Related Blogs

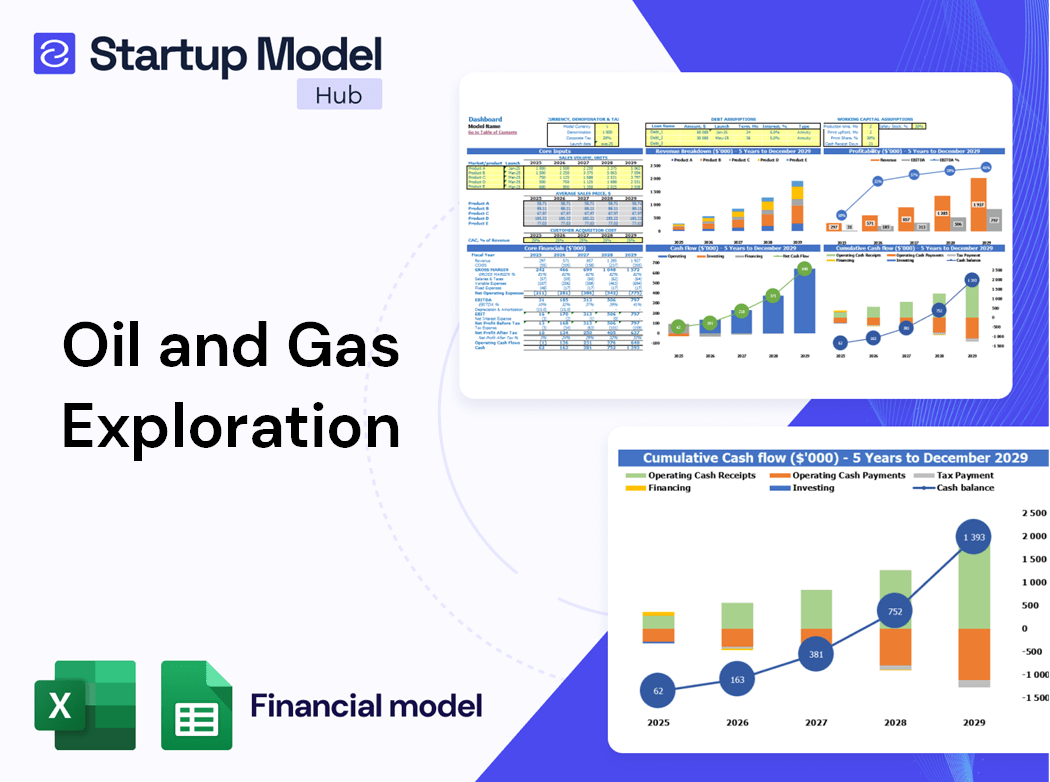

Are you aware of the seven essential KPI metrics that can transform your oil and gas exploration business? Understanding these key metrics not only enhances operational efficiency but also drives profitability and sustainability. Curious about how to calculate them effectively? Discover the insights you need to elevate your strategic planning by exploring our comprehensive resource here: Oil and Gas Exploration Financial Model.

Why Is Tracking KPI Metrics Important For Oil And Gas Exploration?

In the highly competitive landscape of the oil and gas exploration industry, the importance of KPI metrics cannot be overstated. Tracking core KPI metrics for oil and gas exploration allows companies like EcoEnergy Explorers to assess their performance, streamline operations, and ensure sustainable practices. With the industry's focus shifting towards environmental responsibility, integrating these metrics is essential for aligning with modern regulatory standards and public expectations.

Effective KPI tracking in the oil and gas industry provides valuable insights into both financial and operational performance. For instance, companies can monitor financial KPIs for oil and gas such as Return on Investment (ROI) and Cost Per Barrel Extracted, which are critical for evaluating profitability and operational efficiency. The average ROI in the oil sector can vary significantly, but industry benchmarks often hover around 15% to 20%, making it vital for businesses to stay above this threshold to remain competitive.

On the operational side, calculating KPIs for oil and gas such as Production Efficiency and Exploration Success Rate can help companies identify inefficiencies and enhance decision-making processes. For example, the average Exploration Success Rate in the industry is approximately 10% to 15%, thus highlighting the need for rigorous tracking and analysis to improve outcomes in future drilling endeavors.

Tips for Effective KPI Tracking

- Regularly review and update KPIs to align with changing market dynamics.

- Utilize advanced analytics and technology to gather real-time data for better decision-making.

- Ensure that all stakeholders understand the KPIs being tracked and their significance.

Furthermore, the oil and gas exploration performance metrics derived from these KPIs can drive strategic initiatives. Companies that effectively measure their performance are better positioned to make informed decisions, leading to improved environmental compliance and enhanced stakeholder satisfaction. The focus on sustainability is not just a trend; it’s becoming a necessity, with more than 70% of investors considering environmental, social, and governance (ESG) factors in their decision-making processes.

Overall, leveraging essential KPIs for oil and gas success is critical for companies like EcoEnergy Explorers to thrive in a rapidly evolving energy market. By prioritizing KPI tracking and analysis, businesses can navigate challenges while promoting a sustainable and responsible approach to resource extraction.

