Related Blogs

Are you considering diving into the lucrative world of oil and gas exploration? Understanding the top nine startup costs can be a game changer in your journey. From land acquisition to environmental impact assessments, each expense requires careful consideration. Ready to uncover the financial intricacies? Explore a comprehensive business plan that can guide you through the process at this link.

How Much Does It Cost To Start An Oil And Gas Exploration Company?

Starting an oil and gas exploration company is a capital-intensive endeavor, with startup costs varying significantly depending on several factors including location, scale of operations, and technology used. On average, the cost to start an oil exploration company can range from $500,000 to several million dollars. This investment must cover various essential expenses that are critical to establishing a viable business.

Here’s a breakdown of the primary costs involved in launching an oil and gas exploration company:

- Land Acquisition and Leasing Costs: Securing land for exploration can represent a significant portion of your initial investment, often costing between $100,000 to $1 million or more, depending on the area and size.

- Geological and Geophysical Survey Expenses: Conducting detailed geological surveys is vital for identifying potential drilling sites, costing anywhere from $50,000 to $500,000.

- Drilling Equipment Purchase or Leasing: The costs for drilling rigs and associated equipment can be substantial, ranging from $200,000 to over $1 million.

- Environmental Impact Assessment Fees: Compliance with environmental regulations can lead to fees between $10,000 to $100,000.

- Permitting and Regulatory Compliance Costs: Navigating the permitting process can incur costs upwards of $20,000 to $200,000.

- Initial Infrastructure Setup Costs: Establishing necessary infrastructure, such as access roads and facilities, may require an investment of $100,000 to $500,000.

- Technology and Software Development Expenses: Investing in advanced technology and software for data analysis can cost $50,000 to $300,000.

- Legal and Consulting Fees: Engaging legal and financial experts may lead to initial expenses ranging from $10,000 to $100,000.

- Insurance and Bonding Requirements: Adequate insurance coverage is essential and can cost between $20,000 to $150,000 annually.

In total, the initial investment in oil exploration can easily exceed $1 million, particularly in regions with stringent regulatory requirements and high land costs. The oil and gas industry startup costs can be daunting, but understanding these expenses is crucial for effective financial planning.

Tips for Reducing Startup Costs

- Consider partnering with established companies to share resources and reduce individual financial burdens.

- Explore leasing equipment instead of purchasing to minimize upfront costs.

- Utilize technology to streamline operations, which can help in reducing oil exploration overhead costs.

By carefully assessing and planning for these startup costs, entrepreneurs can better navigate the complexities of launching an oil and gas exploration company while positioning themselves for long-term success in the industry.

Is It Possible To Start An Oil And Gas Exploration Company With Minimal Investment?

Starting an oil and gas exploration company typically comes with significant financial burdens. However, with strategic planning and innovative approaches, it is possible to minimize initial investment. The average costs to start an oil exploration company can vary widely but usually fall between **$1 million to $5 million** for a full-scale operation. To embark on the journey with minimal investment, consider the following strategies:

Tips for Reducing Startup Costs

- Leverage Existing Resources: Partner with established firms or utilize rental agreements for drilling equipment instead of outright purchases.

- Focus on Niche Markets: Target smaller, less competitive areas within the oil and gas industry that may have unexplored reserves but lower initial expenses.

- Utilize Technology: Invest in advanced software and technology that can predict oil reserves accurately, reducing geological survey costs.

- Consider Joint Ventures: Collaborate with other companies to share costs of land acquisition and operational expenses, allowing for a reduced financial burden.

- Seek Grants and Funding: Explore governmental and private grants aimed at environmentally sustainable practices, which can help offset costs.

One possible route for minimizing the startup costs of oil and gas exploration lies in focusing on efficient land acquisition and leasing strategies. Instead of purchasing land, many new companies opt for leasing agreements, which can significantly lower upfront financial requirements. In some regions, land leasing for oil exploration can cost as little as **$1,000 to $5,000 per acre**, dramatically reducing the initial investment compared to outright purchases.

Additionally, geological and geophysical surveys, crucial for determining viable drilling locations, can be managed through strategic partnerships with specialized firms. This collaboration helps control expenses for oil exploration startups, with average survey costs ranging from **$50,000 to $200,000**, depending on the complexity of the analysis.

Another area where new companies can mitigate costs is technology. Instead of investing heavily in proprietary software, many emerging firms leverage cloud-based solutions that offer flexible pricing structures, which can range from **$500 to $1,500 per month**. This approach not only reduces initial costs but also ensures access to the latest technology.

While the journey to establish an oil and gas exploration company with minimal investment is challenging, it is not impossible. With careful financial planning and a keen understanding of the industry’s landscape, new ventures like EcoEnergy Explorers can thrive while prioritizing sustainability and efficiency.

Which Costs Can Be Reduced For An Oil And Gas Exploration Company?

