Soybean Processing Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Soybean Processing Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

soybean processing Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

SOYBEAN PROCESSING FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year financial model for agriculture, focused on soybean processing, serves as an essential tool for startups and entrepreneurs engaged in this sector. It includes detailed soybean market analysis, highlighting profitability factors such as soybean extraction costs and operating costs of soybean plants. The model provides financial projections for soybeans, incorporating investment analysis in soybean processing and economic feasibility assessments. With features like break-even analysis, soybean meal demand forecasts, and insights into soybean processing revenue streams, it equips users to navigate the complexities of supply chain management for soybeans. This customizable Excel template is designed to aid in evaluating startup ideas and planning for capital budgeting in the soybean processing industry, ensuring a robust foundation for fundraising and strategic business planning.

The ready-made financial model in Excel template addresses key pain points for buyers by providing a comprehensive overview of the profitability of soybean processing, which includes an in-depth soybean market analysis and a detailed investment analysis in soybean processing. It simplifies cost calculations, highlighting operating costs of soybean plants and the cost of soybean extraction, while offering financial projections for soybeans that incorporate break-even analysis and capital budgeting considerations. This model not only streamlines supply chain management for soybeans but also integrates soybean meal demand forecasts and soybean oil production economics, ensuring users can make informed decisions amidst industry trends. Furthermore, buyers can effectively conduct risk assessments in soybean processing, leading to enhanced financial metrics that drive strategic planning and revenue stream optimization.

Description

This soybean processing startup financial model template provides a robust framework for agricultural financial planning, offering detailed insights into soybean processing costs, the profitability of soybean processing, and critical financial projections for soybeans. It includes five years of financial statements—forecast income statement, cash flow forecasting, and projected balance sheets—allowing for thorough investment analysis in soybean processing. The model also features break-even analysis for soybeans and calculates essential financial metrics, such as DCF and free cash flow, assisting in the economic feasibility of soybean processing. By evaluating key performance indicators and operational costs, this tool aids in risk assessment and strategic decision-making, crucial for navigating the evolving soybean market and optimizing revenue streams.

SOYBEAN PROCESSING FINANCIAL MODEL REPORTS

All in One Place

The professional financial model for agriculture offers vital insights into the future implications of your current decisions. This comprehensive startup financial plan template generates essential financial projections, including forecasted income statements, projected balance sheets, and cash flow statements tailored for soybean processing. Additionally, it calculates key performance indicators (KPIs) based on your assumptions, providing a clear picture of profitability and investment analysis in soybean processing. All financial metrics are presented in an intuitive, well-designed dashboard, facilitating informed decision-making and effective supply chain management for optimal soybean processing revenue streams.

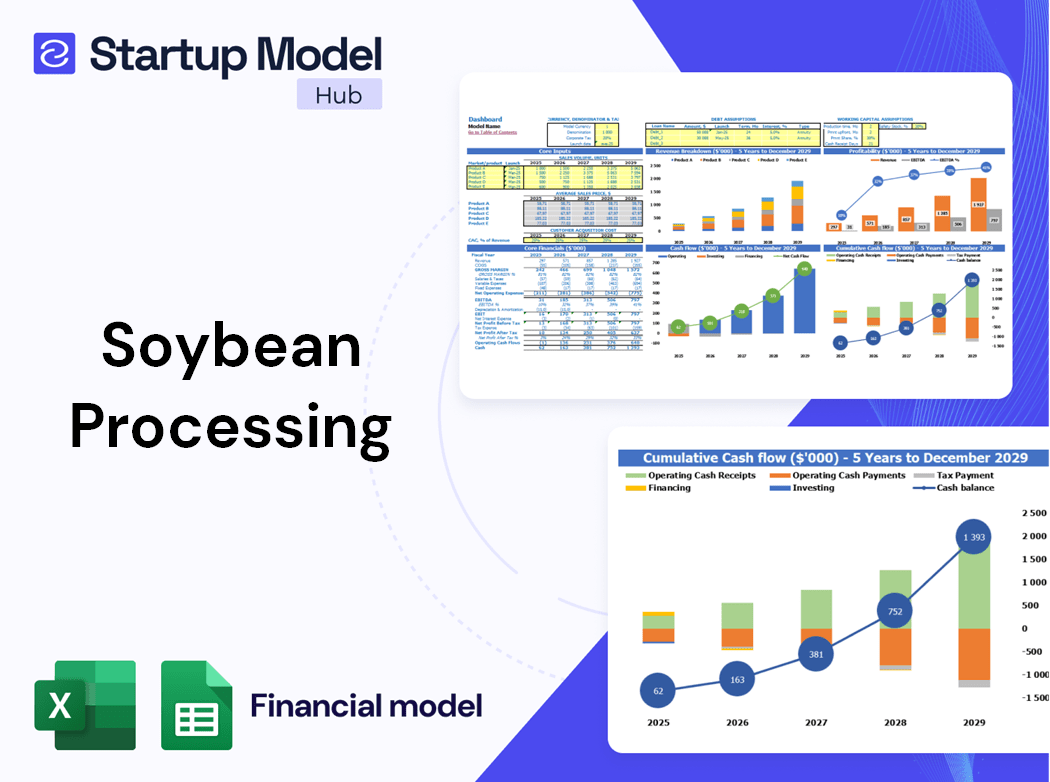

Dashboard

To effectively analyze and forecast in the soybean processing industry, a comprehensive financial model is essential. Utilizing a startup costs template allows for the inclusion of key elements such as pro forma balance sheets, projected income statements, and detailed financial projections. This data, presented in user-friendly graphs and charts, facilitates insightful investment analysis and aids in assessing the economic feasibility of soybean extraction. By leveraging this information, stakeholders can better understand profitability, operating costs, and revenue streams, ultimately enhancing decision-making in soybean supply chain management.