What Are The Essential Financial KPIs For Oil And Gas Exploration?

In the oil and gas exploration sector, financial KPIs are crucial for evaluating profitability, performance, and overall health of operations. EcoEnergy Explorers aims to integrate innovative technology and sustainable practices, making the tracking of these core KPI metrics for oil and gas exploration fundamental for strategic decision-making.

Here are several essential financial KPIs for oil and gas success:

- Return on Investment (ROI): This metric assesses the efficiency of an investment relative to its cost. A common benchmark for oil and gas companies is achieving an ROI of at least 15%, depending on market conditions.

- Cost Per Barrel Extracted: Understanding the cost per barrel is vital for maintaining profitability. Average figures in the industry can range from $20 to $50, with variations based on extraction methods and operational efficiency.

- Revenue per Employee: This KPI tracks overall productivity and can indicate operational efficiency. For the oil and gas sector, a healthy benchmark might be over $1 million per employee.

- Operating Cash Flow: Regular monitoring of cash flow is essential for ensuring liquidity. Oil and gas firms should aim for a positive cash flow ratio, ideally above 1.0, indicating that operating cash is sufficient to cover liabilities.

- Debt-to-Equity Ratio: This financial ratio provides insight into a company's leverage and risk. A ratio under 1.0 is generally preferred in the oil and gas sector to maintain a good credit rating.

- Gross Margin: The gross margin percentage indicates the portion of revenue that exceeds the cost of goods sold. An ideal gross margin for oil and gas firms can range between 40% and 60%.

- Exploration and Development (E&D) Costs: Tracking E&D costs is critical, with efficient companies often keeping these costs under 30% of total revenue.

Measuring these financial KPIs not only aids in keeping a close check on operational performance but also in fulfilling the importance of KPI metrics in oil and gas exploring better investment opportunities while minimizing risks.

Tips for Tracking Financial KPIs

- Regularly benchmark against industry standards to identify areas of improvement.

- Employ integrated software solutions for real-time KPI tracking and reporting.

- Ensure that all financial KPIs are aligned with strategic objectives to facilitate growth and sustainability.

For a comprehensive guide to KPIs in oil and gas, including methodologies for calculating KPIs for oil and gas, you can refer to resources like this article.

Which Operational KPIs Are Vital For Oil And Gas Exploration?

In the highly competitive and resource-intensive sector of oil and gas exploration, operational KPIs serve as essential indicators of efficiency, effectiveness, and overall performance. By focusing on these metrics, companies like EcoEnergy Explorers can ensure that their practices align with innovative technology and sustainability goals while optimizing resource extraction.

Here are some of the most vital operational KPIs to track:

- Production Efficiency: This metric measures the volume of oil and gas produced relative to the total resources consumed. A common benchmark for production efficiency is achieving over 80% efficiency in resource extraction.

- Exploration Success Rate: This KPI indicates the percentage of exploration projects that result in commercially viable discoveries. Industry standards suggest a healthy success rate is typically around 25-30%.

- Cost Per Barrel Extracted: Understanding the economic viability of operations is crucial. The average cost per barrel can vary significantly but should ideally be kept under $40 in a sustainable exploration model. This metric allows organizations to evaluate profitability directly.

- Environmental Compliance Rate: With a growing emphasis on sustainable practices, tracking compliance with environmental regulations is essential. Companies should aim for a compliance rate of 100% to mitigate risks associated with environmental impact.

- Return On Investment (ROI): This financial KPI tracks the profitability of exploration investments. A benchmark ROI of 10-15% is often deemed acceptable for oil and gas projects, ensuring stakeholders see value from their investments.

- Reserve Replacement Ratio: This metric evaluates a company's ability to replace extracted reserves with new discoveries. A ratio of 1 or greater indicates sustainable resource management, vital for long-term viability.

- Health and Safety Incident Rate: Safety is paramount in oil and gas operations. Tracking incidents per 200,000 hours worked, organizations should strive for a rate approaching 0 incidents to ensure a safe working environment.

- Average Daily Production Rate: This KPI measures daily output and is critical for production planning. A healthy average production rate varies by region but should generally fall within the range of 1,000 to 10,000 barrels per day, depending on the scale of operations.

Tips for Effective KPI Tracking

- Regularly review and adjust KPIs based on current market conditions and organizational goals.

- Utilize advanced software for real-time data tracking to enhance decision-making processes.

By closely monitoring these key operational KPIs, EcoEnergy Explorers and similar companies can not only enhance their performance but also contribute to a more sustainable and responsible oil and gas exploration industry.

How Frequently Does Oil And Gas Exploration Review And Update Its KPIs?

In the dynamic landscape of the oil and gas exploration industry, regularly reviewing and updating Key Performance Indicators (KPIs) is crucial to maintaining a competitive edge. Leading companies, like EcoEnergy Explorers, recognize that the KPI review frequency in oil and gas must be aligned with evolving market conditions, regulatory requirements, and technological advancements.