Starting an oil and gas exploration company can be financially daunting. However, there are several areas where costs can be minimized without compromising the integrity and safety of operations. Here are the main costs that can often be reduced:

1. Land Acquisition and Leasing Costs

One of the most significant expenses for oil exploration startups is land acquisition. To reduce these costs, consider:

Leasing vs. Buying

- Leasing land instead of outright purchasing it can lead to substantial savings. Many new companies utilize agreements that allow them to explore potential sites without the hefty upfront investment required for purchasing land.

2. Geological and Geophysical Survey Expenses

Investing in advanced technology for geological surveys is critical, but costs can be slashed through:

Leveraging Data Sharing

- Utilize publicly available geological data or partner with established companies to share the costs of surveys and exploration.

3. Initial Infrastructure Setup Costs

Infrastructure can demand a large portion of your startup budget. To keep this in check:

Modular Solutions

- Opt for modular construction techniques for temporary facilities, reducing initial capital outlay while still providing necessary operational capabilities.

4. Technology and Software Development Expenses

Technology is crucial in the oil and gas sector but can be expensive. Consider the following:

Open-Source Software

- Utilizing open-source software can significantly reduce technology costs while still providing robust tools for exploration and data analysis.

5. Legal and Consulting Fees

Legal costs can be a hidden burden. You can mitigate these by:

Building In-House Expertise

- Hiring knowledgeable personnel who can navigate the legal landscape can reduce reliance on costly external consultants, leading to lower overall legal expenses.

6. Insurance and Bonding Requirements

Insurance is essential for managing risks, but expenses can spiral. To control these costs:

Risk Management Strategies

- Implementing effective risk management and safety protocols may lead to lower insurance premiums over time.

By strategically managing these costs, EcoEnergy Explorers can position itself competitively within the oil and gas exploration market while aligning its operations with the principles of sustainability. For further insights on navigating startup costs in the oil and gas sector, refer to industry insights on profitability and key performance indicators.

Examples of Startup Budgets for Oil and Gas Exploration Companies

Starting an oil and gas exploration company like EcoEnergy Explorers involves significant financial planning and an understanding of various startup costs in the oil and gas industry. A comprehensive oil and gas exploration startup budget typically includes the following components:

- Land Acquisition and Leasing: Costs can range from $1,000 to $5,000 per acre, depending on the location and rights involved.

- Geological and Geophysical Surveys: Initial geological surveys can set you back between $50,000 to $150,000, while more detailed geophysical surveys may cost up to $200,000.

- Drilling Equipment Purchase or Leasing: Depending on the scale of operations, leasing can be around $3,000 to $10,000 per month, while outright purchase can climb into the millions.

- Environmental Impact Assessments: These assessments generally cost between $50,000 to $250,000, reflecting the importance of risk mitigation.

- Permitting and Regulatory Compliance: Depending on the region, this can amount to $10,000 to $100,000, factoring in various local regulations.

- Initial Infrastructure Setup Costs: Costs can vary widely, but expect to invest $100,000 to $1 million in essential infrastructure.

- Technology and Software Development: Investment in technology can range from $50,000 to $500,000, specifically for data analysis tools and drilling software.

- Legal and Consulting Fees: Engaging with experts can easily amount to $20,000 to $100,000 depending on the consultation scope.

- Insurance and Bonding Requirements: Insuring drilling operations may cost $30,000 to $200,000 annually based on coverage levels.

A sample startup budget for an oil exploration company with an initial investment in oil exploration can look like this:

- Land Acquisition: $500,000

- Geological Surveys: $100,000

- Drilling Equipment Leasing: $120,000

- Environmental Assessments: $150,000

- Permitting: $50,000

- Infrastructure Setup: $300,000

- Technology Costs: $200,000

- Legal Fees: $50,000

- Insurance: $80,000

The total initial budget for this hypothetical startup reaches approximately $1.65 million. This amount highlights the importance of proper financial planning for oil and gas exploration, ensuring that all oil and gas business expenses are accounted for effectively.

Tips for Effective Budgeting

- Always include a contingency fund of at least 10-20% to cover unexpected costs.

- Regularly review and adjust your budget based on ongoing expenses and operational changes.

- Utilize software tools for financial planning for oil and gas to streamline your budget tracking.

For further insights, you can refer to this article on [cost breakdown for oil exploration](https://financialmodeltemplates.com/blogs/opening/oil-and-gas-exploration) which provides additional details on establishing a successful oil exploration startup budget.

How to Secure Enough Funding to Start an Oil and Gas Exploration Company?

Securing adequate funding for an oil and gas exploration startup, like EcoEnergy Explorers, is a crucial step in transforming your vision into reality. With the cost to start an oil exploration company often exceeding $1 million for initial phases, a well-structured financial plan becomes paramount. Here are several methods to consider for securing funding:

1. Venture Capital and Private Equity

These firms often seek high-return opportunities, and the oil and gas industry, despite its challenges, remains attractive. The oil and gas industry startup costs can be daunting, but venture capitalists or private equity can inject necessary capital in exchange for equity stakes.

2. Bank Loans and Credit Facilities

Approaching financial institutions for loans can be a feasible alternative. Be prepared to present a comprehensive business plan, as oil and gas exploration startup budgets require detailed financial forecasting.

