Tire Manufacturing Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Tire Manufacturing Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

tire manufacturing Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

TIRE MANUFACTURING FINANCIAL MODEL FOR STARTUP INFO

Highlights

The five-year tire manufacturing financial model provides a comprehensive framework for startups and entrepreneurs seeking to impress investors and secure funding in the competitive tire industry. With a focus on financial forecasts for tire companies, this model incorporates key elements such as tire production cost analysis, variable costs in tire production, and fixed cost management in factories. It also emphasizes tire industry market analysis, operational efficiency in tire production, and cost reduction strategies in manufacturing. By integrating budgeting for tire production and break-even analysis for tire plants, users can effectively navigate capital investment in tire manufacturing while optimizing their tire supply chain. The model includes essential financial statements for tire manufacturers, allowing for profit margin calculations for tires and a solid understanding of equipment depreciation in tire factories. This tailored approach ensures a robust tire pricing strategy that aligns with current tire raw material cost trends and the supply and demand dynamics in the tire market.

The ready-made financial model in Excel addresses key pain points for tire manufacturers by providing a comprehensive tire production cost analysis, allowing users to efficiently manage fixed and variable costs while performing break-even analysis for tire plants. It includes tools to optimize inventory through tire supply chain optimization, ensuring that budgeting for tire production aligns with raw material cost trends. By incorporating financial forecasts for tire companies and profit margin calculations for tires, the template enhances decision-making capabilities, while also offering insights into equipment depreciation and manufacturing overhead allocation. Furthermore, this financial model facilitates operational efficiency in tire production and supports effective capital investment planning, ultimately empowering tire companies to implement effective cost reduction strategies and enhance their pricing strategy in a competitive market.

Description

A comprehensive financial model for tire manufacturing is crucial for assessing the viability of your business, as it allows for an in-depth tire production cost analysis, including variable costs and fixed cost management within factories. This model not only aids in generating financial forecasts for tire companies but also supports budgeting for tire production by evaluating equipment depreciation and manufacturing overhead allocation. Additionally, it provides insights into profit margin calculations, ensuring that the tire pricing strategy aligns with market demands, while also facilitating tire supply chain optimization through break-even analysis for tire plants. The dynamic Excel template encompasses projected income statements, cash flow analyses, and key performance indicators (KPIs), thereby equipping you with robust financial statements that can attract potential investors or banks for capital investment in tire manufacturing, ultimately enhancing operational efficiency and guiding effective cost reduction strategies in manufacturing.

TIRE MANUFACTURING FINANCIAL MODEL REPORTS

All in One Place

Our comprehensive tire manufacturing financial forecast Excel template equips start-ups and established companies with essential financial analytics. It includes detailed projections for profit and loss, cash flow forecasts, and balance sheet assessments. With month-on-month and year-on-year summaries, this tool enables effective budgeting for tire production and supports strategic decision-making. Enhance your operational efficiency and improve financial statements for tire manufacturers with this invaluable resource, tailored to optimize capital investment and manage variable and fixed costs effectively within the tire industry.