Typically, companies in this sector should conduct a thorough KPI analysis on a quarterly basis, allowing for timely adjustments in strategy. Moreover, annual comprehensive reviews are essential to ensure that the KPI metrics remain relevant and effectively measure the oil and gas exploration performance metrics. The following timeframes are commonly implemented:

- Quarterly reviews for operational KPIs to monitor ongoing performance, such as production efficiency and cost per barrel extracted.

- Annual reviews for financial KPIs to assess long-term trends, including return on investment and reserve replacement ratio.

- Mid-year assessments to adjust KPIs in response to significant market shifts or regulatory changes.

Data shows that companies that engage in frequent KPI reviews experience performance improvements of up to 20% compared to those that do not. This practice is essential for timely decision-making and risk management, especially in the context of environmental compliance and safety standards.

Tips for Effective KPI Review

- Utilize technology to automate KPI tracking and generate real-time reports.

- Involve cross-functional teams in the KPI review process to capture diverse insights.

- Benchmark against industry standards to ensure competitiveness.

- Adjust strategies rapidly based on KPI outcomes to mitigate risks.

Ultimately, integrating a structured KPI review process not only enhances operational efficiency but also supports strategic alignment with long-term goals, which is vital for companies like EcoEnergy Explorers committed to sustainable practices in oil and gas exploration.

What KPIs Help Oil And Gas Exploration Stay Competitive In Its Industry?

In the rapidly evolving landscape of the oil and gas exploration sector, it is essential for companies like EcoEnergy Explorers to utilize core KPI metrics for oil and gas exploration effectively. By honing in on relevant financial and operational KPIs, businesses can maintain a competitive edge while promoting sustainable practices.

Several key performance indicators play a crucial role in assessing and enhancing competitiveness:

- Production Efficiency: Measuring the production efficiency ensures that resources are utilized optimally. Industry benchmarks indicate that top performers achieve a production efficiency rate of above 80%, while others may struggle below 60%.

- Exploration Success Rate: A typical exploration success rate in the industry hovers around 10-20%. Companies that consistently exceed this range demonstrate superior geological expertise and operational excellence.

- Cost Per Barrel Extracted: This metric directly impacts profitability; industry leaders often keep their cost per barrel below $30, allowing them to thrive even in fluctuating market conditions.

- Environmental Compliance Rate: With a growing focus on sustainability, achieving an environmental compliance rate above 95% is becoming a baseline standard for competitive firms.

- Return On Investment (ROI): Aiming for an ROI of 15% or higher positions companies favorably in the eyes of investors and stakeholders, crucial for long-term viability.

- Reserve Replacement Ratio: A healthy reserve replacement ratio of at least 1.0 signifies that a company is effectively replenishing its reserves, essential for sustained exploration and production.

- Health And Safety Incident Rate: Maintaining a low incident rate is not only critical for employee wellbeing but also enhances corporate reputation. Companies achieving less than 1.0 incidents per million hours worked are seen as industry leaders.

- Average Daily Production Rate: Keeping an eye on average daily production rates provides insight into operational performance, with successful firms often reporting figures exceeding 10,000 barrels per day.

To effectively incorporate these KPIs into strategic planning, EcoEnergy Explorers can focus on the following:

Tips for Effective KPI Tracking

- Establish clear benchmarks for each KPI and regularly review performance against these standards.

- Utilize advanced analytics to forecast trends and make data-driven decisions that enhance operational performance.

By carefully monitoring these KPIs, EcoEnergy Explorers not only improves its operational efficiency but also positions itself as a leader in the oil and gas exploration industry, anticipating sector shifts while aligning with sustainability goals.

How Does Oil And Gas Exploration Align Its KPIs With Long-Term Strategic Goals?

Aligning core KPI metrics for oil and gas exploration with long-term strategic goals is vital for companies like EcoEnergy Explorers, which emphasizes sustainability and innovative technology. By measuring the right performance indicators, businesses can ensure they are on a trajectory toward achieving their vision of efficient resource extraction while minimizing environmental impact.

To effectively align KPI tracking in the oil and gas industry with strategic goals, organizations should focus on the following essential areas:

- Production Efficiency: Monitoring production efficiency allows companies to identify areas for improvement. For instance, a targeted increase of 10% in production efficiency could result in a substantial increase in output, positively affecting profitability.

- Exploration Success Rate: This metric helps gauge the effectiveness of exploration efforts. Companies should aim for an exploration success rate of at least 30%, a benchmark that reflects industry standards.

- Cost Per Barrel Extracted: Keeping track of this metric enables organizations to manage their budgets effectively. A lower cost per barrel means higher profit margins, with industry averages hovering around $30-$50 per barrel in efficient operations.

- Environmental Compliance Rate: As EcoEnergy Explorers champions sustainability, maintaining a high compliance rate (ideally above 95%) with environmental regulations is critical for long-term viability and public trust.

- Return on Investment (ROI): Measuring ROI provides insight into the profitability of exploration projects. Companies should strive for an ROI of at least 15% to ensure long-term growth.

- Health and Safety Incident Rate: This KPI is crucial for maintaining a safe working environment. Aiming for an incident rate below 2 incidents per million hours worked is a respected industry target.

- Stakeholder Satisfaction Index: Focusing on stakeholder satisfaction, including investors and local communities, can improve brand reputation and support sustainable practices.

