheet, while principal repayments are integrated into financing activities. By understanding these dynamics, businesses can enhance their senior living investment model, ensuring financial sustainability and profitability in an aging population market. Effective budgeting and revenue projections are essential for navigating the complexities of the senior care facility landscape.

SENIOR LIVING FACILITY EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Earnings before interest, tax, depreciation, and amortization (EBITDA) serves as a crucial financial metric in senior living financial analysis, offering insights into profitability. Unlike a cash flow forecast, EBITDA encompasses both monetary and non-monetary factors, making it a valuable tool for assessing the financial sustainability of retirement communities and assisted living facilities. This metric is particularly relevant in evaluating operational expenses and revenue projections within the aging population market. By analyzing EBITDA, investors can better understand long-term care facility profitability and identify potential financial risks in senior housing investments.

Cash Flow Forecast Excel

The cash flow chart template serves as a vital component of senior living financial analysis, facilitating robust financial sustainability for aging services. This Excel template helps in projecting operating, investing, and financing cash flows, crucial for assessing retirement home revenue projections and assisted living cost structures. A well-structured cash flow statement aids in reconciling changes in the pro forma balance sheet, ensuring alignment with senior living operational expenses. By incorporating this tool into your senior housing investment model, you can effectively navigate financial risks and optimize profitability analysis for long-term care facilities in an evolving market.

KPI Benchmarks

The financial benchmarking study within our three-statement financial model serves as a vital tool for senior living investment analysis. By comparing your elderly care facility's performance against industry peers, you can identify areas for improvement and enhance your understanding of senior living operational expenses. This benchmarking process reveals essential insights into retirement home revenue projections and occupancy rate impact. Utilizing these competitive analyses, operators can strategize on capital expenditures and optimize revenue streams, ensuring the financial sustainability and profitability of their senior housing ventures amid evolving demographic trends in aging services.

P&L Statement Excel

In today's landscape, a profit and loss forecast template is essential for senior living enterprises. It not only tracks financial performance but also projects future income and expenses, serving as a strategic roadmap. By employing senior living financial analysis, operators can assess retirement home revenue projections and evaluate the impact of occupancy rates on profitability. This foresight enables businesses to navigate the unique financial sustainability challenges of aging services, allowing for informed budgeting and effective strategies to enhance revenue streams and manage operational expenses in the face of evolving demographic trends.

Pro Forma Balance Sheet Template Excel

This comprehensive business projection template offers an integrated approach to senior living financial analysis. It features a monthly and annual projected balance sheet spanning five years, seamlessly linked with cash flow forecasts and pro forma profit and loss statements. This robust three-way financial model equips users with clear insights into assets, liabilities, and equity, aligning with overall retirement community financial metrics. By leveraging this template, investors can effectively assess the financial sustainability and long-term care facility profitability, ensuring informed decision-making in the evolving aging population market trends.

SENIOR LIVING FACILITY FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our comprehensive pre-revenue startup valuation template for senior living facilities is designed to meet investor needs by presenting critical financial metrics. The weighted average cost of capital (WACC) reassures stakeholders of expected returns on their investments. Additionally, our free cash flow analysis illuminates the cash available for shareholders and creditors, while discounted cash flow projections provide a current valuation of anticipated future cash flows. This financial framework lays the foundation for informed decision-making in senior living financial analysis, ensuring financial sustainability and optimizing profitability in the face of evolving demographic trends.

Cap Table

The equity cap table is essential for senior living financial analysis, allowing business owners to assess shareholder ownership dilution effectively. Our comprehensive capitalization table, integrated into the senior living investment model, accommodates up to four rounds of funding. Users can selectively apply one, two, or all rounds, ensuring tailored projections for elderly care facility budgeting. This flexibility supports robust financial planning, enhancing profitability analysis and cash flow forecasts for senior care. By considering occupancy rate impact and operational expenses, you can navigate the financial sustainability of retirement communities in today’s shifting demographic landscape.

KEY FEATURES

Implementing a robust senior living investment model enhances financial sustainability, ensuring proactive management of operational expenses and occupancy rates.

Implementing a robust senior living investment model enhances financial sustainability by effectively forecasting cash flow and managing operational expenses.

A robust senior living investment model enhances profitability analysis, ensuring financial sustainability and informed decision-making for aging services.

Unlock financial sustainability for your senior living investment with a strategic model that enhances profitability and minimizes risks.

A robust senior living investment model enhances decision-making, ensuring financial sustainability and profitability amidst evolving demographic trends and market demands.

Leverage occupancy rate impact forecasts to optimize senior living financial analysis and ensure sustainable profitability in aging services.

The senior living investment model provides insightful financial analysis, enhancing profitability and sustainability for operators in an aging population market.

Our senior living investment model enhances financial sustainability and profitability analysis, empowering facilities to navigate evolving demographic trends and ensure optimal revenue streams.

A robust senior living investment model enhances profitability analysis, ensuring financial sustainability and effective budgeting for the aging population market trends.

A clear senior living financial model enhances budgeting accuracy and profitability analysis, empowering informed decision-making for sustainable operations.

ADVANTAGES

Leverage our senior living investment model to enhance profitability analysis, ensuring sustainable growth in an evolving aging population market.

Unlock financial sustainability in senior living with a robust investment model that enhances revenue projections and mitigates risks.

The senior living investment model simplifies financial planning, enhancing revenue projections and ensuring long-term profitability in an aging population market.

Enhance financial sustainability with our senior living investment model, ensuring accurate revenue projections and profitability analysis for aging services.

A robust senior living investment model anticipates cash flow risks, ensuring financial sustainability and optimal profitability for elderly care facilities.