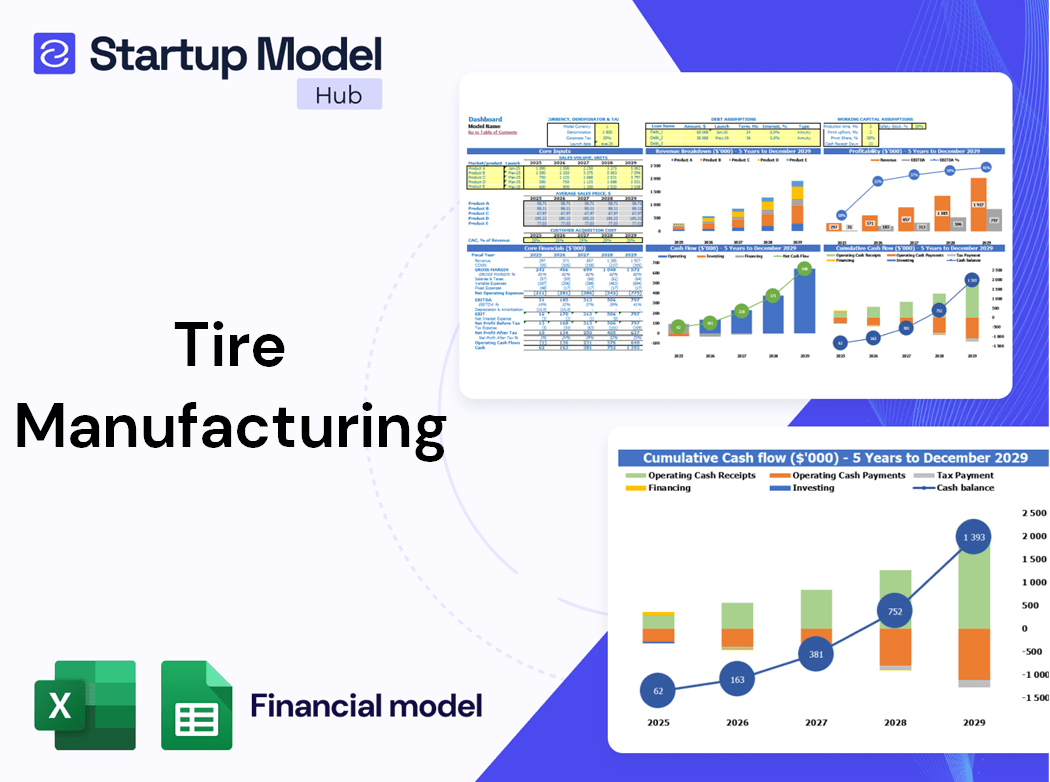

Dashboard

Elevate your financial projections with our specialized tool for the tire industry. Seamlessly input your tire production cost analysis, including fixed cost management and variable costs, to create professional financial statements. Our platform enhances budgeting accuracy and provides insights into capital investment in tire manufacturing, supply chain optimization, and break-even analysis. Make informed decisions with robust market analyses that account for economic factors, tire raw material cost trends, and operational efficiency. Transform your data into compelling presentations that drive profitability and strategic tire pricing while ensuring you're prepared for future financial forecasts.

Business Financial Statements

Understanding a tire manufacturer's performance requires a comprehensive analysis of all three accounting statements. The forecast income statement offers valuable insights into core operating activities and profit margins in tire production. In contrast, the projected balance sheet and cash flow model emphasize capital investment and fixed cost management, essential for optimizing manufacturing overhead allocation. Together, these financial forecasts enable tire companies to assess operational efficiency, budget effectively for tire production, and implement cost reduction strategies, ensuring a robust approach to navigating supply and demand dynamics in the tire industry.

Sources And Uses Statement

The sources and uses of cash statement within a business plan forecast template offers a clear overview of capital inflows (the 'Sources') and outflows (the 'Uses'), ensuring they balance precisely. This template is vital for tire manufacturers, especially during recapitalization, restructuring, or mergers and acquisitions (M&A). Accurate cash flow management is essential for optimizing manufacturing overhead allocation, managing fixed and variable costs, and enhancing operational efficiency. By carefully analyzing these financial statements, tire companies can make informed decisions that align with their growth strategies and improve financial forecasts in a competitive market.

Break Even Point In Sales Dollars

A comprehensive break-even analysis in tire manufacturing is crucial for understanding the relationship between revenue, sales, and profit. While revenue reflects the total income generated from tire sales, profit is derived after accounting for both fixed and variable costs. This distinction is vital for effective financial forecasting and budgeting in tire production, enabling manufacturers to develop cost reduction strategies and optimize operational efficiency. By leveraging insights from financial statements and market analysis, tire companies can enhance their pricing strategy and improve profit margins in a competitive industry landscape.