Regularly revisiting these KPIs ensures they remain aligned with long-term strategic goals. It’s crucial to implement a structured KPI review frequency, such as quarterly assessments, to adapt to market changes effectively.

Tips for Aligning KPIs with Strategic Goals

- Integrate sustainability metrics into your financial KPIs for oil and gas to reflect EcoEnergy Explorers' commitment to environmental responsibility.

- Use data analytics tools to track operational KPIs in oil and gas exploration in real-time, facilitating quicker decision-making.

- Engage stakeholders in the KPI development process to ensure their needs and expectations are considered, increasing buy-in for strategic initiatives.

By keeping these performance metrics in focus and adjusting strategies accordingly, EcoEnergy Explorers can cultivate a competitive edge, ensuring sustainable practices and robust financial health in the ever-evolving oil and gas exploration landscape. For further insights and benchmarks, consider exploring additional resources on KPI analysis for oil and gas companies.

What KPIs Are Essential For Oil And Gas Exploration's Success?

In the dynamic landscape of oil and gas exploration, tracking the right core KPI metrics is crucial for achieving operational excellence and financial viability. EcoEnergy Explorers recognizes the importance of measuring performance in order to drive sustainability and efficiency in resource extraction. Here are some essential KPIs that play a vital role in determining success:

- Production Efficiency: This metric measures the amount of oil and gas produced relative to the resources consumed. A target of achieving a production efficiency of over 95% is often seen as industry standard.

- Exploration Success Rate: This KPI reflects the percentage of successful exploration projects. A success rate above 30% is typically considered effective in the industry, highlighting the need for strategic planning and technology integration.

- Cost Per Barrel Extracted: Understanding the cost per barrel is essential for financial KPIs in the oil and gas sector. Benchmarking this against an industry average of around $20-$30 can help identify areas for cost reductions.

- Environmental Compliance Rate: With increasing scrutiny on sustainability, maintaining a compliance rate of 100% with environmental regulations is critical.

- Return On Investment (ROI): Calculating ROI helps gauge the financial effectiveness of exploration activities. An ROI of greater than 15% is often targeted in successful operations.

- Reserve Replacement Ratio: This KPI indicates the ability to replace extracted reserves. A ratio of greater than 1 is needed to maintain production levels.

- Health And Safety Incident Rate: Monitoring safety metrics is vital, with a target incident rate of less than 1.0 incidents per 200,000 work hours.

- Average Daily Production Rate: This operational KPI tracks daily output, with a benchmark of around 1,000 barrels per day as a strong indicator of operational success.

- Stakeholder Satisfaction Index: Engaging stakeholders effectively can be quantified. Achieving a satisfaction score of above 80% can enhance corporate reputation and support.

To enhance tracking of these essential KPIs for oil and gas success, companies should regularly engage in KPI analysis, ensuring metrics align with long-term strategic goals. Additionally, the importance of KPI metrics in oil and gas cannot be overstated; they provide the necessary insights to make informed decisions amidst market fluctuations.

Tips for KPI Tracking

- Utilize comprehensive dashboards for real-time monitoring of operational KPIs in oil and gas exploration.

- Perform quarterly reviews to adjust financial KPIs for oil and gas according to market trends and performance data.

By integrating these core KPIs into their strategy, EcoEnergy Explorers is not just focused on profitability but also on fostering a sustainable and responsible energy future. For a more detailed guide on calculating KPIs for oil and gas, resources such as this article can be very insightful.

Production Efficiency

Production efficiency is a critical KPI metric in the oil and gas exploration sector, directly impacting both the economic viability and environmental sustainability of operations. In the context of EcoEnergy Explorers, enhancing production efficiency is paramount to minimizing costs and maximizing output while adhering to stringent environmental standards.

To effectively measure production efficiency, companies often use the Oil Production Efficiency Ratio (OPER), which can be calculated by the formula:

OPER = (Total Oil Produced / Total Oil Available for Production) x 100

This ratio reflects how effectively the available resources are being converted into usable product. For instance, if a company has 1 million barrels available for production and manages to extract 800,000 barrels, the production efficiency would be:

OPER = (800,000 / 1,000,000) x 100 = 80%

Tracking production efficiency allows companies to identify bottlenecks in the extraction process and implement strategies for improvement. EcoEnergy Explorers employs cutting-edge technology and best practices to enhance these efficiencies by:

Tips to Enhance Production Efficiency

- Utilize real-time data analytics to monitor extraction processes and equipment performance.

- Invest in advanced drilling technologies to reduce downtime and improve yield.

- Conduct regular maintenance and inspections to ensure that all equipment operates at optimal levels.

Additionally, industry benchmarks provide a reference point for evaluating production efficiency. According to the American Petroleum Institute (API), production efficiency rates typically range between 70% to 90% across the industry. Companies like EcoEnergy Explorers aim to exceed this average by implementing sustainable extraction practices and innovative technologies.

