Taverna Financial Model

- ✔ 5-Year Financial Projections

- ✔ 100% Editable

- ✔ Investor-Approved Valuation Models

- ✔ MAC/PC Compatible, Fully Unlocked

- ✔ No Accounting Or Financial Knowledge

Taverna Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

taverna Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

TAVERNA FEASIBILITY STUDY INFO

Highlights

The highly versatile and user-friendly Taverna financial planning model is designed for startups, facilitating the preparation of essential documents such as a P&L Excel template, cash flow analysis, and balance sheet with detailed monthly and annual timelines. This robust Taverna budgeting model is suitable for both new ventures and existing Taverna businesses, enabling effective financial forecasting and revenue projections. By utilizing the Taverna three-way financial model, entrepreneurs can conduct a comprehensive break-even analysis and assess their funding sources, making it easier to secure funding from banks or investors. Additionally, the model allows for meticulous expense management, profit margin calculation, and operational efficiency tracking, all while providing key financial metrics and performance indicators to optimize strategic decisions. Unlock the full potential of your Taverna business with editable tools that enhance financial insight and valuation methods.

The Taverna financial planning Excel model addresses common pain points for users by offering a streamlined approach to budgeting, cash flow analysis, and revenue projections, allowing for precise financial forecasting and performance monitoring. Its integrated structure simplifies expense management, enabling users to perform break-even analysis and evaluate profit margins effortlessly. The tool also includes robust financial statements and metrics, facilitating a clear understanding of cost structures while supporting informed decision-making through scenario analysis and risk assessment. Additionally, it provides essential valuation methods and funding source evaluations, ensuring users can effectively strategize investments and enhance operational efficiency with relevant financial ratios and performance indicators.

Description

The Taverna financial planning model provides a comprehensive framework for startups, incorporating essential components like taverna revenue projections, cash flow analysis, and expense management to support effective budgeting and operational efficiency. Designed as a user-friendly Excel template, this model facilitates taverna financial forecasting for a five-year period, allowing entrepreneurs to concentrate on marketing and customer relations without being bogged down by complex calculations. It incorporates various financial statements and performance indicators, such as profit margin calculations and break-even analysis, alongside risk assessment and funding sources evaluation to ensure informed decision-making. Additionally, the taverna financial metrics include valuation methods and scenario analysis, empowering users to adapt and strategize effectively in a dynamic market environment.

TAVERNA FINANCIAL PLAN REPORTS

All in One Place

Transform your financial planning with our comprehensive Taverna financial projection template. This user-friendly tool enables you to tailor all aspects, from revenue projections and cash flow analysis to expense management and profit margin calculations. With insights into financial statements, funding sources, and cost structures, you can enhance your operational efficiency. Leverage scenario analysis and market analysis to assess risks and optimize your investment strategy. Take charge of your Taverna’s future by utilizing key financial metrics and performance indicators for informed decision-making. Elevate your business models with our robust template today!