3. Crowdfunding

With the rise of crowdfunding platforms, raising smaller amounts of money from a large number of people can be a viable option. Engaging potential investors in your mission of sustainable exploration might attract sufficient resources.

4. Joint Ventures

Partnering with established companies can mitigate financial risks. A joint venture allows for shared costs and access to established operational networks, reducing overall oil and gas business expenses.

5. Government Grants and Incentives

Various governments provide grants for energy sustainability projects. Researching available grants can unveil funding opportunities that align with your commitment to responsible practices.

Tips for Securing Funding

- Develop a comprehensive financial model that outlines your projected initial investment in oil exploration, operational costs, and expected ROI.

- Network within industry circles to gain insights into potential investors and funding sources.

- Utilize platforms that specialize in oil and gas to identify suitable funding opportunities.

- Stay updated on industry trends to appeal to the interests of potential financiers.

According to industry benchmarks, investors expect a return on investment in the range of 15-20% annually from oil exploration projects. This statistic underscores the importance of presenting a robust business case to potential financial partners, emphasizing your unique approach to sustainable practices.

Ensuring your funding strategies align with your financial planning for oil and gas will attract the necessary investment to set your oil and gas exploration startup on the path to success. Whether through traditional means or innovative funding models, the right approach can make a significant difference in your startup journey.

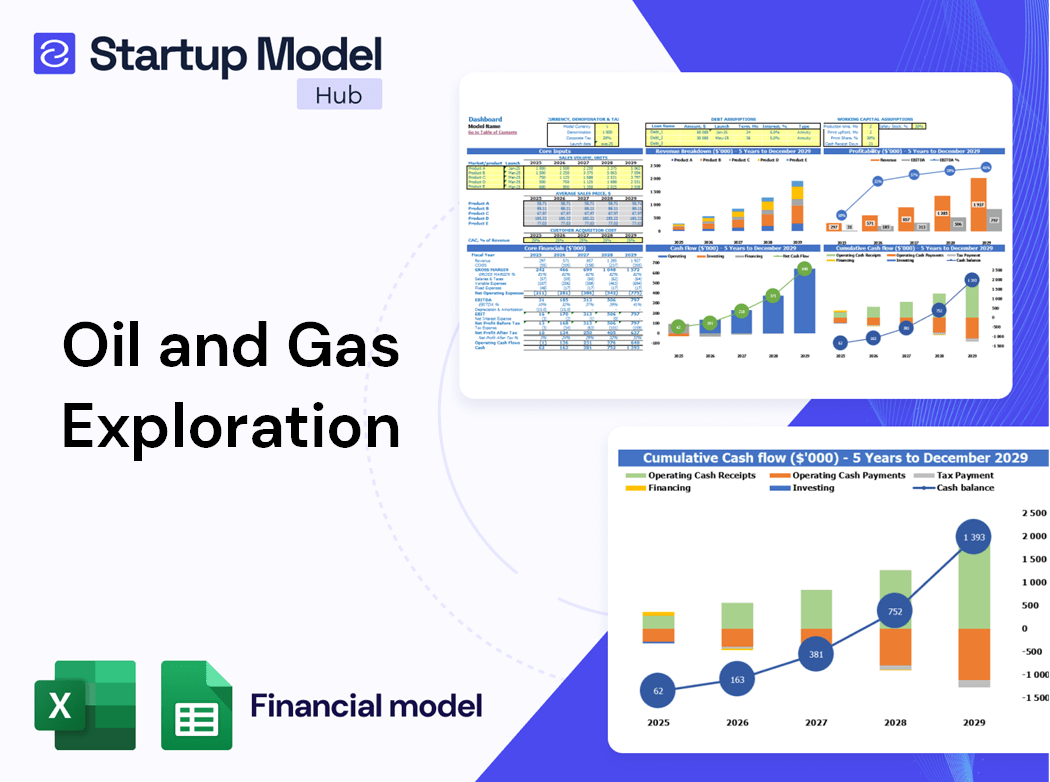

How to Use the Financial Plan for Your Oil and Gas Exploration Company?

Creating a financial plan is critical for the success of your oil and gas exploration startup, such as EcoEnergy Explorers. A well-structured financial plan allows you to forecast expenses, allocate resources efficiently, and secure funding. Here are key components and strategies to consider:

1. Outline Your Startup Costs

To effectively use your financial plan, you need to detail the startup costs for oil and gas exploration. Here’s a breakdown of major costs:

- Land Acquisition and Leasing Costs: Depending on location, costs can range from $25,000 to over $1 million.

- Geological and Geophysical Survey Expenses: Initial assessments can cost between $10,000 to $200,000.

- Drilling Equipment Purchase or Leasing: This can account for 20-30% of your total startup costs.

- Environmental Impact Assessment Fees: Expect fees to vary from $5,000 to $50,000, depending on the scope.

- Permitting and Regulatory Compliance Costs: Costs can be as low as $10,000 or exceed $100,000.

- Insurance and Bonding Requirements: Budget for about 5-10% of your projected costs.