In terms of financial implications, an increase in production efficiency can significantly impact the cost per barrel extracted. For instance, a company achieving an 85% efficiency rate may reduce its extraction costs from $40 per barrel to $30 per barrel, illustrating a 25% cost reduction which can have profound implications on profitability.

| KPI Metric | Current Performance | Target Performance |

|---|---|---|

| Production Efficiency Ratio | 80% | 85% |

| Cost Per Barrel Extracted | $40 | $30 |

| Environmental Compliance Rate | 95% | 98% |

In conclusion, tracking the core KPI metrics for oil and gas exploration, specifically production efficiency, is essential for maintaining a competitive edge. As EcoEnergy Explorers embraces innovative technology and sustainable practices, the commitment to improving production efficiency aligns seamlessly with the broader goal of responsible energy production.

For further assistance in developing robust financial models tailored to oil and gas exploration, consider visiting EcoEnergy Explorers.

Exploration Success Rate

The exploration success rate is a critical KPI metric for oil and gas exploration companies, including innovative ventures like EcoEnergy Explorers. This metric measures the percentage of successful drilling operations relative to the total number of drilling attempts made. A high exploration success rate indicates efficient resource identification and extraction practices, essential for maintaining competitiveness in the oil and gas industry.

To calculate the exploration success rate, use the following formula:

| Total Successful Wells | Total Wells Drilled | Exploration Success Rate (%) |

|---|---|---|

| 5 | 10 | 50% = (5/10) 100 |

| 8 | 10 | 80% = (8/10) 100 |

| 3 | 10 | 30% = (3/10) 100 |

For businesses like EcoEnergy Explorers, maintaining a robust exploration success rate can lead to improved financial metrics for oil and gas. An optimal success rate not only drives profitability but also encourages sustainable practices by focusing on areas with the highest potential yield, thereby enhancing production efficiency in oil exploration.

Tips for Improving Exploration Success Rate

- Utilize advanced geological modeling to accurately predict drilling outcomes.

- Invest in technology and data analytics to optimize selection of drilling sites.

- Conduct thorough environmental assessments before beginning exploratory drilling, ensuring compliance with regulations.

According to industry reports, the average exploration success rate in the oil and gas sector hovers around 30% to 40%, but leading companies achieve rates exceeding 60% to 70%. This disparity highlights the importance of employing effective strategies and technologies. Companies should consistently review their KPI tracking for the oil and gas industry to adapt to market changes and enhance operational efficiency.

Enhancing the exploration success rate can contribute significantly to other important KPIs, such as the reserve replacement ratio and the health and safety incident rate. This interconnectedness underscores the necessity of a thorough approach to measuring oil and gas exploration performance metrics.

Ultimately, as EcoEnergy Explorers focuses on innovative technology and sustainable practices, tracking the exploration success rate becomes essential for aligning KPIs with strategic goals in oil exploration. By prioritizing this metric, companies can navigate the complexities of the industry while remaining committed to their mission of responsible energy management.

Cost Per Barrel Extracted

The Cost Per Barrel Extracted (CPBE) is a critical financial KPI for the oil and gas exploration industry, as it directly affects the profitability and sustainability of an operation. This metric reflects the total costs incurred in the extraction of oil, divided by the total barrels produced during a specific timeframe. By tracking CPBE, companies like EcoEnergy Explorers can optimize their operational efficiency while ensuring sustainable practices.

To calculate the Cost Per Barrel Extracted, the formula is straightforward:

CPBE = Total Extraction Costs / Total Barrels Extracted

Where:

- Total Extraction Costs include drilling, labor, equipment, and overhead costs.

- Total Barrels Extracted are the total volume of oil produced during that period.

Benchmarking against industry averages enhances the effectiveness of tracking this KPI. The current industry average CPBE varies widely, typically ranging from $15 to $40 per barrel, depending on location and extraction methods. For example, in the Permian Basin, one of the most productive regions, the average cost can be as low as $12 per barrel, while more challenging environments can push costs higher.

| Region | Average CPBE ($) | Notes |

|---|---|---|

| Permian Basin | $12 | High efficiency with lower extraction costs. |

| North Sea | $25-$40 | Higher due to challenging conditions. |

| Middle East | $10-$20 | Low costs attributed to rich oil reserves. |

Monitoring CPBE allows EcoEnergy Explorers to identify inefficiencies in the extraction process and adjust operational strategies. Additionally, this metric plays a significant role in financial forecasting and budgeting, thereby enhancing overall strategic planning. Understanding the importance of KPI metrics in oil and gas helps companies leverage financial and operational data for better decision-making.

Tips for Reducing Cost Per Barrel Extracted

- Implement advanced drilling technologies to increase efficiency.

- Optimize logistics for transporting extracted oil.

- Regularly assess equipment maintenance to reduce downtime.

- Utilize data analytics to identify and eliminate cost inefficiencies.

In the pursuit of sustainable practices, tracking environmental impacts along with CPBE is vital. Companies increasingly find that investments into environmental compliance can lead to long-term cost savings and enhanced corporate reputation. Thus, integrating environmental compliance metrics with financial KPIs yields a more rounded view of overall performance.