Business Financial Statements

When developing a financial model for agriculture, clarity and comprehensiveness are vital. Your Excel template should encompass essential components, facilitating an intuitive understanding of financial projections for soybeans. This ensures that stakeholders can easily assess costs, including soybean processing costs and operating costs of soybean plants. A well-structured model enhances investment analysis in soybean processing, making it easier to conduct break-even analysis and evaluate profitability. By incorporating industry trends and demand forecasts, you can effectively communicate the economic feasibility of soybean processing initiatives to potential investors.

Sources And Uses Statement

This financial projection model excels in analyzing the sources and uses of funds within soybean processing. It provides valuable insights into the flow and distribution of capital, enhancing decision-making in investment analysis in soybean processing. By incorporating key elements such as operating costs of soybean plants and revenue streams from soybean oil production and meal demand, this model supports informed financial metrics. Ultimately, it aids in the economic feasibility assessment and risk evaluation for stakeholders aiming for profitability in the ever-evolving soybean market.

Break Even Point In Sales Dollars

The Excel break-even formula offers a clear view of profitability at different sales levels, critical for effective financial modeling in agriculture. Break-even analysis identifies the sales volume at which total contributions equal fixed costs, resulting in zero profit or loss. This technique, grounded in marginal costing principles, reveals how operating costs of soybean processing plants shift with varying output levels. Understanding this relationship is essential for investment analysis in soybean processing, guiding decision-making in capital budgeting and enhancing overall profitability in the soybean market.

Top Revenue

Explore our comprehensive financial projection Excel for soybean processing, which provides an in-depth analysis of revenue streams by year. The Top Revenue tab delivers crucial financial metrics tailored to each product offering. Additionally, the startup financial plan allows users to visualize revenue depth and detailed revenue bridge breakdowns, enhancing investment analysis and risk assessment in soybean processing. This tool supports effective supply chain management and capital budgeting, ultimately aiding in the evaluation of the economic feasibility and profitability of soybean processing ventures. Transform your soybean market analysis with insightful financial projections today.

Business Top Expenses Spreadsheet

In agricultural finance, understanding key metrics like top and bottom lines is crucial for assessing the profitability of soybean processing. The top line reflects total revenues from soybean oil production and processing, indicating market growth potential. Conversely, the bottom line reveals net income, highlighting improved profitability after accounting for operating costs of soybean plants. Financial models for agriculture that incorporate these metrics, alongside investment analysis in soybean processing, can provide valuable insights into economic feasibility, break-even analysis, and financial projections for soybeans, ultimately guiding strategic decision-making in a competitive market.

SOYBEAN PROCESSING FINANCIAL PROJECTION EXPENSES

Costs

Our soybean processing financial model offers comprehensive Pro-forma templates that detail costs, expenses, and funding strategies, tailored for effective budgeting and capital planning. Understanding the operating costs of soybean plants is crucial for ensuring smooth business operations. With our template, you can monitor expenses to avoid underfunding and manage capital effectively. This tool not only aids in financial projections for soybeans but also enhances your investment analysis in soybean processing, ensuring informed decision-making in an evolving market landscape. Stay ahead with insights into the profitability of soybean processing and emerging industry trends.

CAPEX Spending

Our startup budget outlines the total financial investments made in soybean processing to enhance property, plants, and equipment. This strategic allocation is crucial for boosting operational competitiveness. Our report details the CAPEX plan, highlighting its impact on efficiency and identifying which assets benefit from increased startup expenses. It's essential to distinguish that this analysis excludes salaries and general operating costs. Given the variability in capital expenditures across different sectors, a careful examination of each business model is vital for accurate investment analysis in soybean processing and to assess profitability and market dynamics effectively.

Loan Financing Calculator

Monitoring loan repayment schedules is crucial for startups and growing companies, as they outline key details such as principal amounts, terms, maturity periods, and interest rates. These schedules significantly impact cash flow analysis, influencing the financial model for agriculture. The repayment obligations directly affect a company's cash flow projections and are reflected on the balance sheet. Understanding these dynamics aids in effective capital budgeting for soybeans and enhances risk assessment in soybean processing, ultimately supporting sound investment analysis and financial projections for a sustainable soybean processing business.