2. Monitor Ongoing Operating Expenses

Your financial plan should also include ongoing oil and gas business expenses. Typical operating costs include:

- Labor and staffing

- Equipment maintenance

- Fuel and logistics

- Continued geological assessments

3. Use Financial Ratios and Benchmarks

Utilize financial ratios and benchmarks from the oil and gas industry to monitor your performance. For instance, a typical return on investment (ROI) in this sector can center around 10-15%. Regularly comparing your figures with industry standards helps in identifying areas for improvement.

4. Secure Funding with a Robust Financial Forecast

To attract investors, include a detailed budget for your oil exploration company, showcasing your estimated revenue and projected timeline for profitability. Consider financing options such as:

- Private equity or venture capital

- Bank loans or credit lines

- Government grants for sustainable energy projects

Tips for a Successful Financial Plan

- Regularly update your financial plan to reflect changes in market conditions or project advancements.

- Incorporate a contingency budget to handle unexpected costs, typically around 10-15% of total expenses.

- Engage with financial advisors who specialize in the oil and gas sector to ensure accuracy and compliance.

By implementing these strategies in your financial planning for oil and gas, you can confidently navigate the complex landscape of the industry and position EcoEnergy Explorers as a leader in sustainable resource extraction.

What Are The Expenses To Start An Oil And Gas Exploration Company?

Starting an oil and gas exploration company requires a significant financial commitment and understanding of various expenses involved. As the industry is capital-intensive, it is essential to carefully consider the startup costs associated with launching a new venture like EcoEnergy Explorers, which focuses on innovative technology and sustainable practices.

Land Acquisition and Leasing Costs

One of the initial expenses for the oil exploration startup is securing land for exploration and drilling. The cost can vary widely depending on location and availability:

- Land leasing fees can range from $5 to $50 per acre depending on the region.

- Purchasing land outright can cost upwards of $1,000 per acre, particularly in areas with proven reserves.

Geological and Geophysical Survey Expenses

Conducting geological surveys is crucial for identifying viable drilling locations. These expenses can add up quickly:

- Typical costs for geological surveys can range from $10,000 to $100,000 depending on the complexity and size of the area being surveyed.

- Geophysical surveys may cost an additional $50,000 to $150,000 for advanced technology implementation.

Drilling Equipment Purchase or Leasing

The costs associated with drilling equipment can be substantial. A rough estimate includes:

- Purchasing drilling rigs could range from $2 million to $15 million, depending on the technology used.

- Leasing equipment might provide a more affordable option, with costs ranging from $25,000 to $100,000 per month.

Environmental Impact Assessment Fees

Before commencing operations, an environmental impact assessment is often required:

- Fees for these assessments can vary, frequently costing between $20,000 to $200,000.

- This stage is critical in ensuring compliance with environmental regulations and maintaining the company’s reputation.

Permitting and Regulatory Compliance Costs

Obtaining necessary permits and adhering to regulatory requirements is another significant cost:

- Permitting fees can range from $5,000 to $50,000 and vary by state and local regulations.

- Costs for ongoing compliance can total over $100,000 annually, depending on the specific operations.

Initial Infrastructure Setup Costs

Establishing essential infrastructure is vital for operations:

- Initial setup for drilling sites, access roads, and facilities can cost between $500,000 to $5 million.

- Connection to utility services and transportation routes may incur additional expenses.

Technology and Software Development Expenses

Investing in technology is crucial for modern oil and gas exploration:

- Software solutions for managing data and operations can vary, often costing around $10,000 to $100,000.

- Advanced drilling technologies and automation can potentially add several million dollars to the initial investment.

Legal and Consulting Fees

Engaging legal and consulting professionals is essential to navigate the complexities of the oil industry:

- Initial legal costs for contracts and compliance can add up to $20,000 to $200,000.

- Consulting fees may vary widely, needing budget allocations of $10,000 to $100,000.

Insurance and Bonding Requirements

Insurance is a critical component for mitigating risks:

- Costs for general liability insurance can range from $5,000 to $100,000 annually, depending on coverage.

- Bonding requirements, necessary for compliance, can also add $10,000 to $50,000 in upfront costs.

Tips to Manage Oil and Gas Exploration Startup Expenses

- Consider phased exploration to manage costs more effectively.

- Leverage technology partnerships to reduce initial tech expenses.

- Seek government grants or incentives aimed at sustainable practices.

In preparing a comprehensive oil and gas exploration startup budget, understanding these expenses is vital for effective financial planning. Comprehensive data can be found through resources discussing the profitability and cost structures of oil and gas exploration.

Land Acquisition And Leasing Costs

One of the most significant startup costs for an oil and gas exploration company like EcoEnergy Explorers is the acquisition and leasing of land. This initial investment is critical as it directly influences the viability of exploration and extraction operations.