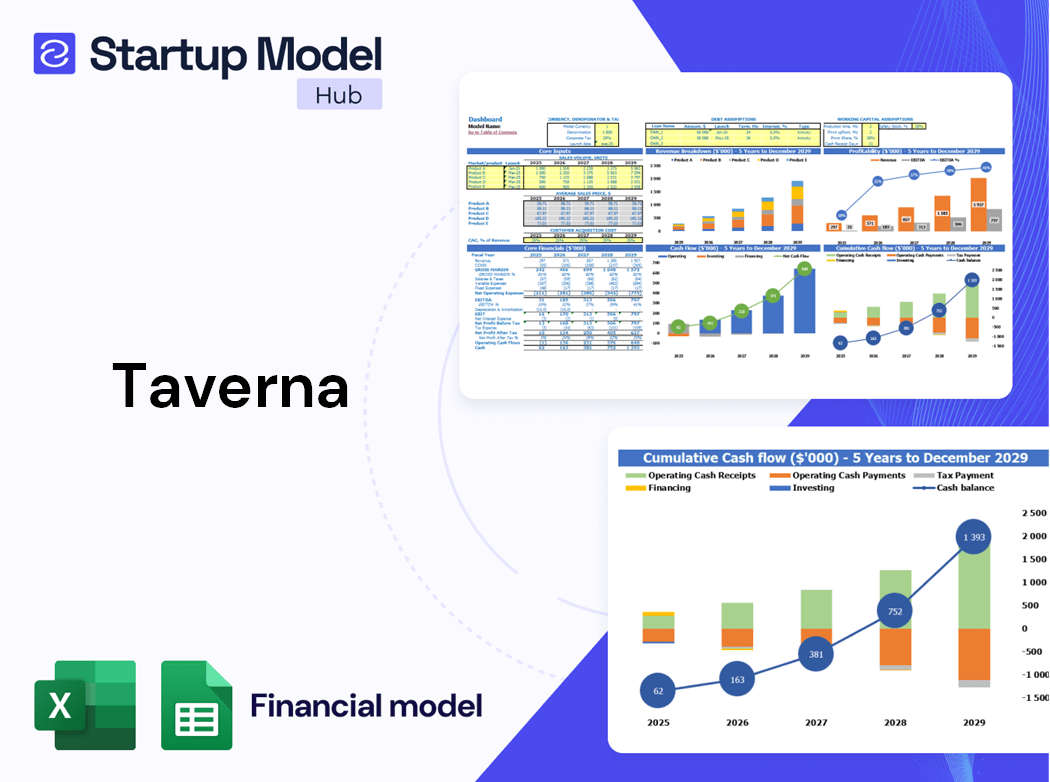

Dashboard

Our Taverna financial dashboard offers a contemporary solution for financial planning and KPI analysis. Featuring dynamic charts and graphs, it provides precise insights that support financial specialists in their assessments. Stakeholders can easily review revenue projections and earnings forecasts through a detailed proforma income statement, underscoring the company's growth potential. Additionally, our robust cash flow analysis enhances operational efficiency, ensuring informed decision-making. With a comprehensive suite of tools, including expense management and performance indicators, Taverna empowers businesses to strategically navigate their financial landscape.

Business Financial Statements

The Taverna financial planning model features an integrated Excel template, encompassing essential financial statements such as projected balance sheets, profit and loss statements, and cash flow analyses. Each template is meticulously designed and interlinked, ensuring seamless data flow across budgeting, revenue projections, and financial forecasting. With a focus on operational efficiency and strategic expense management, this comprehensive tool aids in assessing risk, evaluating profit margins, and conducting break-even analyses. Taverna empowers businesses to make informed decisions by providing key financial metrics and insights that drive performance and enhance investment strategies.

Sources And Uses Statement

A sources and uses of capital schedule is essential for effectively tracking the origins of raised capital and its allocation toward expenditures. This transparency enhances understanding of Taverna's funding sources and cost structure, facilitating better financial planning. By utilizing this schedule, Taverna can optimize its expense management, improve cash flow analysis, and refine its investment strategy. Ultimately, this approach bolsters operational efficiency and supports robust financial forecasting, ensuring that every dollar is strategically directed to enhance profit margins and drive growth.

Break Even Point In Sales Dollars

The Taverna break-even analysis tab in our financial modeling for startups presents a clear visualization of the break-even point in dollars. This critical financial metric indicates the moment your company will transition to profitability, showcasing when revenue projections surpass total expenses. By analyzing this graph, you can strategically assess your operational efficiency and make informed decisions regarding your overall financial planning and expense management, ultimately enhancing your investment strategy and optimizing profit margins. Understanding this pivotal point is essential for achieving long-term success.