In summary, regularly calculating and analyzing the Cost Per Barrel Extracted not only supports operational efficiency but also aligns with EcoEnergy Explorers’ mission of integrating sustainable practices into oil and gas exploration. With innovations in technology and a focus on minimizing environmental impact, the goal is to maintain a competitive edge while operating responsibly.

For more insights into financial metrics that can drive performance in oil and gas exploration, consider exploring detailed financial models tailored for the industry by visiting this link.

Environmental Compliance Rate

The Environmental Compliance Rate is a crucial KPI in the oil and gas exploration industry, especially for companies like EcoEnergy Explorers that prioritize sustainability. This metric measures the percentage of operational practices that adhere to environmental regulations and standards set by governmental and international bodies. Given the growing demand for responsible energy practices, tracking this KPI ensures companies mitigate their environmental impact while maintaining operational efficiency.

To calculate the Environmental Compliance Rate, use the following formula:

| Formula | Description |

|---|---|

| Environmental Compliance Rate = (Number of Compliant Operations / Total Number of Operations) x 100 | This formula allows for a straightforward calculation of compliance levels within the operations. |

For example, if EcoEnergy Explorers conducted 100 operations and 98 of them were compliant with environmental regulations, the Environmental Compliance Rate would be:

Environmental Compliance Rate = (98 / 100) x 100 = 98%

Achieving a high Environmental Compliance Rate directly reflects a company’s commitment to sustainability and can significantly influence investor decisions, customer loyalty, and regulatory relationships. In the oil and gas sector, maintaining a compliance rate above 95% is often seen as a benchmark for industry leaders.

Additionally, regulatory bodies may impose penalties on companies that fail to meet compliance standards. These penalties can average between $10,000 to $250,000 per violation, highlighting the financial incentives behind maintaining a high compliance rate.

Tips for Enhancing Environmental Compliance Rate

- Implement regular environmental audits to identify and rectify non-compliance issues.

- Invest in employee training programs focused on environmental regulations and best practices.

- Utilize technology and innovative practices that enhance compliance tracking and reporting.

Moreover, the importance of KPI metrics in oil and gas cannot be overstated. Not only do they help in maintaining operational efficiency, but they also showcase a company's dedication to ethical practices in an industry that has often faced scrutiny. In fact, a recent study showed that companies with strong environmental compliance records could enhance their market valuation by 25% compared to their non-compliant counterparts.

Investors are increasingly looking for industry-specific KPIs for oil and gas that demonstrate sustainability and responsibility. As EcoEnergy Explorers focuses on eco-friendly methods and technologies, it aligns its Environmental Compliance Rate with broader strategic goals, ensuring that it remains competitive in the ever-evolving energy market.

The correlation between a company’s Environmental Compliance Rate and its overall performance metrics is clear, as firms that prioritize environmental indicators often see improved overall operational KPIs in oil and gas exploration as well.

| KPI | Current Rate | Industry Benchmark |

|---|---|---|

| Environmental Compliance Rate | 98% | 95% |

| Health and Safety Incident Rate | 0.5 incidents per 200,000 hours worked | 1.0 incidents |

| Return on Investment | 15% | 12% |

In conclusion, by focusing on the Environmental Compliance Rate, EcoEnergy Explorers positions itself as a pioneer in the quest for a more sustainable oil and gas exploration industry. For those interested in the financial modeling required to track these essential KPIs, more information can be found at [EcoEnergy Explorers Financial Model](/products/oil-and-gas-exploration-financial-model).

Return On Investment

In the oil and gas exploration industry, tracking the Return on Investment (ROI) is crucial for assessing the profitability and efficiency of various projects. ROI is a key financial KPI that indicates the percentage return generated from investments relative to their costs. Understanding and calculating ROI allows companies like EcoEnergy Explorers to make informed decisions and strategize for sustainable growth.

The formula for calculating ROI is as follows:

- ROI = (Net Profit / Cost of Investment) × 100

For example, if a project generates a net profit of $1 million from an initial investment of $5 million, the ROI would be:

- ROI = (1,000,000 / 5,000,000) × 100 = 20%

Maintaining a healthy ROI is especially vital in the oil and gas sector due to the high costs associated with exploration and production. Here are some benchmarks for ROI in the industry:

| Year | Average ROI (%) | Top Performers (%) |

|---|---|---|

| 2020 | 7% | 12% |

| 2021 | 10% | 15% |

| 2022 | 9% | 18% |

Tracking ROI helps organizations prioritize projects, allocate resources efficiently, and gauge their financial health. For instance, if the ROI for a new drilling technology is significantly higher than traditional methods, it may warrant increased investment and adoption.

Tips for Maximizing ROI in Oil and Gas Exploration

- Implement advanced analytics and data technologies to enhance decision-making.

- Regularly review exploration projects to identify underperforming investments.

- Focus on sustainable practices that not only reduce costs but also enhance your company's reputation and long-term viability.

Furthermore, aligning ROI with broader operational KPIs can shed light on critical performance metrics, including production efficiency and cost per barrel extracted. For instance, companies that manage to maintain a cost per barrel below $30 often see ROIs that exceed 15%.