Typically, land acquisition costs can vary widely depending on several factors, including location, size, and the local market conditions. In the oil and gas industry, these costs can range from a few thousand dollars to millions. For instance, prime locations in established oil fields may command higher premiums, while less explored regions may offer more competitive rates.

| Type of Land Acquisition | Estimated Cost per Acre | Examples |

|---|---|---|

| Purchased Land | $1,500 - $3,000 | Established oil regions |

| Leased Land | $100 - $600 | Emerging exploration sites |

In addition to the initial land costs, companies must also consider the ongoing expenses for land leasing. Leasing agreements often span several years and include annual fees, which can add significant financial pressure. Furthermore, depending on the jurisdiction, environmental fees related to land use may also apply, increasing overall costs.

Tips for Managing Land Acquisition Costs

- Conduct thorough market research to identify the best opportunities for land leasing or acquisition.

- Negotiate terms that allow for cost reductions, such as longer lease periods with lower annual fees.

- Explore options for joint ventures to share costs and risks associated with land acquisition.

Ultimately, careful financial planning for oil and gas exploration is essential. Understanding the breakdown of these land acquisition and leasing costs is critical for creating an effective oil and gas exploration startup budget. For more detailed financial models and strategies to navigate these costs effectively, check out [this resource](https://financialmodeltemplates.com/products/oil-and-gas-exploration-financial-model).

In summary, accurately assessing and planning for land acquisition and leasing costs is crucial in determining the overall expenses for oil exploration startup. These costs can significantly impact both short-term cash flow and long-term operational viability.

Geological and Geophysical Survey Expenses

In the oil and gas exploration industry, geological and geophysical survey expenses represent a significant portion of the overall startup costs. These surveys are crucial for assessing the potential of a site before any drilling takes place. The cost can vary widely depending on the location, geological conditions, and the methods employed.

Typically, the expenses for geological and geophysical surveys can be broken down into several key components:

| Expense Type | Estimated Cost | Remarks |

|---|---|---|

| Seismic Surveys | $20,000 - $500,000 | Varies based on area size and technology used |

| Geological Mapping | $10,000 - $200,000 | Detailed mapping of geological features |

| Sample Analysis | $5,000 - $50,000 | Testing rock samples for resource potential |

For a startup like EcoEnergy Explorers, the investment in geological and geophysical surveys is not merely a cost but an essential strategy for minimizing future risks. The right surveys can lead to more informed decisions about where to drill, ultimately saving time and money in the long run. It is crucial to plan for these expenses within the oil and gas exploration startup budget.

Additionally, companies must factor in costs related to the tools and technology used for these surveys. Modern techniques such as 3D seismic imaging can provide more accurate data but come at a higher price. The balance between cost and the quality of information is a critical component of financial planning for oil and gas endeavors.

Tips for Managing Geological Survey Expenses

- Conduct thorough research on the latest surveying technologies to ensure optimal data quality for lower costs.

- Consider partnering with established firms to leverage their expertise and share costs.

- Utilize government grants or incentives available for sustainable exploration practices to help offset costs.

Understanding the potential costs associated with geological surveys can help in the overall cost breakdown for oil exploration. With reported costs ranging from $30,000 to upwards of $1 million depending on the survey depth and technology used, it’s important to secure funding for these initial investments early in the process.

Furthermore, adhering to environmental regulations will increase your initial expenditure due to the necessary environmental impact assessments related to these surveys. Budgeting for environmental fees oil exploration is essential, particularly for a company like EcoEnergy Explorers, which stresses sustainable practices in its operational model.

Ultimately, geological and geophysical surveys represent foundational steps in establishing a successful oil and gas exploration venture. Proper budgeting and financial strategy in these areas can lead to better returns on investment and contribute to a responsible energy future.

For those looking to create a detailed budget for their oil exploration company or seeking various financing options, more resources can be found at Oil and Gas Exploration Financial Model.

Drilling Equipment Purchase or Leasing

The cost to start an oil exploration company significantly hinges on one of its most critical components: drilling equipment. This equipment is essential for extracting resources efficiently and safely, and can represent a substantial portion of your oil and gas business expenses. The options available for acquiring this equipment typically include purchasing or leasing, each with its own set of advantages and implications for your startup budget.

For new companies like EcoEnergy Explorers, the financial burden of purchasing drilling equipment outright can be daunting. On average, purchasing new drilling rigs can cost anywhere between $1 million to $20 million or more, depending on the size and capabilities of the rig. Alternatively, leasing can provide a more manageable initial investment for oil exploration while preserving cash flow. Leasing payments can range from $10,000 to $50,000 per month, depending on the equipment and lease terms.

Here’s a breakdown of common drilling equipment costs:

| Equipment Type | Purchase Cost | Monthly Lease Cost |

|---|---|---|

| Land Rigs | $1 million - $10 million | $20,000 - $50,000 |

| Offshore Rigs | $10 million - $20 million | $50,000 - $150,000 |

| Directional Drilling Equipment | $500,000 - $3 million | $10,000 - $30,000 |

When considering your drilling equipment purchase or leasing options, it is essential to evaluate the following:

Key Considerations for Drilling Equipment

- **Type of exploration**: The equipment needed will vary based on whether you’re pursuing onshore or offshore drilling.

- **Duration of projects**: For short-term projects, leasing may be more financially viable, while long-term endeavors might justify a purchase.