Top Revenue

Utilize the Top Revenue tab to generate a demand report for your taverna’s products and services. This crucial analysis assesses profitability and financial viability, guiding future strategic decisions. With the pro forma financial statements template, create a revenue bridge to analyze factors influencing revenue streams over time, such as product volume and pricing. This detailed overview enhances taverna financial forecasting, allowing for effective demand projections across various periods, including weekdays and weekends, ultimately aiding in resource planning for your sales team.

Business Top Expenses Spreadsheet

Our Taverna financial planning model includes a dedicated tab for in-depth analysis of your company's revenue streams, allowing for precise revenue projections. This comprehensive budgeting model breaks down revenue by product or service, enhancing your cash flow analysis and operational efficiency. With a focus on performance indicators and financial metrics, it supports an effective expense management strategy and aids in break-even analysis. Additionally, utilize Taverna's valuation methods to assess funding sources, ensuring informed decision-making for sustainable growth. Experience improved financial forecasting and risk assessment through this user-friendly template.

TAVERNA FINANCIAL PROJECTION EXPENSES

Costs

Our Taverna financial planning tool is vital for startups across industries, offering intuitive budgeting models and robust financial forecasting. With our five-year revenue projections, you can strategically manage and analyze expenses, ensuring clarity over time horizons. By utilizing essential metrics like cost-to-income ratios, payroll, and recurring expenses, we categorize costs into goods sold (COGS), fixed or variable expenses, wages, and capital expenditures. This comprehensive approach enhances operational efficiency and supports informed decision-making for sustainable growth.

CAPEX Spending

CAPEX start-up expenses encompass the total costs for acquiring assets, significantly impacting financial statements and balance sheet forecasts. These substantial investments play a crucial role in enhancing operational efficiency and supporting the company's growth. By optimizing technology and equipment, these expenditures aim to improve performance indicators and profit margins. Additionally, they should be incorporated into the financial forecasting models, cash flow analysis, and projected profit and loss templates. Effectively managing these costs is vital for successful taverna financial planning and achieving a strong return on investment.

Loan Financing Calculator

Calculating loan payments is crucial for startups navigating financial planning. Many businesses struggle with this task, but our Taverna financial planning model simplifies the process. With an integrated loan amortization schedule and calculator, you can easily manage your loan obligations. This tool enhances your budgeting model, supports accurate revenue projections, and ensures effective expense management. By utilizing Taverna's financial metrics and cash flow analysis, companies can optimize their investment strategy and improve operational efficiency, empowering them to achieve greater financial clarity and stability.

TAVERNA INCOME STATEMENT METRICS

Financial KPIs

Our business plan template XLS includes a detailed breakdown of revenue projections, allowing for comprehensive taverna financial planning. The Pro-forma chart illustrates monthly income from five distinct revenue streams, enabling easy adjustments to the financial analysis period or the addition of new products. This flexibility supports effective taverna budgeting, cash flow analysis, and performance tracking. Enhance your taverna's operational efficiency and financial forecasting with our tailored tools designed to optimize expense management and improve profit margin calculations. Access valuable taverna financial statements and metrics to guide your investment strategy.

Cash Flow Forecast Excel

The Taverna cash flow analysis template is essential for understanding your business’s financial health. It enables you to track and analyze cash flows, ensuring you have sufficient liquidity for operations and potential financing. This forecasting model incorporates key elements such as payable and receivable days, annual income, working capital, and long-term debt. By calculating net cash flow, including beginning and ending balances, you gain valuable insights into your cash management strategy. Utilize this comprehensive tool for effective expense management and to enhance your overall operational efficiency.

KPI Benchmarks

The financial benchmarking study tab in our Taverna budgeting model effectively evaluates company performance by comparing key financial metrics with industry averages. By focusing on comparable businesses, this robust method highlights strengths and identifies areas for improvement, aiding in cash flow analysis and expense management. Insights drawn from this scenario analysis allow firms to establish new operational efficiency standards, refine their investment strategies, and achieve goals with minimal financial loss. Every business owner should leverage benchmarking to gain valuable insights into their unique cost structure and performance indicators, ultimately driving success.