Top Revenue

In the Top Revenue tab of this business financial model template, users can expertly forecast demand by product or service. This report provides insights into potential profitability and financial viability, allowing for comprehensive tire industry market analysis. Users can visualize revenue depth and bridge while assessing forecasted demand variations, such as weekdays versus weekends. This detailed analysis enhances resource scheduling—optimizing manpower, inventory, and operational efficiency—ultimately informing cost reduction strategies in tire production and supporting effective budgeting for capital investments in manufacturing.

Business Top Expenses Spreadsheet

Our projected income statement template offers a comprehensive overview of top expenses, categorized into four distinct groups, with an additional 'other' category for flexibility. This allows for the inclusion of specific data pertinent to your tire manufacturing operations, enabling precise financial forecasts and enhanced budgeting for tire production. By utilizing this pro forma template, you can effectively monitor performance and analyze operational efficiency over a five-year horizon, ensuring your capital investment aligns with your tire pricing strategy and financial statements. Optimize your cost management and support strategic decision-making with this valuable tool.

TIRE MANUFACTURING FINANCIAL PROJECTION EXPENSES

Costs

Our financial projection model offers a robust methodology for comprehensive cost budgeting in tire manufacturing. Plan and forecast operational expenses for up to 60 months, with detailed expense allocations such as variable and fixed costs. Pre-built forecasting curves allow for dynamic adjustments based on revenue percentages or growth rates. Easily manage capital investments and budgeting while ensuring precise accounting treatment for COGS and other key expense categories. Optimize operational efficiency and enhance profit margin calculations, positioning your tire company for sustainable growth in a fluctuating market.

CAPEX Spending

Capital expenditures (CAPEX) in tire manufacturing represent the financial investments aimed at enhancing competitiveness and business growth, excluding staff salaries and operational costs. Conducting a thorough analysis of these expenditures aids in identifying optimal investment opportunities. Variance in CAPEX across different business models underscores the importance of detailing this analysis within the overall business framework. This strategic approach not only informs budgeting for tire production but also enhances operational efficiency, ultimately contributing to stronger financial forecasts for tire companies amidst fluctuating market dynamics.

Loan Financing Calculator

Similar to the amortization of financial projections in a business plan, effective budgeting in tire production involves systematic allocation of costs over specified periods. This approach encompasses fixed cost management and variable costs analysis to enhance operational efficiency in tire manufacturing. By evaluating capital investment and equipment depreciation, companies can optimize their manufacturing overhead allocation. Regular assessments of profit margins, along with thorough financial forecasts, enable tire manufacturers to navigate supply and demand dynamics, implement cost reduction strategies, and refine their pricing strategy for sustained profitability in the competitive tire industry.

TIRE MANUFACTURING EXCEL FINANCIAL MODEL METRICS

Financial KPIs

In tire manufacturing, key financial indicators like revenue growth rate, gross margin, and EBITDA margin are essential for comprehensive financial forecasts. Effective budgeting for tire production should also consider metrics such as cash burn rate and capital investment requirements, alongside operational efficiency and fixed cost management. Monitoring KPIs relevant to the tire industry—like profit margin calculations, variable costs in tire production, and equipment depreciation—enables companies to optimize their supply chains and improve their pricing strategies. Focusing on these metrics ensures sustained success and aligns with evolving market trends and demand.

Cash Flow Forecast Excel

In a comprehensive financial model template for tire manufacturers, the cash flow spreadsheet meticulously tracks all cash inflows and outflows. This critical analysis enables companies to assess their ability to meet liabilities and sustain operational efficiency in tire production. When engaging with banks, financial institutions scrutinize this cash position and the company's capacity to service debt, making it an essential tool for capital investment discussions. By utilizing this model, tire companies can better navigate variable and fixed costs, optimize their pricing strategy, and enhance overall financial forecasts in an increasingly competitive tire industry.

KPI Benchmarks

Benchmarking studies are essential for tire companies to assess their performance against industry peers. By analyzing financial metrics such as profit margin, variable costs in tire production, and operational efficiency, businesses can identify best practices. In comparing their financial statements, including cost per unit and productivity margins, companies can uncover areas for improvement. This strategic tool is particularly beneficial for start-ups, enabling them to navigate economic factors affecting tire sales and adopt effective cost reduction strategies. Utilizing such insights facilitates a more competitive tire pricing strategy and enhances overall manufacturing overhead allocation.