- **Technology advancements**: Keeping up with technology can reduce operational costs; hence an assessment of current vs. newer technology should be part of your strategy.

Additionally, it’s crucial to forecast ongoing maintenance and operational costs associated with your drilling equipment. These can account for an estimated 15-20% of the initial equipment cost annually. Regular inspections and maintenance can prevent larger repair expenses down the line, making financial planning for oil and gas essential.

By considering the operational landscape and weighing the costs of owning versus leasing drilling equipment, startups like EcoEnergy Explorers can make informed decisions that align with financial sustainability and project goals.

In summary, navigating the startup costs of oil and gas exploration, particularly drilling equipment, requires thorough financial planning. Utilizing tools such as a comprehensive financial model can significantly aid in this process. For those looking to secure their financing, detailed planning and a clear budget are critical components to ensure a robust launch into the oil and gas industry. More detailed insights and tools can be found here.

Environmental Impact Assessment Fees

When launching an oil and gas exploration company such as EcoEnergy Explorers, one of the significant components of your startup costs is the Environmental Impact Assessment (EIA) fees. An EIA is a crucial process that evaluates the potential environmental effects of your proposed exploration activities. This assessment not only helps ensure compliance with legal frameworks but also demonstrates your commitment to sustainable practices in the oil and gas industry.

The costs involved in conducting an EIA can vary widely based on several factors, including the scope of the project, the geographic location, and the specific regulatory requirements of the region. On average, the expenses for an EIA can range from $20,000 to over $500,000, depending on these variables.

Here’s a breakdown of the typical costs associated with Environmental Impact Assessments:

| Cost Factor | Average Cost Range | Notes |

|---|---|---|

| Initial Assessment Fee | $5,000 - $20,000 | Preliminary evaluations and documentation. |

| Public Consultation | $10,000 - $50,000 | Engaging stakeholders and addressing public concerns. |

| Technical Studies | $15,000 - $300,000 | Detailed analysis of ecological impacts, including flora and fauna assessments. |

| Final Report Preparation | $5,000 - $20,000 | Documentation and submission to regulatory bodies. |

Given that an EIA is a mandatory component of the permitting process for oil exploration, understanding and budgeting for these fees is essential for any startup in the sector. The impact assessment not only aids in risk mitigation but also enhances your credibility with investors and regulatory authorities.

Tips for Managing EIA Costs

- Engage with local authorities early on to understand specific EIA requirements in your area.

- Consider bundling studies to save costs—sometimes, you can combine geological surveys with your EIA.

- Utilize technology for data collection and analysis, which can reduce both time and costs associated with traditional methods.

To navigate the complexities of EIA fees effectively, it's also beneficial to consult with experienced professionals or legal experts specializing in the oil and gas sector. They can provide insights on impact assessment costs for oil projects and help you develop a comprehensive financial plan that includes these necessary expenses. The right financial strategy will be a cornerstone of success in your oil exploration startup.

Moreover, aligning your exploration endeavors with sustainable practices can provide a competitive edge in the market. Investors are increasingly looking for companies that prioritize environmental considerations alongside traditional financial metrics. Thus, understanding the costs associated with environmental assessments is not just an overhead; it's an investment in your company's long-term reputation and viability.

For more insights and detailed budgeting tools tailored to the oil and gas industry, consider visiting this resource to enhance your financial planning for oil and gas exploration.

Permitting and Regulatory Compliance Costs

The oil and gas exploration industry is highly regulated, and understanding the permitting and regulatory compliance costs is crucial for any startup. These costs are essential components of the overall startup costs for oil and gas exploration, and they can significantly impact the oil and gas exploration startup budget.

Typically, the costs associated with obtaining the necessary permits and complying with regulations can vary widely based on the geographical location and the specific activities planned. On average, companies may incur anywhere from $50,000 to $500,000 solely for permitting and compliance, depending on the complexity of the project and local regulations.

The following are key components contributing to permitting and regulatory compliance costs in the oil and gas sector:

- Environmental Impact Assessments (EIAs): This cost can range from $20,000 to $200,000 depending on the scope and complexity of the assessment required by local environmental agencies.

- Permitting Fees: These can also fluctuate, with initial application fees often falling between $5,000 and $50,000, depending on the jurisdiction.

- Legal and Consulting Fees: Engaging legal experts and consultants to navigate regulatory frameworks can cost upwards of $100,000, especially for larger projects that require extensive documentation and negotiation.

- Compliance Monitoring: After obtaining permits, ongoing compliance monitoring might require annual expenditures of $10,000 to $50,000 to ensure adherence to environmental standards.

Ultimately, these costs highlight the importance of meticulous financial planning for oil and gas ventures. Each dollar spent on permitting and compliance is an investment in securing the legal groundwork necessary for exploration.

Tips for Managing Permitting Costs

- Begin the permitting process early to avoid delays that can lead to increased costs.

- Leverage technology to streamline documentation and improve communication with agencies.

- Consult with local experts who have experience navigating regulatory terrain to ensure compliance.