SOYBEAN PROCESSING EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) serves as a vital financial metric for assessing the operating performance of soybean processing businesses. It is calculated by subtracting relevant expenses from total revenue, offering a clear picture of profitability. In the context of the soybean market, understanding EBITDA aids in evaluating financial projections, investment analysis, and operating costs associated with soybean processing plants. This metric is crucial for conducting a thorough break-even analysis and enhances supply chain management, thereby informing strategic decisions within the soybean processing industry.

Cash Flow Forecast Excel

The cash flow model is essential for assessing the financial health of a soybean processing venture. Our template provides a dedicated sheet to track and analyze cash flows, critical for understanding the operating costs of soybean plants and securing additional financing. It incorporates key factors such as payable and receivable days, working capital, and net cash. This financial model for agriculture not only assists in evaluating soybean processing revenue streams but also aids in break-even analysis, ensuring robust financial projections for soybeans, and optimizing investment analysis in soybean processing.

KPI Benchmarks

The benchmarking tab is a vital component of our financial model for agriculture, specifically tailored for soybean processing. It calculates key industry and financial metrics, enabling you to assess your company’s performance against peers. By analyzing these benchmarks, you gain insights into successful players within the soybean market. This data-driven approach not only highlights areas for improvement but also aids in investment analysis in soybean processing. Use these insights to enhance profitability, optimize operating costs, and refine your supply chain management strategies, ensuring your soybean processing venture thrives in a competitive landscape.

P&L Statement Excel

The Profit and Loss statement template for soybean processing offers a comprehensive way to analyze expenses and revenues over time, complementing the cash flow statement. Unlike cash flow tracking, this P&L model enables financial projections by incorporating variables like depreciation, crucial for long-term investment analysis in soybean processing. By utilizing this template, stakeholders can effectively evaluate the operating costs of soybean plants, assess profitability, and conduct break-even analysis. This strategic financial model is vital for optimizing revenue streams and enhancing risk assessment in the dynamic soybean market.

Pro Forma Balance Sheet Template Excel

The pro forma balance sheet provides a snapshot of a soybean processing company's assets and liabilities, highlighting its financial health at a specific moment. In contrast, the profit and loss projection (P&L) outlines operational performance over time, aiding in financial model development for agriculture. For startups, a projected balance sheet reveals net worth, differentiating between equity and borrowed funds. Key indicators such as liquidity, solvency, and turnover ratios, found within this financial framework, are essential for assessing the economic feasibility of soybean processing and guiding investment analysis in the soybean market.

SOYBEAN PROCESSING FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

The seed stage valuation spreadsheet features essential calculators for Weighted Average Cost of Capital (WACC), Discounted Cash Flows (DCF), and Free Cash Flows (FCF). WACC serves as a pivotal risk assessment tool, informing banks of a company's capital generation costs from debt and equity, influencing loan approval decisions. Meanwhile, DCF calculations present the projected value of future cash flows, crucial for investment analysis in soybean processing. By integrating these financial metrics, stakeholders can effectively evaluate the economic feasibility and profitability of soybean processing ventures, aligning with industry trends and market analyses.

Cap Table

A cap table is a critical financial tool for startups, offering clarity on ownership stakes through various funding rounds. In our financial model for agriculture, particularly in soybean processing, understanding equity distribution is essential. It encompasses equity shares, preferred shares, and options, enabling stakeholders to anticipate dilution effects. This approach is vital for investment analysis in soybean processing, guiding users in capital budgeting, risk assessment, and financial projections. By integrating a robust cap table, agribusinesses can navigate soybean processing costs, optimize profitability, and enhance their decision-making in the evolving soybean market landscape.

KEY FEATURES

A robust financial model for agriculture enhances investment analysis, ensuring profitability and sustainability in soybean processing ventures.

Utilizing a financial model for agriculture enhances your soybean processing venture's attractiveness, drawing in potential investors effortlessly.

A robust financial model for agriculture enhances investment analysis, optimizing profitability and mitigating risks in soybean processing ventures.

Implementing a robust financial model for agriculture enables accurate cash flow projections, minimizing risks and supporting sustainable growth in soybean processing.

A robust financial model for agriculture enhances profitability by accurately forecasting soybean processing costs and revenue streams.

This user-friendly financial model for agriculture ensures reliable soybean processing revenue streams and profitability insights, regardless of your planning experience.

A robust financial model for agriculture enhances stakeholder trust by providing clear insights into soybean processing profitability and investment feasibility.

A robust financial model enhances stakeholder confidence, facilitating investment in soybean processing through clear future projections and risk management.

A robust financial model for agriculture enhances profitability by accurately forecasting soybean processing costs and revenue streams.

A sophisticated financial model streamlines soybean processing analysis, enabling accurate projections and improved decision-making for all business stages.

ADVANTAGES

A robust financial model for agriculture enhances investment analysis in soybean processing, minimizing risks and optimizing profitability.

Implementing a robust financial model for agriculture significantly enhances the profitability and efficiency of soybean processing operations.

A robust financial model for agriculture enhances investment analysis, ensuring profitability and informed decision-making in soybean processing ventures.

A robust financial model for agriculture enhances decision-making by assessing profitability, costs, and market dynamics in soybean processing.

Leverage a financial model for agriculture to optimize soybean processing costs and enhance profitability in today’s competitive market.