P&L Statement Excel

The projected profit and loss statement template serves as a vital tool for assessing key performance indicators in tire manufacturing. It not only highlights profit or loss but also forecasts future profitability amidst supply and demand fluctuations in the tire market. Utilizing various charts and tables, this pro forma income statement evaluates operational efficiency and budgeting for tire production. Annual reports provide comprehensive insights into financial activities, enabling manufacturers to navigate cost reduction strategies, manage fixed and variable costs, and enhance capital investment decisions for sustained growth in the competitive tire industry.

Pro Forma Balance Sheet Template Excel

A pro forma balance sheet is crucial for tire manufacturers, showcasing essential assets like buildings and equipment, alongside liabilities and capital as of a specific date. This financial statement is vital for securing loans, as banks closely examine the asset section for collateral. By incorporating insights from tire production cost analysis, manufacturers can enhance their financial forecasts and budgeting for tire production. This strategic approach ensures better management of fixed and variable costs, ultimately improving operational efficiency and supporting informed capital investment decisions in the tire industry.

TIRE MANUFACTURING FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Every business carries inherent risks, which is why our pre-revenue company sheet is essential. It provides a clear overview of key financial metrics, including NPV, IRR, and Return on Invested Capital (ROIC). This comprehensive startup financial plan incorporates all critical indicators necessary for assessing the sustainability of your tire manufacturing business. By utilizing aggregated customer data, you can effectively forecast future cash flows and optimize budgeting for tire production. Empower your decision-making with insights into variable costs, fixed cost management, and financial forecasts tailored for the tire industry.

Cap Table

A comprehensive business forecast template, including an equity cap table, is crucial for tire manufacturers. It outlines the ownership structure, clarifying who holds equity, the volume of shares, and their valuation. This model is essential for assessing financial forecasts, guiding capital investment in tire manufacturing, and optimizing operational efficiency. By understanding equity shares, preferred shares, and options, tire companies can strategically navigate variable costs and fixed cost management. Additionally, it aids in monitoring financial statements and supports budgeting to enhance profitability in a competitive tire industry shaped by evolving supply and demand dynamics.

KEY FEATURES

A robust financial model enhances decision-making by optimizing tire production costs and improving profitability through effective budgeting and forecasting.

This sophisticated financial model empowers tire manufacturers to optimize costs and enhance operational efficiency, regardless of their business size.

A robust financial model enhances decision-making by optimizing tire production costs, improving profit margins, and streamlining budgeting processes.

Implementing a financial model allows tire manufacturers to optimize cash flow by identifying late payments and testing various payment scenarios.

Our financial model enhances operational efficiency by providing precise insights for cost reduction strategies in tire production.

The Budget Financial Model streamlines financial forecasts for tire companies, enhancing operational efficiency without requiring complex programming or expensive consultants.

Utilizing a financial model streamlines cost reduction strategies, enhancing operational efficiency and maximizing profit margins in tire production.

Our financial model streamlines your tire production planning, enabling you to focus on growth without the complexity of technicalities.

Our financial model enhances operational efficiency by providing precise insights for cost reduction strategies in tire production.

The 5 Year Financial Projection Template Excel streamlines tire production cost analysis, enhancing decision-making without the need for complex configurations.

ADVANTAGES

Pro forma projections enhance cash flow management by optimizing the timing of accounts payable and receivable in tire manufacturing.

A robust financial model in Excel enhances stakeholder trust by delivering precise insights into tire production costs and market dynamics.

Implementing a robust financial model enhances operational efficiency and optimizes cost management in tire production, driving profitability and strategic growth.

Utilizing the feasibility study template in Excel enhances budgeting for tire production and strengthens financial forecasts for tire companies.

Utilizing a comprehensive financial model enhances decision-making and boosts profitability in tire production through precise cost analysis and forecasts.