To further illustrate the financial impact, consider the following table that outlines potential costs associated with permitting and compliance:

| Cost Element | Estimated Cost Range |

|---|---|

| Environmental Impact Assessment | $20,000 - $200,000 |

| Permitting Fees | $5,000 - $50,000 |

| Legal and Consulting Fees | $100,000+ |

| Compliance Monitoring | $10,000 - $50,000 (annual) |

These figures underscore the necessity of careful budgeting in the overall cost breakdown for oil exploration. Moreover, a detailed budget for your oil exploration company should encapsulate these expenses to avoid financial pitfalls.

To delve deeper into the financial planning aspect, consider using tailored financial models available at this link, which can assist in developing a solid budget for your startup.

Initial Infrastructure Setup Costs

Setting up the initial infrastructure for an oil and gas exploration company, such as EcoEnergy Explorers, can be a substantial part of the overall startup costs for oil and gas exploration. These costs encompass a range of necessary elements to ensure the company operates efficiently and adheres to regulatory requirements. Here’s a breakdown of typical infrastructure expenses:

| Expense Item | Estimated Cost (USD) | Description |

|---|---|---|

| Site Preparation | $100,000 - $500,000 | Clearing and prepping land for drilling operations. |

| Road Construction | $50,000 - $300,000 | Building access roads for transport and equipment movement. |

| Utility Setup | $20,000 - $100,000 | Establishing power, water, and waste management systems. |

| Permanent Facilities | $200,000 - $1,000,000 | Construction of offices, workshops, and storage facilities. |

These oil and gas business expenses can vary widely based on location, project scale, and specific operational needs. For instance, in remote areas, the costs may increase due to challenges in logistics and accessibility.

In addition to these physical infrastructures, there are other essential considerations:

- Communication Systems: Establishing reliable communication networks is crucial and can range from $10,000 to $50,000.

- Environmental Compliance: Infrastructure must adhere to strict environmental regulations, which could add an additional $20,000 to $100,000 in setup costs.

- Health and Safety Facilities: Developing adequate safety measures and facilities is necessary for workforce protection, costing around $50,000 to $200,000.

Tips for Reducing Initial Infrastructure Setup Costs

- Consider leasing equipment instead of purchasing to minimize upfront expenses.

- Partner with local contractors who understand the region for cost-effective solutions.

- Employ modular building techniques for quick and flexible infrastructure development.

Understanding the initial infrastructure costs is vital for effective financial planning for oil and gas. A detailed budget for oil exploration should account for unexpected surges in pricing or delays that might inflate expenses. On average, the total cost to start an oil exploration company could range from $500,000 to several million dollars, depending on the scale of operations.

Organizations like EcoEnergy Explorers should also create a strategic plan for managing these costs over time. Establishing efficient operational practices and adhering to a disciplined budget could lead to significant savings in the long term.

For further insights into financial modeling and planning for your oil and gas exploration startup, check out this comprehensive resource: Oil and Gas Exploration Financial Model.

Technology and Software Development Expenses

In the oil and gas exploration industry, technology and software development expenses play a critical role in modernizing operations and increasing efficiency. With a strong focus on data analytics, geological modeling, and remote monitoring, these technological investments are essential to remain competitive while adhering to sustainable practices. The **startup costs for oil and gas exploration** can vary significantly depending on the scale and scope of the technology utilized.

These expenses can be categorized into the following key components:

- Geographic Information Systems (GIS): Licensing and maintenance of GIS software can range from $10,000 to $50,000 annually, depending on the complexity of the tools chosen.

- Reservoir Simulation Software: Advanced simulation tools, necessary for modeling subsurface conditions, can incur costs of up to $100,000 for initial licenses and training.

- Data Acquisition Technologies: Implementing sensors, drones, and satellite monitoring systems may require an initial investment between $30,000 and $200,000, depending on the required capabilities.

- Analytics Platforms: The integration of big data analytics to assess drilling data could lead to expenses as high as $50,000 for software licenses and startup training.

- Custom Software Development: Creating tailored solutions to maximize operational efficiency and productivity may range from $20,000 to $150,000.

A well-structured financial plan for your oil and gas exploration company must consider these technology costs. For instance, an effective **oil and gas exploration startup budget** often allocates around **15-20% of the overall budget** specifically for technology and software development.

Tips for Managing Technology Expenses

- Prioritize open-source software where applicable to reduce initial investment costs.

- Implement phased technology adoption to spread out expenses over time.

- Consider partnerships with tech firms to leverage their expertise and reduce costs.

For EcoEnergy Explorers, leveraging the latest technology is not just about cutting costs, but rather enhancing exploration capabilities. **Initial investment in oil exploration** can be daunting, making it imperative to analyze the cost breakdown for oil exploration systematically.

| Technology Type | Estimated Cost | Notes |

|---|---|---|

| GIS Licensing | $10,000 - $50,000 | Annual costs for software. |

| Reservoir Simulation Software | $100,000 | Including training costs. |

| Data Acquisition Technologies | $30,000 - $200,000 | Varies based on technology requirements. |

| Analytics Platforms | $50,000 | For data management and analysis. |

| Custom Software Development | $20,000 - $150,000 | Tailored solutions for operations. |

As the oil and gas industry evolves, embracing technological advancements is crucial. The **expenses for oil exploration startup** must encompass these software and technology costs to align with EcoEnergy Explorers' mission of sustainable practices. Investing in cutting-edge tools not only enhances exploration success but also ensures compliance with increasingly stringent environmental regulations, ultimately leading to a more responsible energy future.