P&L Statement Excel

Utilizing our profit and loss statement template in Excel, you can develop comprehensive and precise financial statements for your taverna. This reliable forecasted income statement is essential for informed daily management decisions. Our business plan financial projections template enables you to conduct thorough cash flow analysis and revenue projections, allowing you to assess your taverna’s strengths and weaknesses effectively. By leveraging these financial planning tools, you will gain insights into expense management, profit margin calculations, and overall operational efficiency, putting you on the path to successful financial forecasting and strategy development.

Pro Forma Balance Sheet Template Excel

The Taverna financial forecasting model seamlessly integrates monthly and annual balance sheet projections with cash flow analysis, forecasted income statements, and comprehensive financial planning worksheets. This robust setup empowers users to gain a holistic view of assets, liabilities, and equity, aligning with essential financial statements. By leveraging Taverna's budgeting model and revenue projections, users can enhance operational efficiency and make informed decisions based on accurate financial metrics and risk assessments, ultimately guiding effective investment strategies and expense management. Experience clarity in your financial journey with Taverna's expert approach to forecasting and analysis.

TAVERNA INCOME STATEMENT VALUATION

Startup Valuation Model

The Taverna valuation report template empowers users to conduct a comprehensive discounted cash flow valuation. By simply entering relevant rates for the cost of capital, you can unlock insightful taverna financial projections. This tool not only enhances your taverna financial planning but also supports robust scenario analysis and risk assessment. Elevate your budgeting model and optimize your cash flow analysis to boost operational efficiency and improve profit margin calculation. Leverage Taverna's integrated approach to financial statements and performance indicators for a clearer financial outlook and strategic investment planning.

Cap Table

Our Taverna financial planning model features a comprehensive equity cap table that tracks the evolution of tangible assets over time. This innovative tool provides insights into profitability for investors, detailing revenue projections and expense management strategies. By incorporating Taverna's financial forecasting and break-even analysis, we ensure a robust understanding of cash flow dynamics. With our valuation methods and performance indicators, we empower stakeholders to make informed decisions, optimizing their investment strategy and enhancing operational efficiency. Explore how Taverna's financial metrics can elevate your business planning today.

KEY FEATURES

Taverna's financial forecasting model enhances decision-making by providing accurate revenue projections and insightful cash flow analysis.

Taverna's financial forecasting model enhances decision-making by providing clear insights into cash flow, profitability, and operational efficiency.

The Taverna financial planning model provides clear insights for optimal budgeting, enhancing operational efficiency and effective expense management.

Taverna's financial planning model provides insightful reports, enhancing your decision-making through detailed forecasts and comprehensive financial ratios.

The Taverna budgeting model simplifies financial planning, enabling accurate revenue projections and effective expense management for enhanced operational efficiency.

The Taverna three-way financial model delivers quick, reliable insights, enabling effective financial planning and enhanced decision-making for any business.

Taverna's budgeting model enhances operational efficiency, allowing effective management of surplus cash for strategic investments and growth.

Taverna's financial forecasting offers vital insights for strategic cash surplus management, empowering businesses to seize reinvestment opportunities effectively.

Taverna's financial forecasting model enhances better decision making by providing accurate insights into revenue projections and cash flow analysis.

Enhance your operational efficiency and decision-making confidence with Taverna’s cash flow analysis and revenue projections.

ADVANTAGES

The Taverna budgeting model enhances financial clarity by comparing expenses and income, optimizing decision-making for future growth.

Optimize cash flow and enhance profitability with Taverna's financial planning and budgeting model for startups.

Enhance your decision-making with Taverna's financial planning model, optimizing budgeting and improving overall operational efficiency.

Enhance stakeholder confidence with Taverna's financial forecasting model, ensuring accurate revenue projections and informed decision-making.

Utilizing Taverna's financial planning model enhances decision-making by providing accurate projections and insights for strategic hiring.