The importance of KPI metrics in oil and gas exploration cannot be understated. A robust KPI tracking system enables businesses like EcoEnergy Explorers to identify trends and make data-driven adjustments to their strategies, ensuring they remain competitive in a challenging industry landscape.

By utilizing tools such as the oil and gas exploration financial model, organizations can better forecast their ROI and adjust their operational strategies accordingly, optimizing for both profitability and sustainability.

Reserve Replacement Ratio

The Reserve Replacement Ratio (RRR) is a critical performance metric in the oil and gas exploration industry, particularly for companies like EcoEnergy Explorers, which prioritize both sustainable practices and efficient resource management. This KPI measures the amount of oil and gas reserves added to a company’s existing reserves during a specific period, relative to the amount extracted. A healthy RRR is essential for ensuring long-term viability and profitability in the sector.

To calculate the Reserve Replacement Ratio, use the following formula:

RRR = (Reserves Added / Production) × 100

Where:

- Reserves Added = the total amount of oil and gas reserves that have been discovered and classified as economically recoverable during a reporting period.

- Production = the total volume of oil and gas produced during the same period.

For instance, if a company added 10 million barrels to its reserves and produced 8 million barrels in during the year, the RRR would be:

RRR = (10 million barrels / 8 million barrels) × 100 = 125%

An RRR greater than 100% indicates that a company is effectively replacing the resources it depletes, which is vital for maintaining investor confidence and supporting ongoing operations.

Benchmark RRR levels can vary by company and region, but the industry average typically ranges from 90% to 150%. Companies that consistently achieve an RRR above 100% are often considered to be in a strong position, demonstrating their capability to explore and develop new reserves successfully.

Tips for Monitoring RRR Effectively

- Regularly update reserve estimates based on the latest geological and market data to ensure accurate calculations.

- Utilize advanced technologies like geological modeling and data analytics to improve exploration success rates.

- Engage in strategic partnerships and joint ventures to enhance exploration opportunities and resource sharing.

For EcoEnergy Explorers, tracking the RRR is not just about maintaining a sustainable business model but also about aligning with the growing emphasis on environmental responsibility within the energy sector. By focusing on this core KPI metric, companies can better manage their resources, increase stakeholder confidence, and contribute to a more secure energy future.

Additionally, integrating KPIs like RRR with financial performance metrics can provide a comprehensive view of overall business health. Efficient KPI tracking allows for timely decisions that can pivot company strategies as needed, bolstering sustainability efforts while ensuring robust financial health.

| KPI Metric | Calculation | Benchmark (Average Industry) |

|---|---|---|

| Reserve Replacement Ratio | (Reserves Added / Production) × 100 | 90% - 150% |

| Production Efficiency | (Total Production / Total Reserves) × 100 | 70% - 85% |

| Cost Per Barrel Extracted | Total Production Cost / Total Barrels Produced | $30 - $50 |

In summary, the Reserve Replacement Ratio is a vital indicator of an oil and gas exploration company's ability to sustain its operations and deliver value to stakeholders. EcoEnergy Explorers understands that measuring oil and gas performance through KPIs such as RRR not only drives operational efficiency but also aligns with long-term strategic goals in a rapidly evolving industry landscape. For a deeper dive into financial modeling tailored for the oil and gas sector, visit here.

Health And Safety Incident Rate

The Health and Safety Incident Rate (HSIR) is a critical operational KPI in the oil and gas exploration sector, reflecting the commitment of a company to safeguard its workforce and maintain compliance with safety regulations. For a business like EcoEnergy Explorers, which prioritizes sustainable practices alongside efficient resource extraction, tracking this metric is vital for not only protecting employees but also for enhancing overall operational efficiency.

The HSIR is calculated using the formula:

HSIR = (Number of Recordable Incidents × 200,000) / Total Hours Worked

This formula allows companies to benchmark their health and safety performance against industry standards. The number '200,000' represents the number of hours that is equivalent to 100 employees working 40 hours a week for 50 weeks. This normalization helps facilitate comparisons across organizations of different sizes.

| Year | HSIR | Industry Average |

|---|---|---|

| 2022 | 1.8 | 3.5 |

| 2021 | 2.0 | 3.8 |

| 2020 | 2.5 | 4.0 |

As indicated in the table above, EcoEnergy Explorers has successfully reduced its HSIR over the years, significantly outperforming the industry average. This improvement can be attributed to various initiatives, such as enhanced training programs and the adoption of advanced safety technologies.

Monitoring the HSIR not only fosters a safer workplace but also provides financial benefits. Companies with low incident rates typically experience:

- Reduced workers' compensation claims

- Lower insurance premiums

- Increased employee morale and productivity

In today's oil and gas exploration landscape, where safety regulations are increasingly stringent, it’s essential to maintain a proactive approach to health and safety. Ensuring that all employees are trained and aware of potential hazards is crucial. Additionally, leveraging technology can enhance safety measures and minimize incident rates further.

Tips for Improving HSIR

- Implement regular safety training sessions tailored to specific job roles.

- Conduct frequent safety audits to identify and mitigate risks.

- Incorporate feedback from employees to enhance safety protocols.