For a deeper dive into creating a financial model exclusive to oil and gas exploration, explore comprehensive financial planning tools available at this link.

Legal and Consulting Fees

Starting an oil and gas exploration company like EcoEnergy Explorers requires careful consideration of various legal and consulting fees, which constitute a significant part of the overall startup costs oil and gas exploration. These expenses can vary widely depending on the scope of operations, the geographical location, and the complexity of legal requirements involved in the exploration process.

Legal fees may include costs related to:

- Forming a legal business entity (e.g., LLC, Corporation)

- Drafting and negotiating contracts for land leases and drilling rights

- Compliance with federal, state, and local regulations

- Environmental law consultations and assessments

- Litigation or dispute resolution costs if necessary

Consulting fees can also be significant, especially when seeking out expert guidance in areas like environmental impact assessments and geological surveys. These services typically cost between $150 to $500 per hour, and comprehensive reports can add thousands to your budget. According to industry benchmarks, the average legal and consulting fees can range from 10% to 20% of the initial investment in oil exploration.

| Cost Type | Typical Cost Range | Percentage of Total Startup Costs |

|---|---|---|

| Legal Fees | $20,000 - $150,000 | 5% - 15% |

| Consulting Fees | $10,000 - $100,000 | 2% - 10% |

Given the critical nature of these fees, it is essential to engage with experienced professionals who specialize in the oil and gas industry startup costs. A poorly structured legal framework can lead to significant long-term expenses or jeopardize operations altogether. To minimize these costs, consider the following tips:

Tips for Managing Legal and Consulting Fees

- Conduct thorough research to identify reputable legal and consulting firms with experience in the oil and gas sector.

- Obtain multiple quotes and assess the cost-benefit ratio before deciding on service providers.

- Utilize technology for certain legal documentation needs where applicable to reduce costs.

Furthermore, the cost to start oil exploration company can be greatly influenced by effective financial planning. It is advisable to prepare a detailed budget that allocates funds accurately across the various legal and consulting requirements to ensure compliance while avoiding unnecessary expenditures.

Lastly, securing funding for your oil and gas exploration startup can be facilitated by presenting a well-structured budget that clearly outlines the oil and gas business expenses, including the anticipated legal and consulting fees. For more insights and detailed financial models tailored for the oil and gas industry, check out this resource: Oil and Gas Exploration Financial Model.

Insurance And Bonding Requirements

Starting an oil and gas exploration company, such as EcoEnergy Explorers, involves a myriad of costs, and one of the most critical considerations is the insurance and bonding requirements. The oil and gas industry is inherently risky, with potential liabilities from environmental damages, equipment failures, and workplace accidents. Therefore, securing the right insurance coverage is essential for protecting your startup's assets and operations.

The costs associated with insurance and bonding can vary significantly based on factors such as the scale of operations, location, and specific activities involved. Here's a breakdown of common expenses related to insurance and bonding:

| Type of Insurance | Estimated Annual Cost | Coverage Details |

|---|---|---|

| General Liability Insurance | $1,000 - $5,000 | Covers bodily injury, property damage, and personal injury claims. |

| Workers' Compensation Insurance | $2,000 - $10,000 | Provides coverage for employee injuries and illnesses. |

| Environmental Liability Insurance | $5,000 - $20,000 | Covers costs related to environmental cleanup and damages. |

| Bonding Costs | $1,500 - $10,000 | Guarantees funds for project completion and regulatory compliance. |

In addition to these basic types of insurance, you may also need to consider other coverage options, including:

- Equipment Insurance: Protects against damage or loss of drilling equipment.

- Business Interruption Insurance: Covers lost income due to unforeseen interruptions.

- Professional Liability Insurance: Shields against claims of negligence in professional services.

Understanding the specific insurance needs of your oil and gas exploration startup can help mitigate potential risks and ensure compliance with industry regulations. Here are a few tips for managing your insurance and bonding costs:

Tips for Managing Insurance Costs

- Shop around for quotes from multiple insurers to find the best rates.

- Consider bundling different types of insurance for potential discounts.

- Evaluate your coverage needs regularly to avoid overpaying for unnecessary policies.

Additionally, bonding requirements are essential for ensuring compliance with state and federal regulations. The costs associated with bonding can range widely based on the project size and associated risks. For example, a small-scale drilling operation might require a bond of $10,000, while larger projects could necessitate bonds of $100,000 or more.

In summary, while the startup costs in oil and gas exploration are significant, particularly in insurance and bonding, these expenses are crucial for establishing a secure and responsible business model. For more detailed financial planning and budgeting tailored to the oil and gas sector, consider exploring resources that provide comprehensive models and templates: Oil and Gas Exploration Financial Model.