Ultimately, a strong emphasis on health and safety can lead to a culture of responsibility and accountability within EcoEnergy Explorers. By focusing on the Health and Safety Incident Rate as part of the core KPI metrics for oil and gas exploration, the company not only adheres to regulatory demands but also positions itself as an industry leader dedicated to the well-being of its workforce.

For companies interested in delving deeper into financial models tailored for the oil and gas sector, including KPI calculations, visit EcoEnergy Financial Models.

Average Daily Production Rate

The Average Daily Production Rate (ADPR) is a critical KPI in the oil and gas exploration industry, serving as a primary indicator of production performance and operational efficiency. This metric measures the amount of oil or gas produced on average each day over a specified period and provides essential insights into the sustainability of production levels.

To calculate the ADPR, use the following formula:

ADPR = (Total Production Volume) / (Total Days of Production)

For instance, if an exploration company extracts 300,000 barrels of oil over a period of 30 days, the ADPR would be:

ADPR = 300,000 / 30 = 10,000 barrels per day

Monitoring the ADPR enables companies like EcoEnergy Explorers to evaluate the efficiency of their extraction processes and identify trends that could impact profitability. It is essential for comparing performance against industry benchmarks, and identifying areas for improvement in operational KPIs.

| Year | Total Production Volume (Barrels) | ADPR (Barrels per Day) |

|---|---|---|

| 2021 | 1,095,000 | 3,000 |

| 2022 | 1,200,000 | 3,287 |

| 2023 (Projected) | 1,500,000 | 4,109 |

As seen in the table above, the ADPR has seen a steady increase with better operational efficiencies and advanced technologies, demonstrating the importance of this KPI in driving progress in the oil and gas sector.

Tips for Improving Average Daily Production Rate

- Invest in automation and digital technologies to streamline extraction processes.

- Conduct regular maintenance of equipment to prevent downtime.

- Implement data analytics to optimize production schedules and resource allocation.

Organizations should also prioritize the importance of KPI metrics in oil and gas to remain competitive. Regular reviews of operational KPIs in oil and gas exploration, including ADPR, can help in aligning production goals with broader strategic objectives. By effectively tracking these essential KPIs, companies can make informed decisions and drive sustainable growth.

In the current market landscape, measuring oil and gas performance through KPIs like ADPR allows firms to assess their production efficiency and financial viability. This is vital for ensuring compliance with industry regulations and meeting stakeholder expectations.

For a comprehensive understanding of how to implement effective KPI strategies in your operations, explore resources like the oil and gas exploration financial model, which provides key insights into metrics that drive success in the industry.

Stakeholder Satisfaction Index

In the oil and gas exploration industry, the Stakeholder Satisfaction Index serves as a vital KPI metric to gauge the perceptions and priorities of all parties involved, from employees and investors to local communities and regulatory bodies. This metric not only reflects the overall health of the business but also provides insights into how well the company, such as EcoEnergy Explorers, aligns its operations with stakeholder expectations.

The calculation of the Stakeholder Satisfaction Index involves multiple factors, reflecting the diverse interests of stakeholders:

- Employee Satisfaction: Surveys and feedback mechanisms gauge work environment and morale.

- Investor Returns: Evaluating profits, share price growth, and dividends reflects investor trust.

- Community Engagement: Initiatives and outreach programs designed to ensure local community support.

- Regulatory Compliance: Adhering to environmental standards and operational regulations.

To derive the index, you can follow these formulas:

- For Employee Satisfaction Index: (Total Positive Responses / Total Responses) x 100

- For Investor Satisfaction: (Current Share Price - Original Investment) / Original Investment x 100

- Community Engagement Score: (Positive Community Feedback / Total Feedback) x 100

According to a recent industry report, a 75% satisfaction rate among stakeholders is often considered a benchmark for success in the oil and gas sector. Companies that exceed this threshold tend to experience fewer operational disruptions and are often viewed more favorably by investors and regulatory agencies.

| Stakeholder Group | Expected Satisfaction Rate (%) | Current Satisfaction Rate (%) |

|---|---|---|

| Employees | 80% | 76% |

| Investors | 90% | 85% |

| Local Communities | 75% | 70% |

| Regulatory Bodies | 95% | 90% |

Effective KPI tracking in the oil and gas industry includes prioritizing the Stakeholder Satisfaction Index as it influences many aspects of operational performance. A focus on this KPI can lead to increased operational efficiency, better community relationships, and an overall improved corporate reputation.

Tips for Measuring Stakeholder Satisfaction

- Conduct regular surveys to gather real-time feedback from employees and other stakeholders.

- Implement transparent communication strategies to keep stakeholders informed about company operations and initiatives.

- Engage in community partnership programs that reflect a commitment to social responsibility.

The Stakeholder Satisfaction Index is not just an indicator of current performance; it also aligns with EcoEnergy Explorers' long-term strategic goals of sustainability and responsibility in oil and gas exploration. By focusing on stakeholder needs, companies can enhance their overall exploration success rate while adhering to environmentally compliant practices.

For those looking to develop a comprehensive understanding of KPI metrics, including how to calculate oil and gas KPI metrics effectively, consider exploring financial modeling resources available at this link.